Morgan Stanley has adjusted its outlook for Revolve Group (RVLV, Financial), revising the price target downwards from $29 to $21 while maintaining an Equal Weight rating on the company's shares. The decision reflects broader adjustments in the firm's North American internet stock assessments.

The revisions are prompted by anticipated macroeconomic pressures and implications of tariff policies that are expected to affect e-commerce performance and digital advertising revenues. As these factors continue to unfold, Morgan Stanley is adjusting its financial forecasts accordingly to better capture the potential impact on Revolve Group and similar companies.

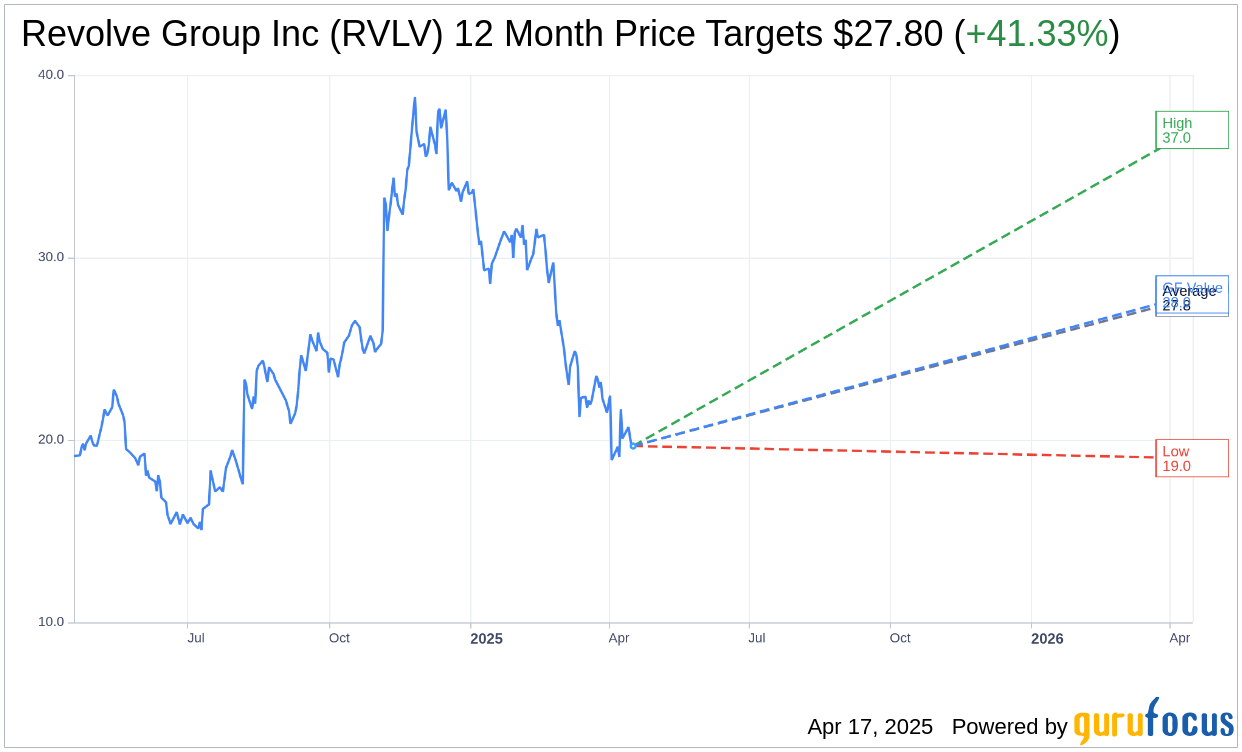

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Revolve Group Inc (RVLV, Financial) is $27.80 with a high estimate of $37.00 and a low estimate of $19.00. The average target implies an upside of 41.33% from the current price of $19.67. More detailed estimate data can be found on the Revolve Group Inc (RVLV) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Revolve Group Inc's (RVLV, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Revolve Group Inc (RVLV, Financial) in one year is $27.98, suggesting a upside of 42.25% from the current price of $19.67. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Revolve Group Inc (RVLV) Summary page.