- American Express (AXP, Financial) beats first-quarter earnings expectations but experiences a stock dip due to falling network volume.

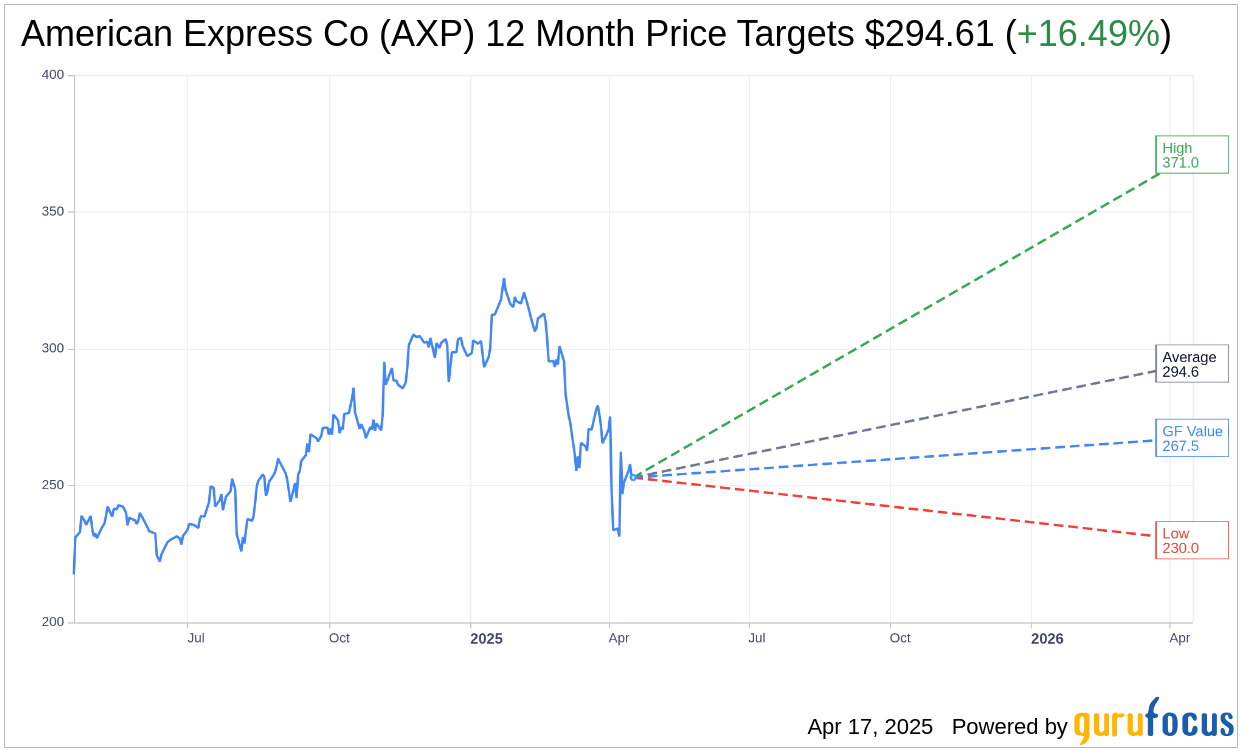

- Analyst average target price suggests a potential upside of 16.49% from the current price.

- GuruFocus estimates indicate a moderate growth potential with a one-year GF Value suggesting a 5.75% upside.

American Express (AXP) delivered first-quarter earnings that exceeded analyst predictions, reporting impressive revenue of $17.0 billion and earnings per share (EPS) at $3.64. However, despite these strong numbers, the stock saw a 1.3% dip in premarket trading. The decline was attributed to a drop in network volume, which fell to $439.6 billion, falling short of market expectations.

Wall Street Analysts Forecast

Wall Street analysts provide insightful projections for American Express Co (AXP, Financial). Based on forecasts from 26 analysts, the average target price is set at $294.61. This suggests a significant upside of 16.49% from its current trading price of $252.92, with estimates ranging between a high of $371.00 and a low of $230.00. Investors can delve into more comprehensive estimates on the American Express Co (AXP) Forecast page.

Examining brokerage firm recommendations, American Express Co (AXP, Financial) holds an average brokerage recommendation of 2.6, classified under "Hold." The recommendation scale, running from 1 (Strong Buy) to 5 (Sell), reflects a cautious but stable outlook from 31 firms.

Furthermore, GuruFocus provides its own valuation insights with an estimated GF Value for American Express Co (AXP, Financial) predicting a price of $267.47 in the next year. This forecast indicates a modest growth potential with a 5.75% upside from the current price of $252.92. GF Value represents GuruFocus’ fair value estimation, derived from historical stock multiples, past business growth, and anticipated future performance. Comprehensive details are available on the American Express Co (AXP) Summary page.