UBS has increased its price target for Colgate-Palmolive (CL, Financial) from $105 to $109, maintaining a Buy rating on the stock. This adjustment comes as part of a broader preview for the consumer staples sector ahead of the first quarter earnings reports.

According to UBS analysts, the overall market environment has been challenging, with decreased consumer demand and uncertainties surrounding tariffs affecting the sector. Despite these challenges, UBS is optimistic about certain companies, including Colgate-Palmolive, where there is a higher level of fundamental visibility and potential for improvement.

In addition to Colgate-Palmolive, the firm highlights several other companies that are favorably positioned ahead of their earnings announcements. These include Coca-Cola (KO), Keurig Dr Pepper (KDP), Celsius Holdings (CELH), Monster Beverage (MNST), and Church & Dwight (CHD). UBS suggests these companies might navigate the tricky earnings season better due to their strong fundamentals.

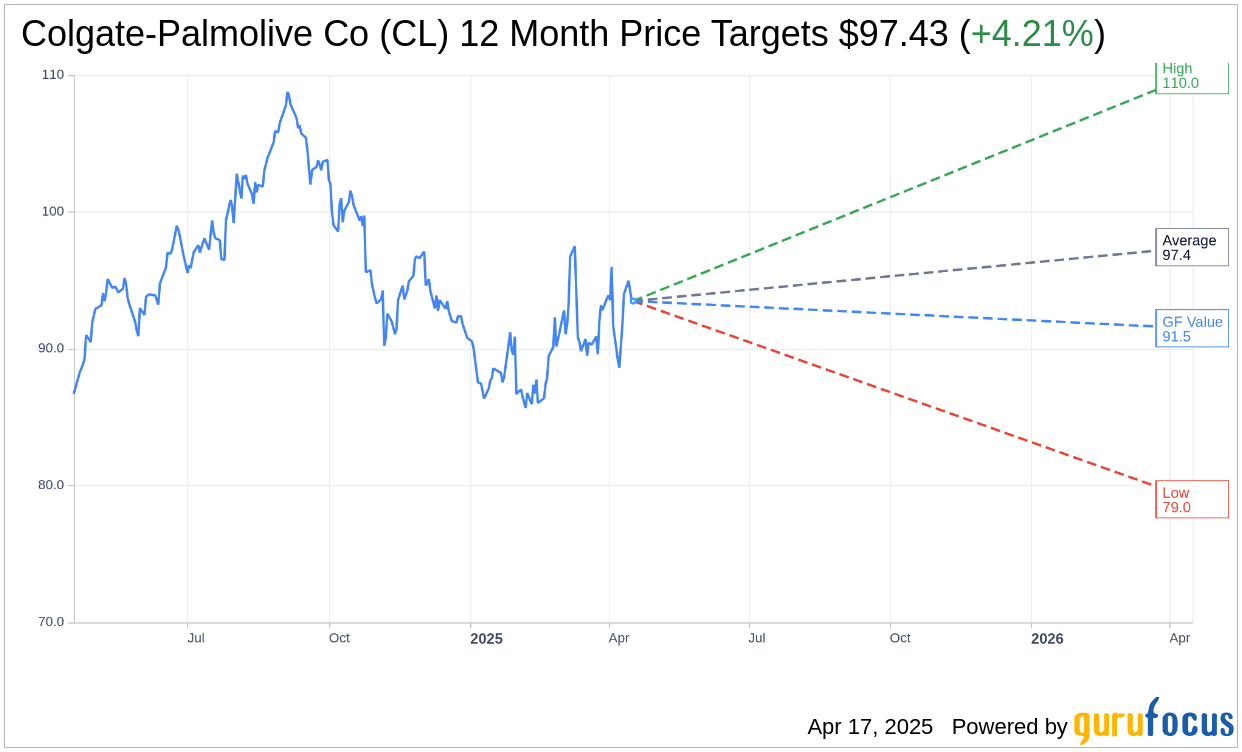

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Colgate-Palmolive Co (CL, Financial) is $97.43 with a high estimate of $110.00 and a low estimate of $79.00. The average target implies an upside of 4.21% from the current price of $93.49. More detailed estimate data can be found on the Colgate-Palmolive Co (CL) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Colgate-Palmolive Co's (CL, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Colgate-Palmolive Co (CL, Financial) in one year is $91.50, suggesting a downside of 2.13% from the current price of $93.49. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Colgate-Palmolive Co (CL) Summary page.