Can-Fite BioPharma (CANF, Financial) has announced a recent milestone for its oncological drug Namodenoson, which now has FDA approval for its first single-patient compassionate use treatment. This development has piqued the interest of oncologists from prominent U.S. medical centers, who are seeking approval to employ Namodenoson for treating pancreatic cancer patients under similar compassionate use protocols.

At the same time, Can-Fite is advancing its clinical trials, actively enrolling participants in Israel for a Phase IIa study. This trial is tailored for patients with advanced pancreatic adenocarcinoma who have not responded to at least one line of prior therapy. The open-label study, under the leadership of Dr. Salomon Stemmer from the Institute of Oncology at Rabin Medical Center, is focused on evaluating the safety, clinical activity, and pharmacokinetics of Namodenoson in this difficult-to-treat population.

In addition to the recent FDA compassionate use approval, Namodenoson has received Orphan Drug Designation from the U.S. FDA, highlighting its potential as a significant therapeutic candidate for pancreatic cancer. This designation may provide regulatory benefits and incentives as Can-Fite continues to explore Namodenoson's capabilities as a treatment option.

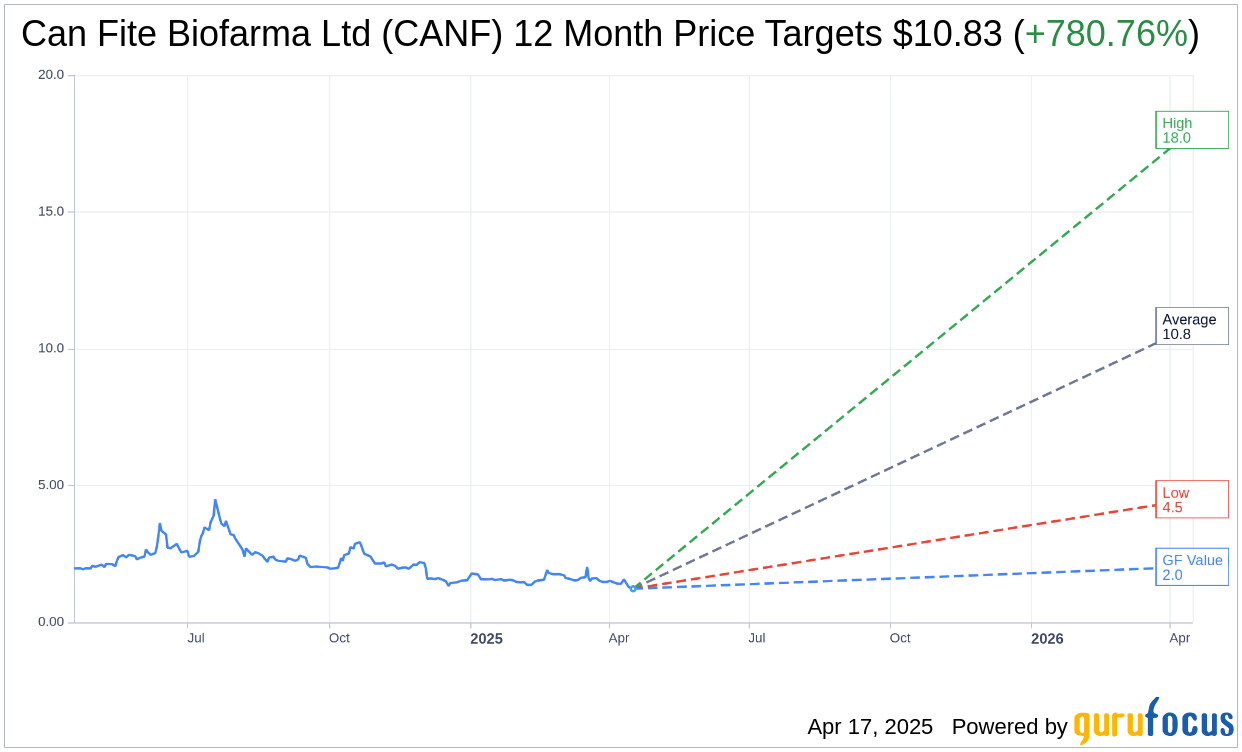

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Can Fite Biofarma Ltd (CANF, Financial) is $10.83 with a high estimate of $18.00 and a low estimate of $4.50. The average target implies an upside of 780.76% from the current price of $1.23. More detailed estimate data can be found on the Can Fite Biofarma Ltd (CANF) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Can Fite Biofarma Ltd's (CANF, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Can Fite Biofarma Ltd (CANF, Financial) in one year is $2.03, suggesting a upside of 65.04% from the current price of $1.23. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Can Fite Biofarma Ltd (CANF) Summary page.