William Blair has initiated coverage of Context Therapeutics (CNTX, Financial) with an Outperform rating, suggesting a promising future for the company within the biopharmaceutical sector. The industry is currently experiencing rapid advancements in the development of T-cell engagers, particularly for solid tumors, and Context Therapeutics is well-positioned to leverage these developments through its three fully owned programs.

The firm highlights Claudin 6 as a particularly promising target for CD3-based T-cell engagers (TCEs) due to its limited expression in healthy tissues, which could minimize potential side effects. This insight underscores the potential of Context’s initiatives in the field.

Looking ahead, William Blair anticipates that the initial results expected in 2026 may significantly influence the stock's performance. The results are considered a potential critical turning point for CNTX, driven by the considerable promise of its assets in development.

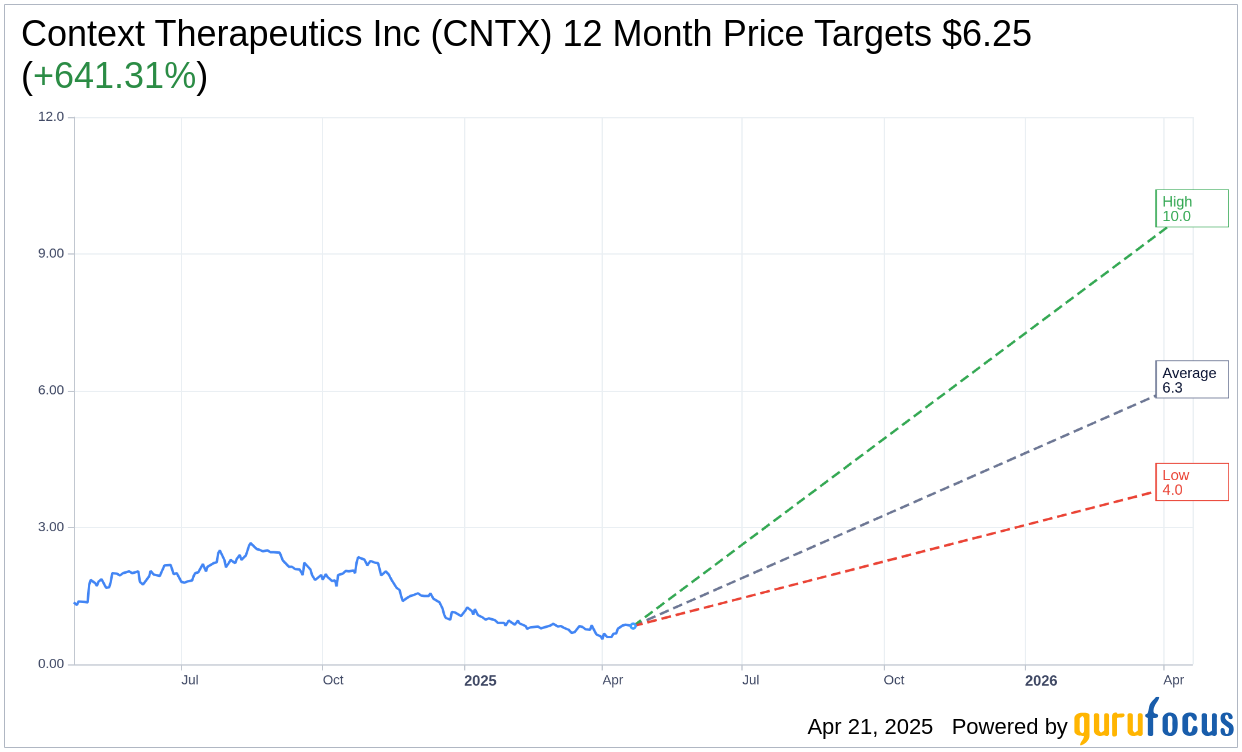

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Context Therapeutics Inc (CNTX, Financial) is $6.25 with a high estimate of $10.00 and a low estimate of $4.00. The average target implies an upside of 641.31% from the current price of $0.84. More detailed estimate data can be found on the Context Therapeutics Inc (CNTX) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Context Therapeutics Inc's (CNTX, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.