- Avantor's Q1 revenue missed expectations at $1.58 billion, highlighting challenges in the lab solutions segment.

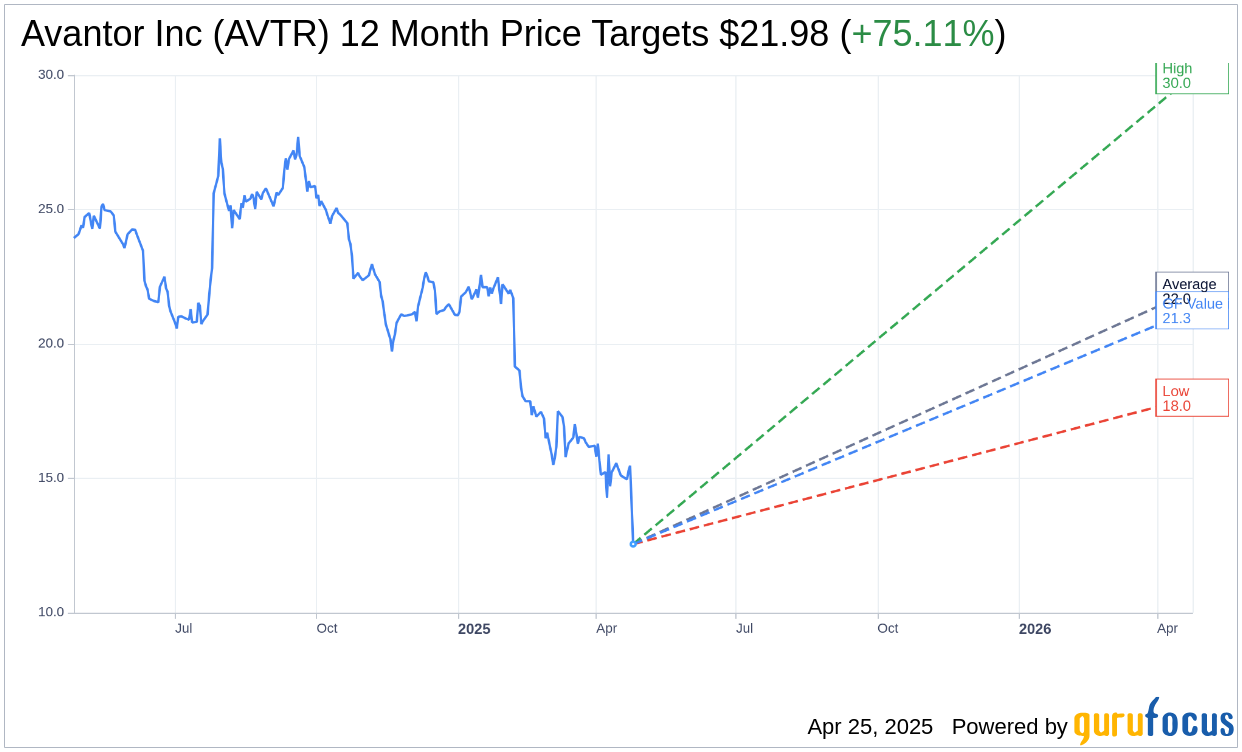

- Wall Street analysts see a potential upside of over 75% for Avantor's stock from current levels.

- GuruFocus projects a year-ahead GF Value of $21.25, indicating a significant opportunity for investors.

Shares of Avantor Inc. (AVTR, Financial) encountered a steep decline after the release of its first-quarter revenue results, which fell short of analyst expectations at $1.58 billion, below the projected $1.61 billion. This shortfall has been primarily attributed to the diminished demand within its lab solutions division, particularly affecting the education and government sectors.

Revenue and Growth Forecasts

Amid the revenue miss, Avantor has revised its organic sales growth forecast for 2025. The company now anticipates either a slight decline or a modest increase, which contrasts with previous growth projections. In light of these developments, Avantor is also focusing on cost transformation efforts aimed at margin expansion, targeting a range between 17.5% and 18.5%. Consequently, the stock has witnessed a significant drop of approximately 16% in morning trading and is down about 38% year-to-date.

Wall Street Analysts Forecast

In the face of these challenges, Wall Street remains somewhat optimistic. According to price targets from 20 analysts, Avantor Inc.'s average target price is projected at $21.99, with estimates ranging from a high of $30.00 to a low of $18.00. This average target reflects a notable upside potential of 75.11% from the current stock price of $12.56. For a more detailed analysis, visit the Avantor Inc (AVTR, Financial) Forecast page.

Analyst Recommendations

The stock's performance is further supported by a consensus recommendation from 24 brokerage firms, giving Avantor Inc. an average rating of 2.3, indicative of an "Outperform" status. The rating system spans from 1, which signifies a Strong Buy, to 5, denoting a Sell recommendation.

GuruFocus Valuation Perspective

From a valuation standpoint, GuruFocus provides an insightful perspective with its estimated GF Value for Avantor Inc. at $21.25 over the coming year. This suggests a substantial upside of 69.26% from the current trading price of $12.555. The GF Value represents GuruFocus' calculated fair value of the stock, derived from historical trading multiples, past business growth, and future performance estimates. For further details, explore the Avantor Inc (AVTR, Financial) Summary page.