Raymond James has slightly adjusted its target price for Union Pacific (UNP, Financial), reducing it from $260 to $258, while maintaining a Strong Buy rating. The firm expresses confidence in Union Pacific's efforts to enhance service quality and foster growth through strategic network changes. These initiatives are expected to boost profitability by increasing asset turnover and implementing a more stringent transportation plan.

Wall Street Analysts Forecast

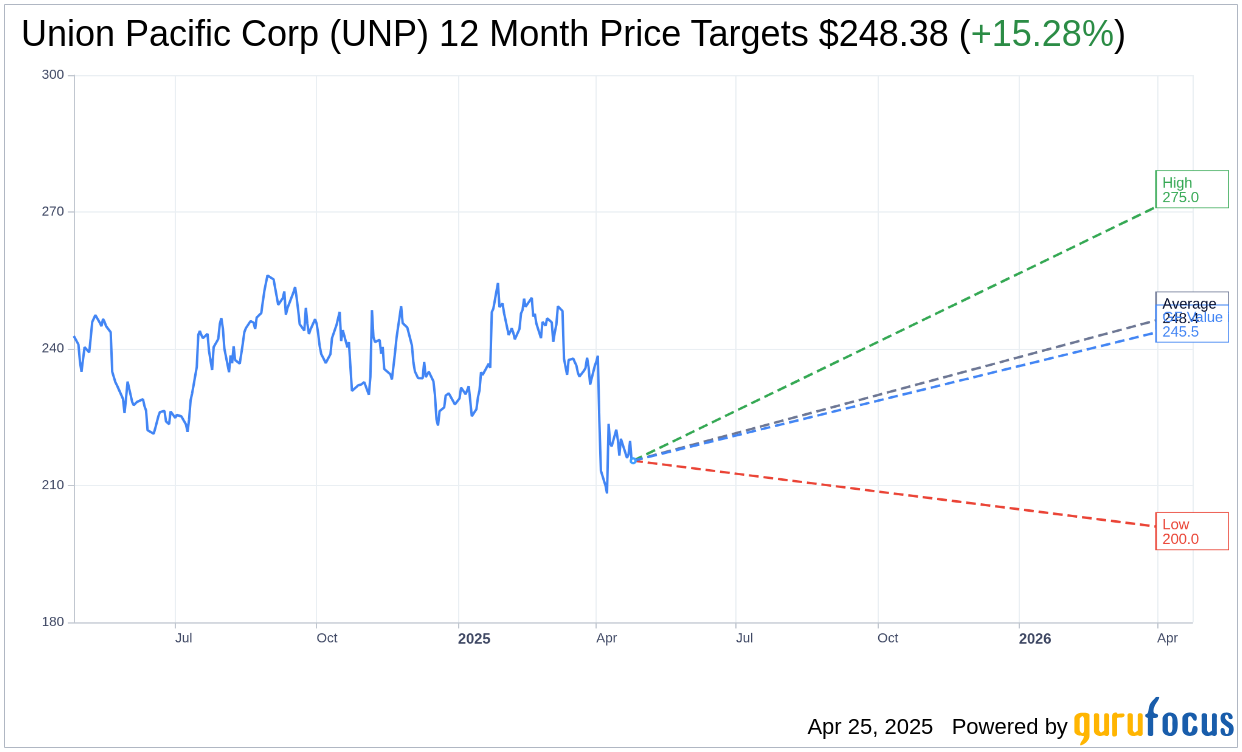

Based on the one-year price targets offered by 27 analysts, the average target price for Union Pacific Corp (UNP, Financial) is $248.38 with a high estimate of $275.00 and a low estimate of $200.00. The average target implies an upside of 15.28% from the current price of $215.45. More detailed estimate data can be found on the Union Pacific Corp (UNP) Forecast page.

Based on the consensus recommendation from 31 brokerage firms, Union Pacific Corp's (UNP, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Union Pacific Corp (UNP, Financial) in one year is $245.53, suggesting a upside of 13.96% from the current price of $215.45. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Union Pacific Corp (UNP) Summary page.