On April 24, 2025, AllianceBernstein Holding LP (AB, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. The company, a prominent investment management firm, provides services to institutional, retail, and private clients, managing $793 billion in assets as of October 2024. These assets are primarily allocated in fixed-income and equity strategies.

Financial Performance Overview

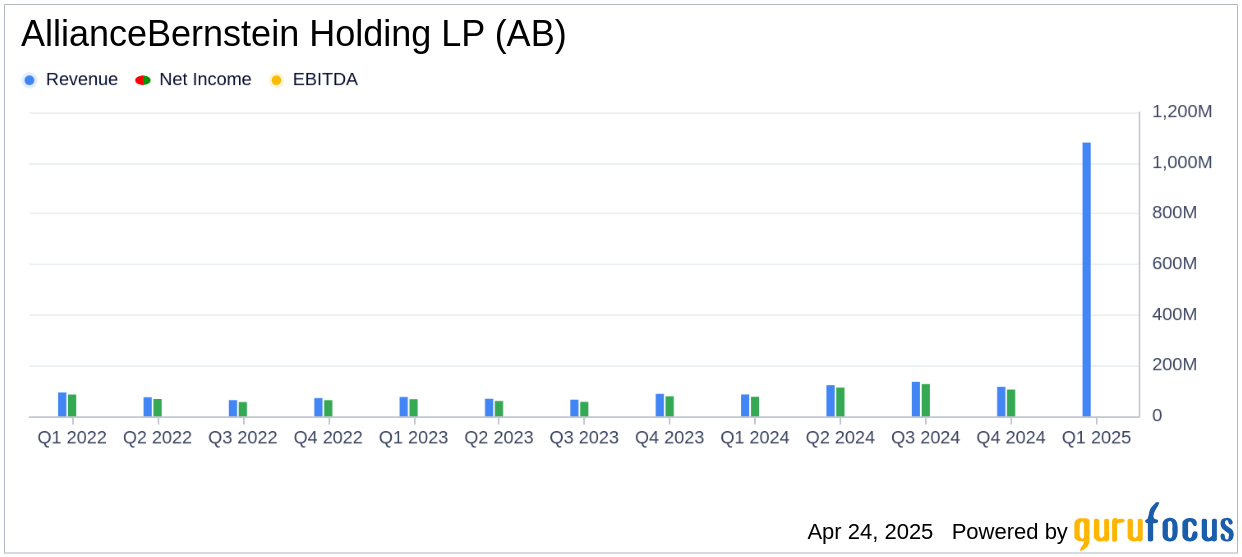

AllianceBernstein reported a GAAP net income of $0.67 per unit, aligning with analyst estimates. However, the company's revenue of $1.08 billion exceeded the estimated $852.93 million. Adjusted net income per unit was $0.80, reflecting a 9.6% increase from the previous year. The firm declared a cash distribution of $0.80 per unit, also marking a 9.6% increase year-over-year.

Key Financial Metrics and Achievements

Despite a challenging market environment, AllianceBernstein achieved $2.7 billion in active net inflows during the first quarter, driven by institutional investments in private alternative strategies. The firm's adjusted operating income rose by 6% to $282.7 million, with an adjusted operating margin of 33.7%, up 340 basis points from the previous year.

Against a tough market backdrop that intensified into the second quarter, all three of our global distribution channels grew organically, totaling $2.7 billion active net inflows in the first quarter of 2025," said Seth P. Bernstein, President and CEO of AllianceBernstein.

Income Statement and Balance Sheet Insights

AllianceBernstein's net revenues decreased by 2.1% year-over-year to $1.08 billion, primarily due to investment losses and the deconsolidation of Bernstein Research Services. Operating income also saw a decline of 2.3% to $236.4 million. The company's operating margin improved slightly to 21.8% from 21.2% in the previous year.

| Metric | 1Q 2025 | 1Q 2024 | % Change |

|---|---|---|---|

| Net Revenues | $1,080,607 | $1,104,151 | (2.1)% |

| Operating Income | $236,369 | $241,997 | (2.3)% |

| Operating Margin | 21.8% | 21.2% | 60 bps |

| Adjusted Net Revenues | $838,214 | $884,176 | (5.2)% |

| Adjusted Operating Income | $282,748 | $267,426 | 5.7% |

| Adjusted Operating Margin | 33.7% | 30.3% | 340 bps |

Strategic Insights and Market Position

AllianceBernstein's strategic focus on private alternative strategies and fixed-income platforms has yielded positive results, with significant net inflows in these areas. The firm's ability to adapt to market conditions and maintain strong client engagement has been crucial in navigating the current economic landscape.

Our retail channel gross sales surpassed $25 billion for the third quarter in a row, extending organic gains for the seventh consecutive quarter," Bernstein elaborated.

Overall, AllianceBernstein's performance in the first quarter of 2025 highlights its resilience and strategic positioning in the asset management industry. The firm's focus on diversified investment strategies and strong client relationships continues to drive growth and stability amidst market uncertainties.

Explore the complete 8-K earnings release (here) from AllianceBernstein Holding LP for further details.