JPMorgan has revised its price target for Jamf Holding (JAMF, Financial), reducing it from $18 to $15 while maintaining an Overweight rating on the stock. This adjustment comes as the firm updates its hardware and networking models, taking into account the broader implications of current economic uncertainties driven by tariffs.

The analysis by JPMorgan foresees a macroeconomic slowdown, which is expected to impact demand across various customer segments, including consumers, enterprises, and telecom companies. The firm integrates the potential for a broader economic deceleration and the related demand moderation into its future estimates for the company.

The adjustments reflect JPMorgan's cautious outlook on how macroeconomic conditions might influence Jamf Holding's performance moving forward.

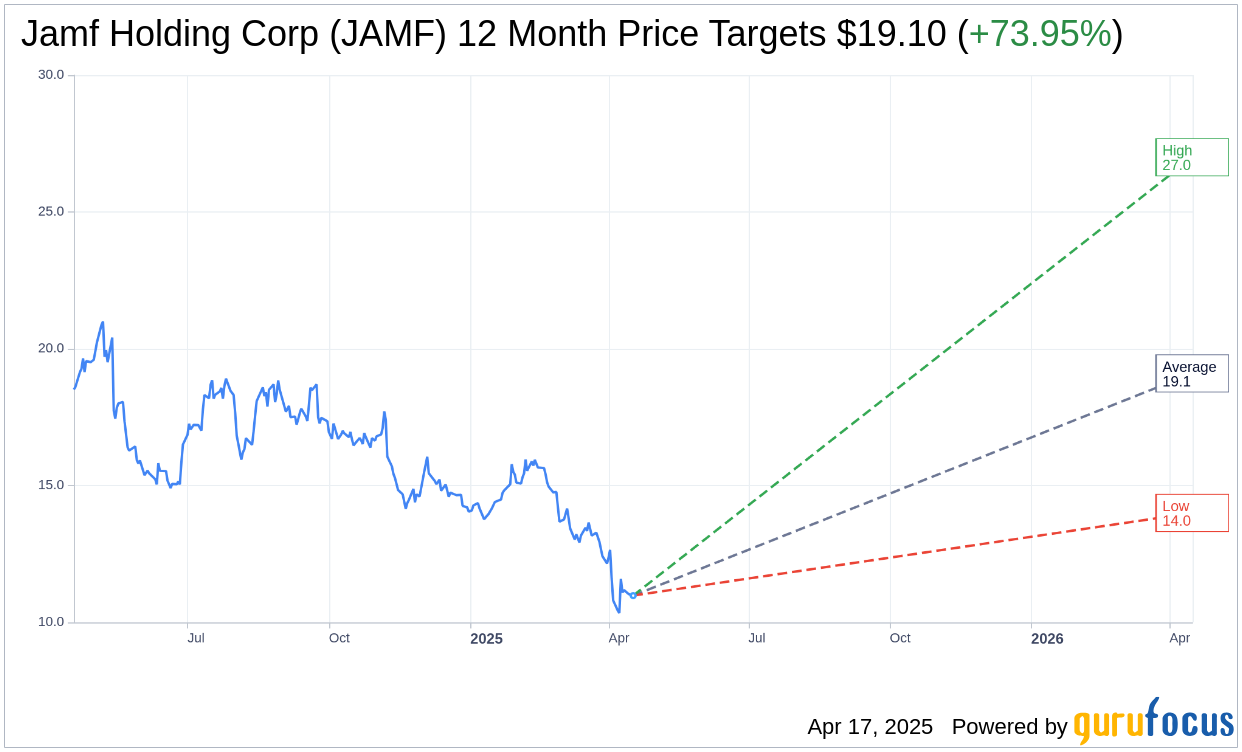

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Jamf Holding Corp (JAMF, Financial) is $19.10 with a high estimate of $27.00 and a low estimate of $14.00. The average target implies an upside of 73.95% from the current price of $10.98. More detailed estimate data can be found on the Jamf Holding Corp (JAMF) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Jamf Holding Corp's (JAMF, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Jamf Holding Corp (JAMF, Financial) in one year is $23.79, suggesting a upside of 116.67% from the current price of $10.98. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Jamf Holding Corp (JAMF) Summary page.