Minerals Technologies Inc. (MTX, Financial) has recorded a provision of $215 million to cover estimated expenses associated with resolving ongoing and future talc-related claims. This reserve aims to fund the establishment of a trust to manage these claims and to support BMI OldCo's Chapter 11 proceedings, including related litigation costs.

The preparation includes a $30 million debtor-in-possession financing from MTI Investments to the Debtors, which received approval from the United States Bankruptcy Court for the Southern District of Texas on April 14. This financial backing is part of MTX's continued support for BMI OldCo's strategy to comprehensively settle all talc-related claims via a court-approved reorganization plan within the Chapter 11 process. The plan aims to channel all such claims into a dedicated trust for resolution.

Although a definitive settlement of all issues in the Chapter 11 case has yet to be reached, MTX remains committed to assisting BMI OldCo in achieving a final resolution. The proposed trust will play a central role in managing the financial and legal aspects of the talc-related liabilities.

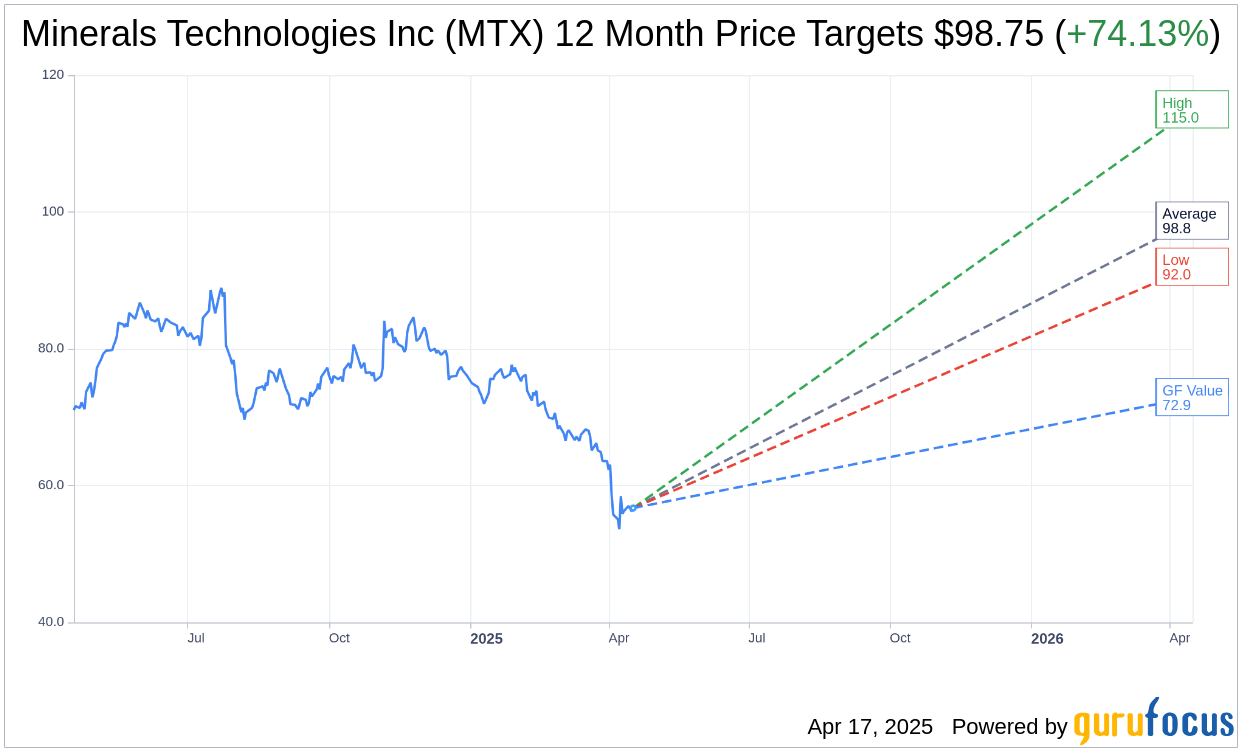

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Minerals Technologies Inc (MTX, Financial) is $98.75 with a high estimate of $115.00 and a low estimate of $92.00. The average target implies an upside of 74.13% from the current price of $56.71. More detailed estimate data can be found on the Minerals Technologies Inc (MTX) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Minerals Technologies Inc's (MTX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Minerals Technologies Inc (MTX, Financial) in one year is $72.94, suggesting a upside of 28.62% from the current price of $56.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Minerals Technologies Inc (MTX) Summary page.