Key Takeaways:

- Colgate-Palmolive (CL, Financial) reported a 3% profit increase, reaching $1.08 billion, buoyed by strong performance in Europe and its Hill's segment.

- Despite a 3.2% decline in total sales, the company exceeded earnings expectations with a non-GAAP EPS of $0.91.

- Analysts project an average price target of $97.81, presenting potential upside for investors.

Colgate-Palmolive's Financial Performance

Colgate-Palmolive (CL) demonstrated resilience in a challenging market by posting a 3% rise in profit to $1.08 billion. This growth was largely fueled by substantial gains in its European markets and the Hill's segment. Despite facing a 3.2% dip in total sales amidst tough global conditions, the company outperformed earnings expectations with a non-GAAP EPS of $0.91. Looking ahead, Colgate-Palmolive anticipates maintaining low single-digit sales growth.

Wall Street Analysts Forecast

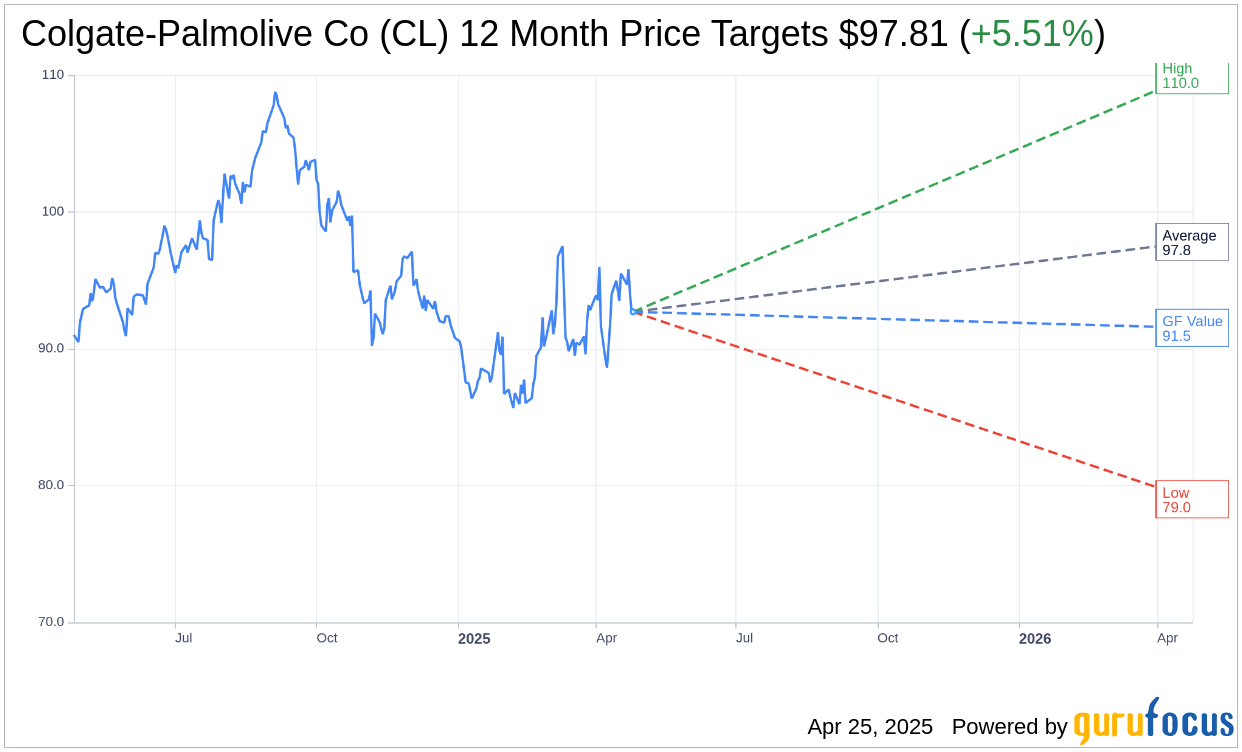

According to price targets set by 21 analysts, Colgate-Palmolive Co (CL, Financial) has a one-year average price target of $97.81, with a high projection of $110.00 and a low of $79.00. This average suggests a potential upside of 5.51% from the current trading price of $92.70. To explore more comprehensive estimates, visit the Colgate-Palmolive Co (CL) Forecast page.

Analyst Recommendations

The consensus recommendation among 24 brokerage firms places Colgate-Palmolive Co (CL, Financial) at an average rating of 2.5, signifying an "Outperform" status. This rating system ranges from 1, representing a Strong Buy, to 5, indicating a Sell.

GF Value Estimation

According to GuruFocus estimates, the projected GF Value for Colgate-Palmolive Co (CL, Financial) over the next year is $91.53, pointing to a potential downside of 1.26% from the present price of $92.70. The GF Value represents GuruFocus' assessment of the stock's fair trading value, calculated based on historical trading multiples, past business growth, and future performance forecasts. For further details, refer to the Colgate-Palmolive Co (CL) Summary page.