Bank of America (BofA) has adjusted its price target for CubeSmart (CUBE, Financial), lowering it from $46 to $44, while maintaining a Neutral rating on the stock. The revision comes after BofA conducted a detailed tour in Chicago and held discussions with leaders in the private self-storage sector.

Despite reducing the price target, BofA expressed a more optimistic outlook for the self-storage industry compared to other Real Estate Investment Trust (REIT) sectors. This positive sentiment stems from the belief that self-storage offers some stability amid the current macroeconomic challenges. The analyst highlighted that this sector's resilience could be a beneficial aspect for investors navigating the uncertain economic landscape.

CubeSmart, as a prominent player in the self-storage market, remains a focal point for investors seeking opportunities within this relatively stable segment. The updated price target reflects the ongoing evaluation of market conditions and sector performance.

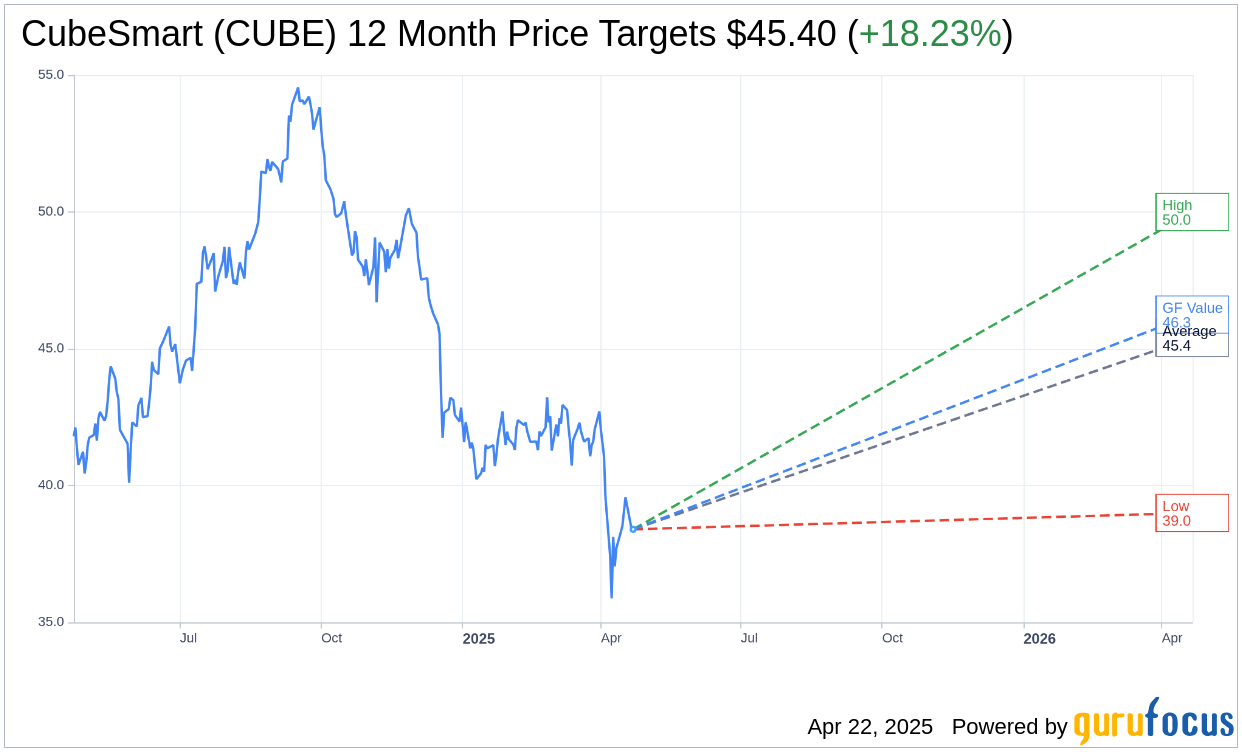

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for CubeSmart (CUBE, Financial) is $45.40 with a high estimate of $50.00 and a low estimate of $39.00. The average target implies an upside of 18.23% from the current price of $38.40. More detailed estimate data can be found on the CubeSmart (CUBE) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, CubeSmart's (CUBE, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CubeSmart (CUBE, Financial) in one year is $46.25, suggesting a upside of 20.44% from the current price of $38.4. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CubeSmart (CUBE) Summary page.