On April 24, 2025, Heritage Financial Corp (HFWA, Financial) released its 8-K filing announcing its first-quarter 2025 financial results. The company reported a net income of $13.9 million, or $0.40 per diluted share, which fell short of the analyst estimate of $0.45 per share. Revenue details were not explicitly provided, but the company's strategic repositioning and other financial metrics offer insights into its performance.

Company Overview

Heritage Financial Corp is a bank holding company that, through its subsidiary, provides commercial lending and deposit relationships with small businesses and their owners in its market areas. The company offers various deposit products and makes real estate construction loans, land development loans, and consumer loans. Heritage Financial Corp operates primarily in the United States.

Performance and Challenges

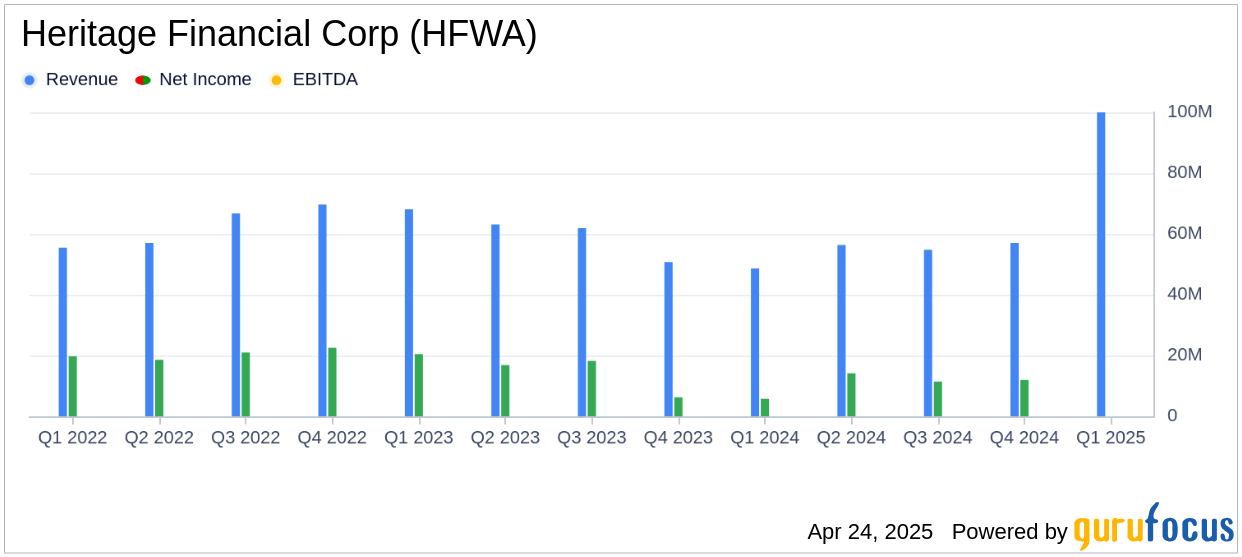

Heritage Financial Corp's net income for Q1 2025 was $13.9 million, up from $11.9 million in the previous quarter and $5.7 million in the same quarter last year. Despite this growth, the company's earnings per share of $0.40 missed the analyst estimate of $0.45. The company incurred a pre-tax loss of $3.9 million on the sale of investment securities, impacting earnings by $0.09 per share. This strategic repositioning aims to improve future profitability but has affected current earnings.

Financial Achievements

The company's net interest margin increased to 3.44% from 3.36% in the previous quarter, indicating improved profitability from its interest-earning assets. Deposits grew by $160.7 million, or 2.8%, reflecting strong customer acquisition and retention. The cost of interest-bearing deposits decreased to 1.92%, enhancing the company's interest expense management.

Key Financial Metrics

| Metric | Q1 2025 | Q4 2024 | Q1 2024 |

|---|---|---|---|

| Net Income ($ millions) | 13.9 | 11.9 | 5.7 |

| Diluted EPS ($) | 0.40 | 0.34 | 0.16 |

| Net Interest Margin (%) | 3.44 | 3.36 | 3.29 |

| Total Deposits ($ billions) | 5.85 | 5.68 | 5.53 |

Analysis of Financial Statements

Heritage Financial Corp's balance sheet shows a decrease in total investment securities by $53.8 million, reflecting strategic sales and purchases to optimize yields. Loans receivable slightly decreased by $37.3 million, while total deposits increased significantly, indicating a strong liquidity position. The company's capital ratios remain robust, with a stockholders' equity to total assets ratio of 12.4%.

Commentary

"We are very pleased with our operating results for the first quarter, which included solid deposit growth, margin expansion, and lower cost of deposits. In addition, we have maintained strong credit quality metrics including low levels of net charge-offs and nonaccrual loan balances." - Jeff Deuel, Chief Executive Officer

Conclusion

Heritage Financial Corp's Q1 2025 results highlight its strategic efforts to reposition its balance sheet for future profitability, despite the short-term impact on earnings. The company's strong deposit growth and improved net interest margin are positive indicators of its financial health. However, the missed EPS estimate underscores the challenges of balancing strategic initiatives with immediate financial performance. Investors will be keen to see how these strategies unfold in the coming quarters.

Explore the complete 8-K earnings release (here) from Heritage Financial Corp for further details.