Rithm Property Trust (RPT, Financial) has experienced a reduction in its price target, now set at $4, down from the previous $5, according to B. Riley analyst Randy Binner. Despite this adjustment, the firm maintains its Buy rating on the stock.

The decision to lower the price target comes amid indications of slower than expected loan origination and investment activity in the first quarter. This slowdown has led to a downward revision of earnings forecasts for Rithm Property Trust.

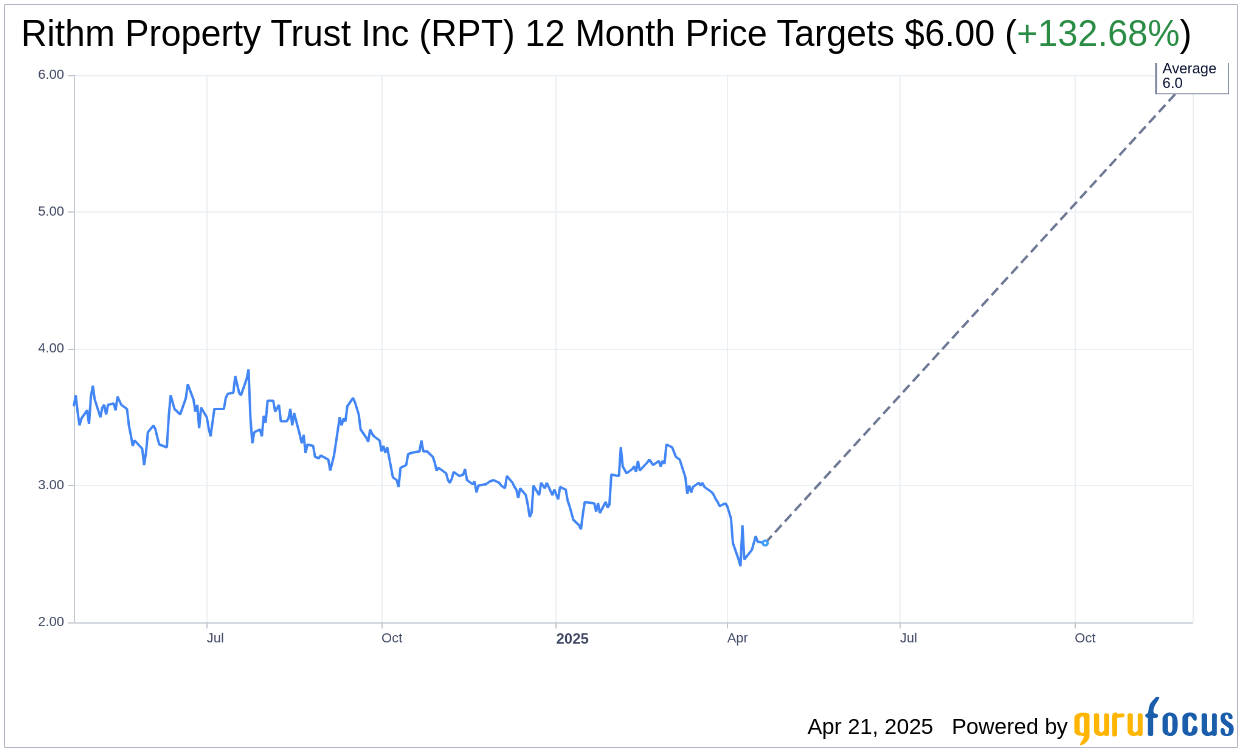

Wall Street Analysts Forecast

Based on the one-year price targets offered by 1 analysts, the average target price for Rithm Property Trust Inc (RPT, Financial) is $6.00 with a high estimate of $6.00 and a low estimate of $6.00. The average target implies an upside of 132.68% from the current price of $2.58. More detailed estimate data can be found on the Rithm Property Trust Inc (RPT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Rithm Property Trust Inc's (RPT, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.