Tompkins Financial Corporation (TMP, Financial) reported a promising start to the fiscal year with its first-quarter net interest income reaching $56.66 million, showcasing a noticeable improvement compared to previous periods. This growth contributed to an increase in the company's net interest margin, climbing to 2.98% from last year's 2.73%.

The financial firm's tangible book value per share stands at $44.88, reflecting a solid foundation for further development. The company attributes its positive results to increased net interest and noninterest income, along with higher loan and deposit balances when compared to both the first and fourth quarters of 2024.

As Tompkins Financial embarks on the new year amid economic uncertainties, its leadership remains optimistic. The firm's strategy centers on maintaining a robust balance sheet while fostering growth through the cultivation of strong customer relationships and community support.

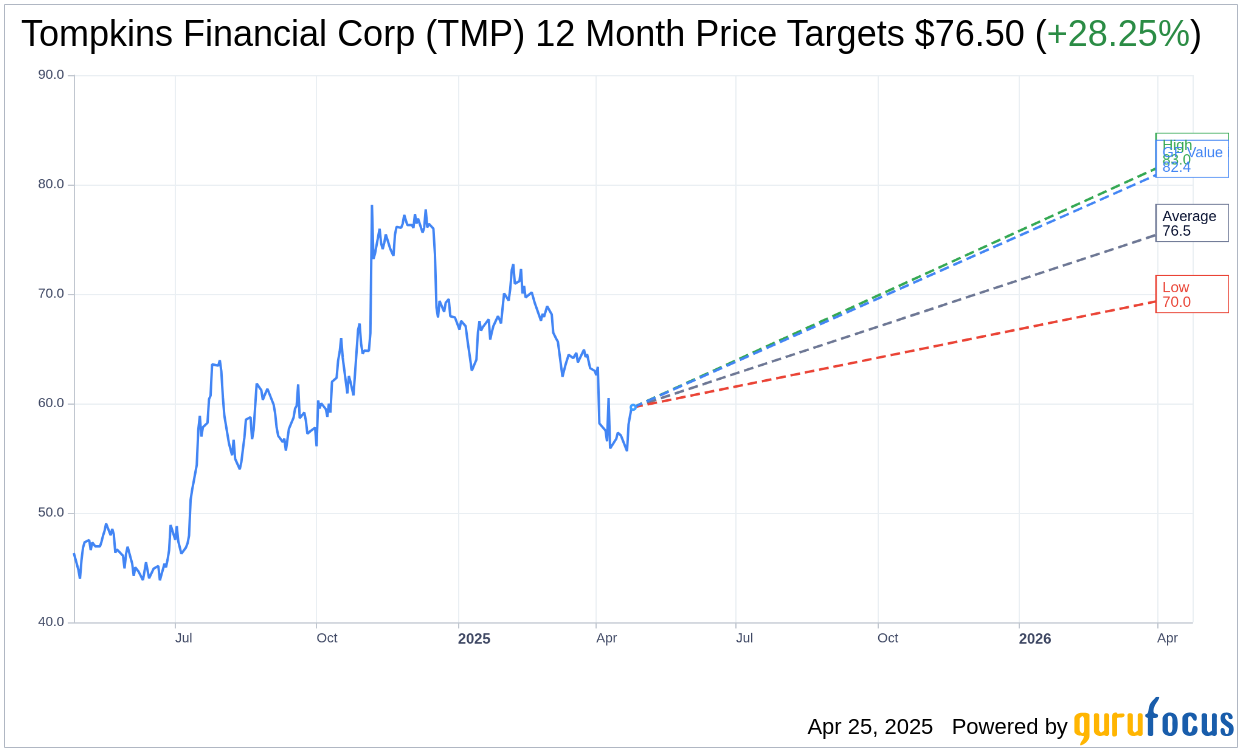

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for Tompkins Financial Corp (TMP, Financial) is $76.50 with a high estimate of $83.00 and a low estimate of $70.00. The average target implies an upside of 28.25% from the current price of $59.65. More detailed estimate data can be found on the Tompkins Financial Corp (TMP) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Tompkins Financial Corp's (TMP, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Tompkins Financial Corp (TMP, Financial) in one year is $82.36, suggesting a upside of 38.07% from the current price of $59.65. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Tompkins Financial Corp (TMP) Summary page.