Fifth Third Bancorp (FITB, Financial) shines with better-than-expected earnings but faces challenges in meeting revenue forecasts.

- FITB beats earnings expectations with a $0.73 adjusted EPS, overshooting by $0.04.

- Despite revenue growth of 1.9% year-over-year, FITB's revenue fell short by $20 million.

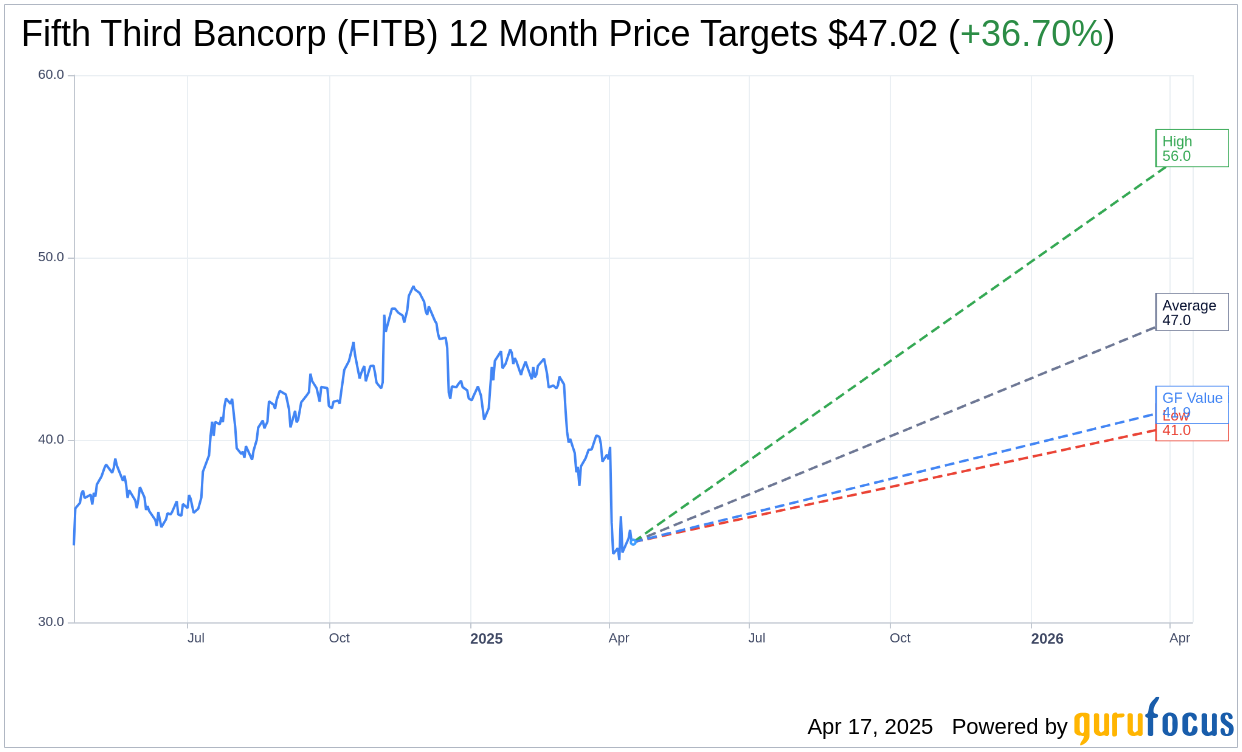

- Analysts project a 36.70% upside potential based on current price targets.

Financial Highlights of Fifth Third Bancorp

Fifth Third Bancorp recently announced its first-quarter financial results, posting an adjusted earnings per share of $0.73. This exceeded market expectations by $0.04, marking a positive note for investors. However, the bank reported revenues of $2.14 billion, which, despite being a 1.9% increase from the previous year, fell short of analysts’ estimates by $20 million.

Wall Street Analysts Forecast

The outlook from Wall Street analysts presents an optimistic scenario for Fifth Third Bancorp. With assessments from 20 analysts, the average target price stands at $47.02, with a spectrum ranging from a high of $56.00 to a low of $40.97. This target suggests a potential upside of 36.70% from the current trading price of $34.40. For a deeper dive into these projections, visit the Fifth Third Bancorp (FITB, Financial) Forecast page.

Brokerage Recommendations and GF Value Insights

The bank holds an "Outperform" status with an average brokerage recommendation of 2.1, according to 23 brokerage firms. This rating is indicative of confidence in the bank's future performance, aligning with a scale where 1 is a Strong Buy and 5 is a Sell.

Further supporting this positive outlook, GuruFocus estimates the GF Value for Fifth Third Bancorp at $41.93 over the next year. This estimation suggests a potential upside of 21.89% from the current price, illustrating a promising scenario for the stock. The GF Value is derived from the historical trading multiples, past business growth, and projected future performance of the company. More comprehensive data can be explored on the Fifth Third Bancorp (FITB, Financial) Summary page.

Overall, while Fifth Third Bancorp faces some revenue challenges, its strong earnings and positive analyst outlook could potentially offer rewarding opportunities for investors.