- Ensysce Biosciences, Inc. (ENSC, Financial) raises $2.2 million through warrant exercises, bolstering its pain management development initiatives.

- Analysts predict significant upside potential for ENSC, with a remarkable average target price increase of over 1,173%.

- The company holds an "Outperform" rating, reflecting positive sentiment from major brokerage firms.

Ensysce Biosciences, Inc. (ENSC) has successfully concluded agreements enabling the immediate exercise of warrants, facilitating the purchase of 630,376 common shares at a price of $3.24 per share. This strategic move has generated approximately $2.2 million in capital, earmarked to propel the advancement of the company's cutting-edge pain management programs. Additionally, new warrants for 1,260,752 shares have been issued to further enhance funding opportunities.

Wall Street Analysts Forecast

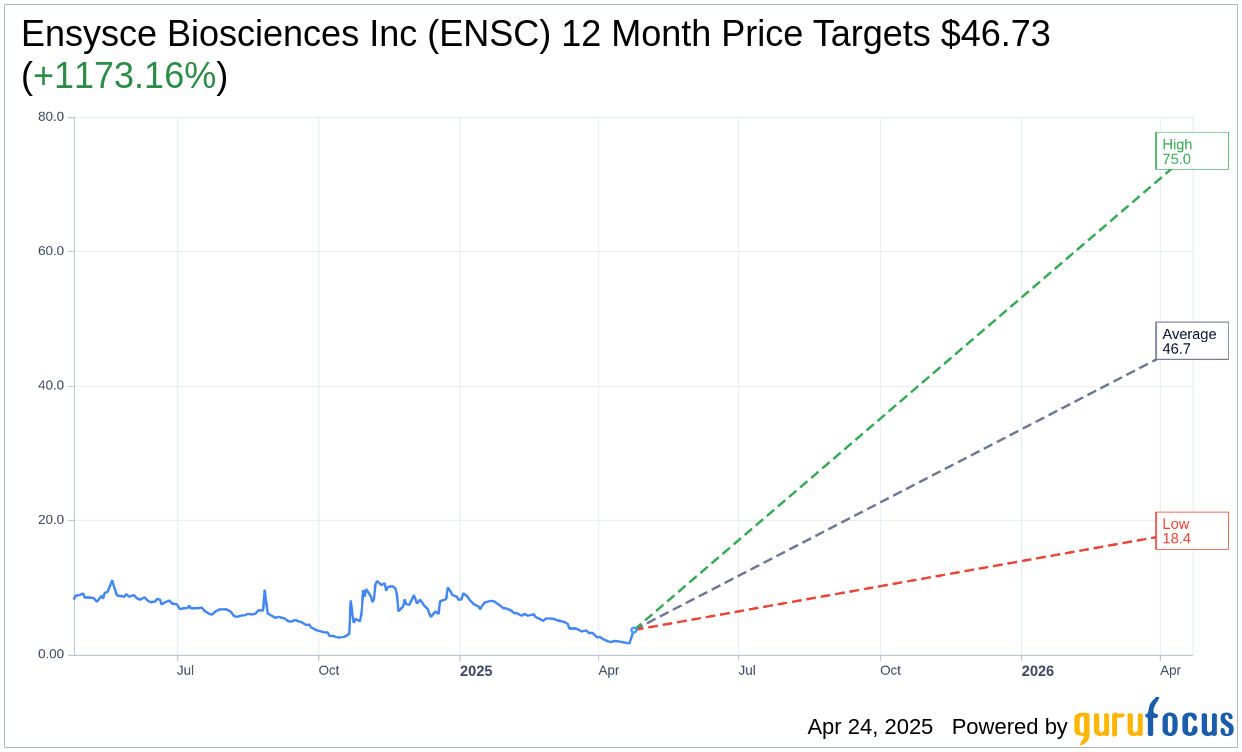

Wall Street analysts have provided one-year price targets for Ensysce Biosciences Inc (ENSC, Financial), with an average target price of $46.73. The high estimate reaches an impressive $75.00, while the low estimate stands at $18.45. This average target suggests a substantial upside of 1,173.16% from the current share price of $3.67. For more in-depth analysis and data, please visit the Ensysce Biosciences Inc (ENSC) Forecast page.

Moreover, according to the consensus recommendation from one brokerage firm, Ensysce Biosciences Inc (ENSC, Financial) holds an "Outperform" status, with an average brokerage recommendation score of 2.0. This score falls within a rating scale ranging from 1 to 5, where 1 represents a Strong Buy and 5 indicates a Sell, underscoring the company's favorable market position and investor confidence.