Piper Sandler has increased its price target for Bank First (BFC, Financial) from $110 to $111, while maintaining a Neutral rating for the company's shares. This decision follows Bank First's impressive performance in the first quarter, which saw a 5% uplift in pre-provision net revenue (PPNR) driven by solid growth in its balance sheet and higher core fee income.

The firm highlights that Bank First's profitability continues to exceed that of its peers, positioning it as an attractive option for long-term investors. Piper Sandler's analysis suggests that the bank's robust financial health and strategic direction are key factors in its promising outlook.

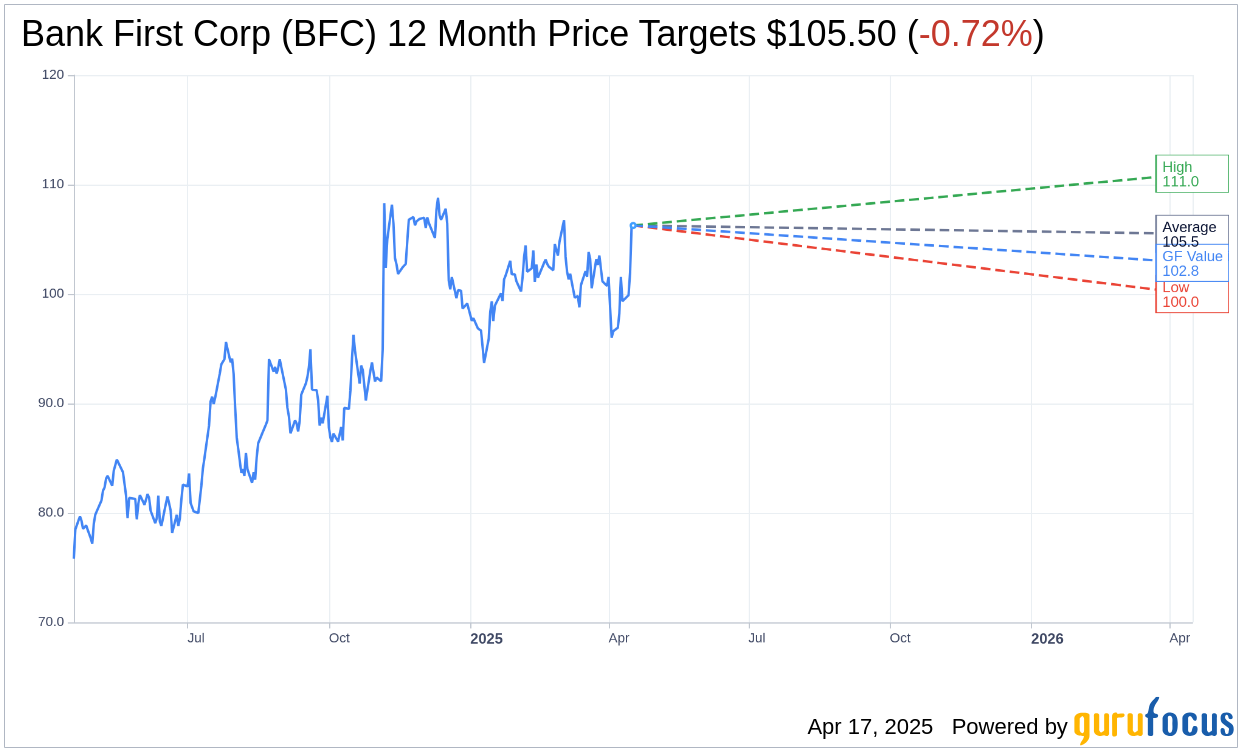

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Bank First Corp (BFC, Financial) is $105.50 with a high estimate of $111.00 and a low estimate of $100.00. The average target implies an downside of 0.72% from the current price of $106.27. More detailed estimate data can be found on the Bank First Corp (BFC) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Bank First Corp's (BFC, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bank First Corp (BFC, Financial) in one year is $102.85, suggesting a downside of 3.22% from the current price of $106.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bank First Corp (BFC) Summary page.