In its first-quarter financial results, (Company) reported a revenue of $46.1 million, slightly exceeding the market consensus of $45.96 million. The company also announced a tangible book value per share of $8.48 and a Common Equity Tier 1 (CET1) capital ratio of 14.1%.

(Company) showed a strong quarterly performance, with profitability rising by 9% compared to the previous quarter. This increase was driven by an improved net interest margin, effective expense management, and enhanced asset quality. Despite a seasonally low demand for loans and some deposit outflows, (Company) managed to maintain healthy financial metrics.

Strategic efforts to reinvest excess liquidity into new investment securities are expected to boost future net interest income and margin. Looking at the bigger picture, the firm observed a 14% rise in net income over the first quarter of the previous year, along with improvements in annualized returns on average assets and equity.

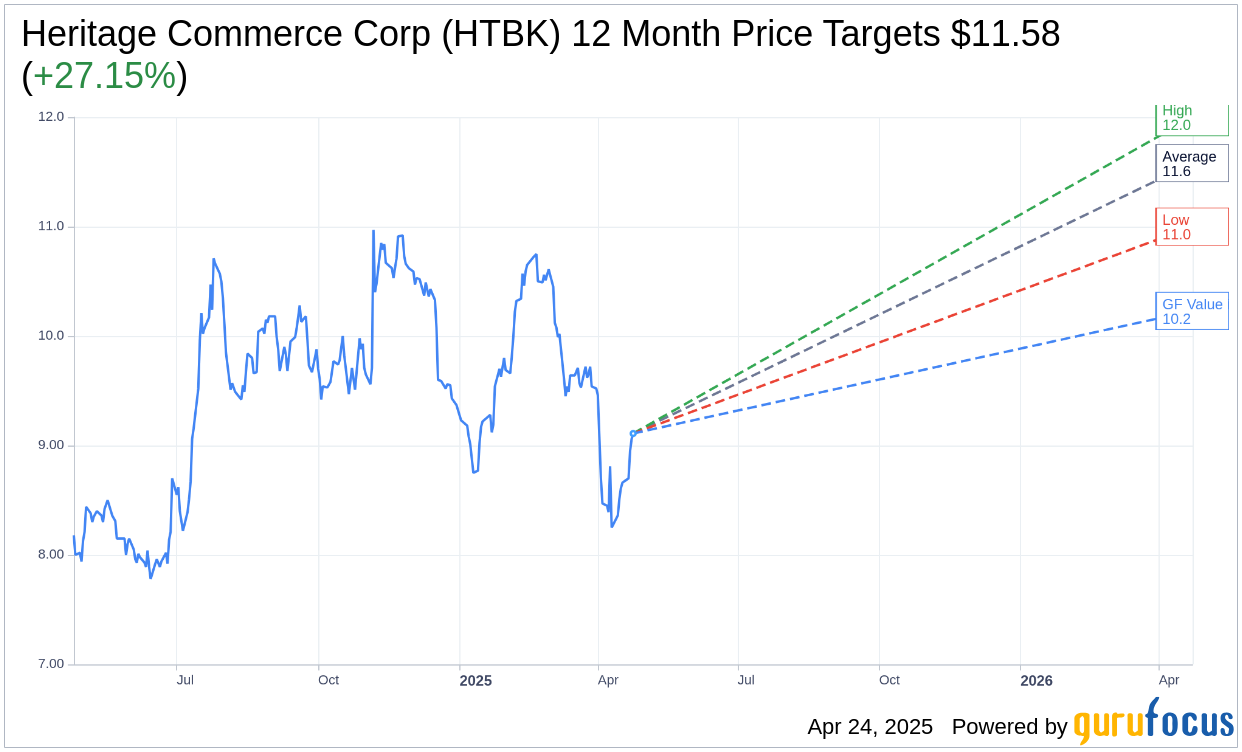

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Heritage Commerce Corp (HTBK, Financial) is $11.58 with a high estimate of $12.00 and a low estimate of $11.00. The average target implies an upside of 27.15% from the current price of $9.11. More detailed estimate data can be found on the Heritage Commerce Corp (HTBK) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Heritage Commerce Corp's (HTBK, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Heritage Commerce Corp (HTBK, Financial) in one year is $10.23, suggesting a upside of 12.29% from the current price of $9.11. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Heritage Commerce Corp (HTBK) Summary page.