- Medpace (MEDP, Financial) to announce Q1 earnings on April 21st, with EPS expected to dip 3.8%.

- Analysts predict revenue growth of 3.2%, despite downward revisions.

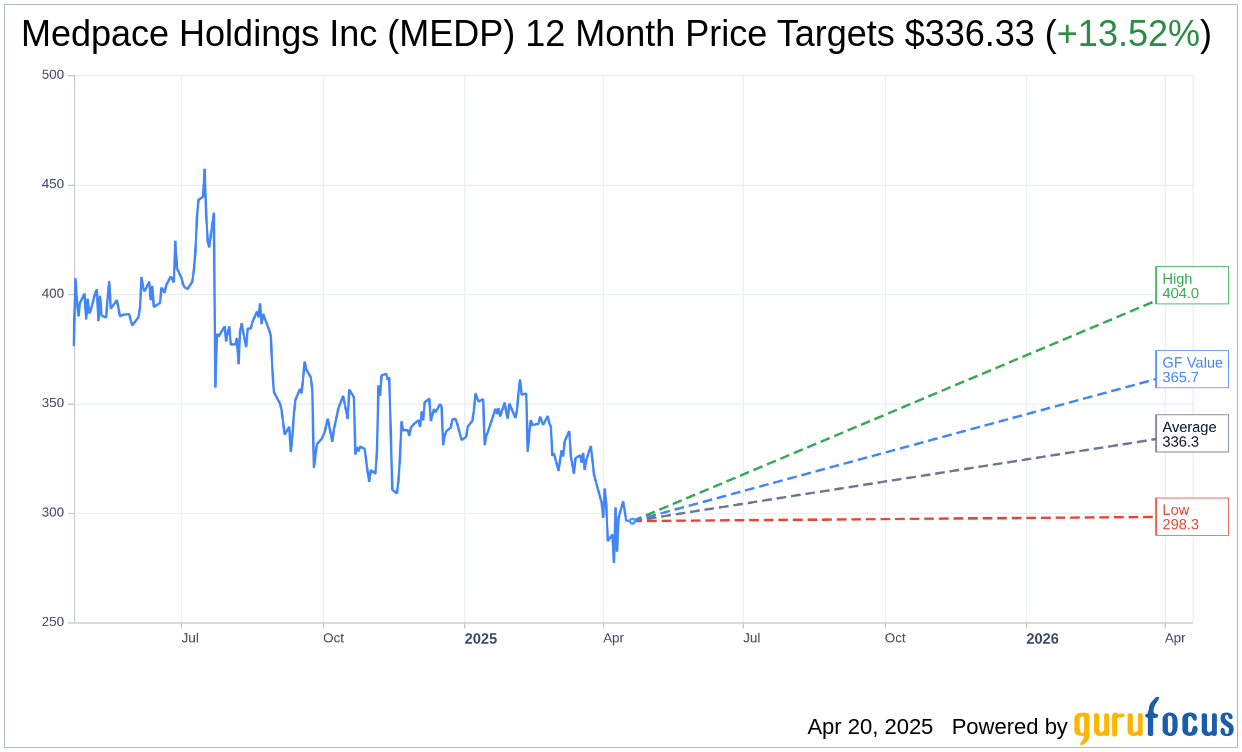

- Current stock price shows significant potential upside according to Wall Street projections and GuruFocus metrics.

Upcoming Earnings Release

Investors are keenly awaiting Medpace's (MEDP) first-quarter earnings report, which is set for release after market close on April 21st. Wall Street analysts have set an earnings per share (EPS) forecast of $3.08, representing a 3.8% decline from the previous year. Revenue is anticipated to rise by 3.2% to reach $527.15 million. It is notable that EPS predictions have recently adjusted downward once, while revenue forecasts have been revised down five times.

Wall Street Analysts Forecast

The collective one-year price targets from 10 analysts place Medpace Holdings Inc (MEDP, Financial) at an average target price of $336.33, with projections spanning a high of $404.00 and a low of $298.31. This average target suggests a potential upside of 13.52% from the current value of $296.28. Further details on these estimates are available on the Medpace Holdings Inc (MEDP) Forecast page.

Brokerage Recommendations

The consensus recommendation from 11 brokerage firms is a "Hold," with Medpace Holdings Inc's (MEDP, Financial) average brokerage rating at 2.6 on a scale where 1 signifies a Strong Buy and 5 suggests a Sell.

GuruFocus Insights

According to estimates from GuruFocus, the projected GF Value for Medpace Holdings Inc (MEDP, Financial) in the forthcoming year is $365.69. This suggests an upside of 23.43% from the current stock price of $296.28. The GF Value is GuruFocus' assessment of the stock's fair trading value, determined by historical trading multiples, past business growth, and future business performance expectations. More comprehensive data can be accessed via the Medpace Holdings Inc (MEDP) Summary page.