Kratos Defense & Security Solutions (KTOS, Financial) is advancing its presence in the Midwest with the operational expansion of its automated truck platooning systems in Ohio and Indiana. This marks a significant step following the company's March 2024 announcement, where it secured a contract to implement its self-driving technology along a key transportation corridor between these two states.

The recent development signifies progress in the company's I-70 automated driving project. Supported by the U.S. Department of Transportation, DriveOhio, and the Indiana Department of Transportation, the initiative aims to enhance the adoption of automation technologies within the regional logistics industry.

Kratos’ efforts are focused on transforming how freight is moved across the Midwest, leveraging advanced truck automation to potentially increase efficiency and safety in commercial transport. This project is part of a broader strategy to incorporate cutting-edge technologies in the logistics sector.

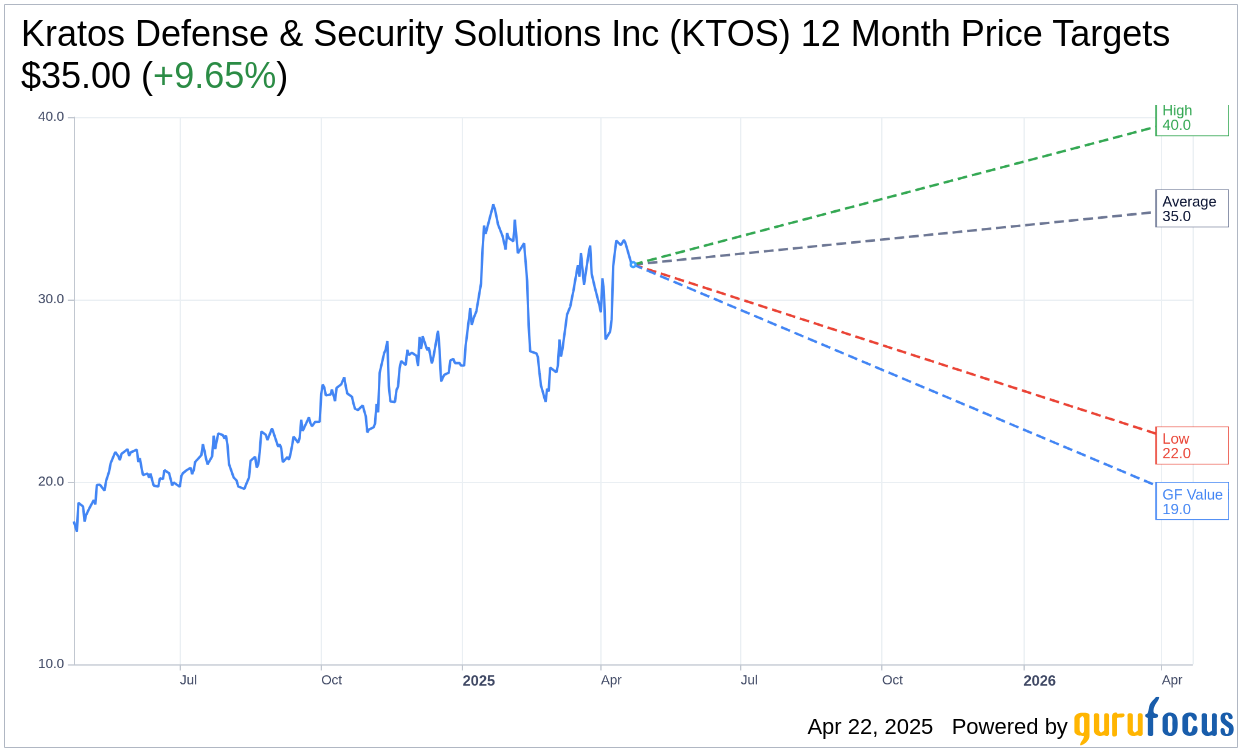

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Kratos Defense & Security Solutions Inc (KTOS, Financial) is $35.00 with a high estimate of $40.00 and a low estimate of $22.00. The average target implies an upside of 9.65% from the current price of $31.92. More detailed estimate data can be found on the Kratos Defense & Security Solutions Inc (KTOS) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Kratos Defense & Security Solutions Inc's (KTOS, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Kratos Defense & Security Solutions Inc (KTOS, Financial) in one year is $18.96, suggesting a downside of 40.6% from the current price of $31.92. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Kratos Defense & Security Solutions Inc (KTOS) Summary page.