Truist has increased its price target for Integer Holdings Corporation (ITGR, Financial) from $140 to $150, affirming a Buy rating on the stock. This adjustment follows Integer's impressive first-quarter performance, surpassing expectations in both earnings per share (EPS) and organic revenue. The firm attributes this success to robust demand in the Cardio and Vascular segments.

In addition to the current performance, Integer has maintained its guidance for an 8% to 10% organic growth rate through fiscal year 2025. Furthermore, the company has raised its EPS guidance, signaling optimism for continued financial improvement.

Truist's analysis suggests potential for further gains as the fiscal year advances. The company is expected to capitalize on its market opportunities, potentially growing at a rate outpacing its established markets. Investors are advised to watch Integer's performance closely as it aims for profitable expansion.

Wall Street Analysts Forecast

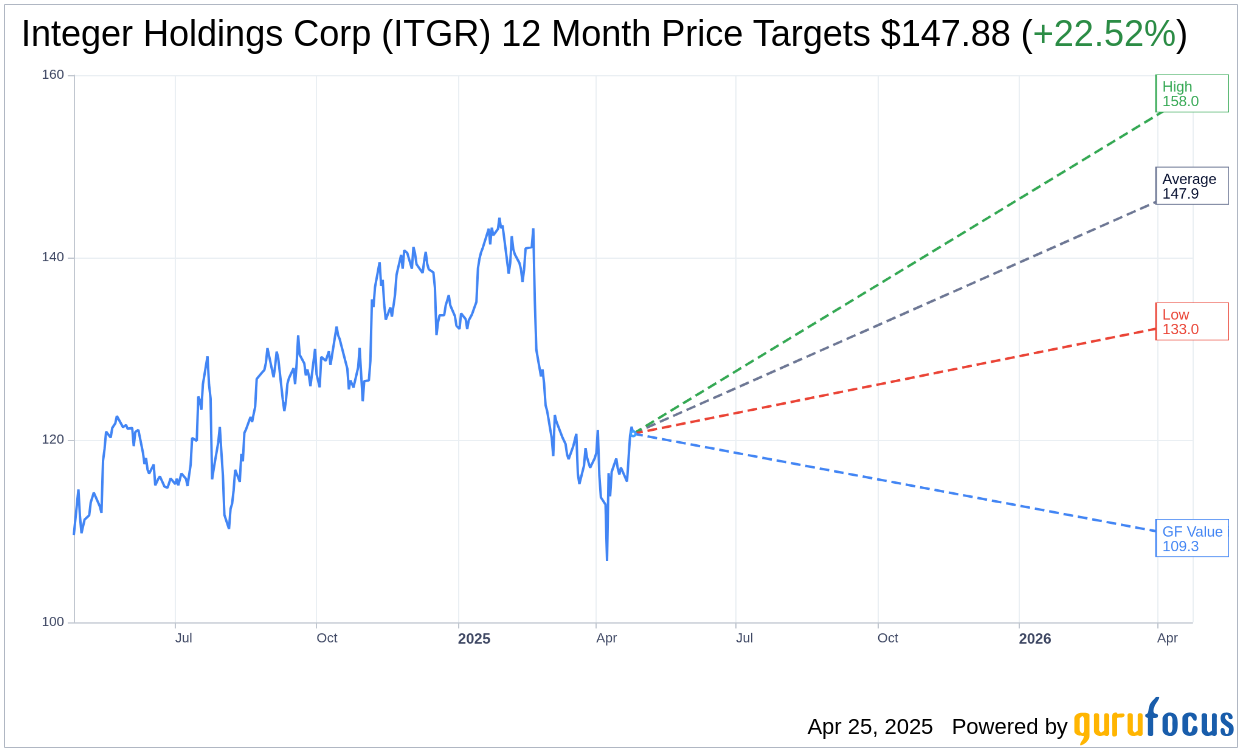

Based on the one-year price targets offered by 8 analysts, the average target price for Integer Holdings Corp (ITGR, Financial) is $147.88 with a high estimate of $158.00 and a low estimate of $133.00. The average target implies an upside of 22.52% from the current price of $120.69. More detailed estimate data can be found on the Integer Holdings Corp (ITGR) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Integer Holdings Corp's (ITGR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Integer Holdings Corp (ITGR, Financial) in one year is $109.25, suggesting a downside of 9.48% from the current price of $120.69. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Integer Holdings Corp (ITGR) Summary page.

ITGR Key Business Developments

Release Date: February 20, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Integer Holdings Corp (ITGR, Financial) reported strong sales growth of 11% in the fourth quarter of 2024, both organically and on a reported basis.

- The company completed the divestiture of Electric Kim for $50 million, making it a pure play medical device company.

- Integer Holdings Corp (ITGR) ended the year with a leverage ratio of 2.6 times adjusted EBITDA, at the low end of their target range, providing capacity for strategic acquisitions.

- The company announced the acquisition of Precision Coating for $152 million and VSI Paroline for $28 million, enhancing their vertical integration and proprietary coating capabilities.

- Integer Holdings Corp (ITGR) expects continued above-market growth with expanding margins, projecting 8% to 10% sales growth and 11% to 16% adjusted operating income growth for 2025.

Negative Points

- The company faces uncertainty regarding tariffs, particularly in Mexico, which could impact operations and costs.

- Gross margin in the fourth quarter came in below expectations despite better revenue performance, attributed to inefficiencies during new product ramps.

- The exit from the portable medical product line is expected to result in a $29 million decline in sales by the end of 2025.

- Higher interest expenses and taxes impacted adjusted net income, with a noted increase in the adjusted effective tax rate due to new legislation.

- The strong performance of Integer Holdings Corp (ITGR) stock price has led to dilution in adjusted weighted average shares outstanding, affecting EPS.