- Colgate-Palmolive (CL, Financial) anticipates a $200 million impact due to tariffs, yet maintains a positive profit growth outlook.

- Analyst consensus rates the stock as "Outperform," with a price target average suggesting moderate upside potential.

- GuruFocus metrics indicate a GF Value estimate slightly below the current market price.

Colgate-Palmolive Co. (CL) is navigating the complexities of global supply chains heightened by tariff-related disruptions. The company anticipates a significant $200 million incremental impact. However, CEO Noel Wallace remains optimistic, attributing their resilience to robust brand innovation and strategic sourcing measures. Despite market volatility, the company continues to report solid profit growth and maintains a positive outlook for the end of the fiscal year.

Wall Street Analysts' Price Targets

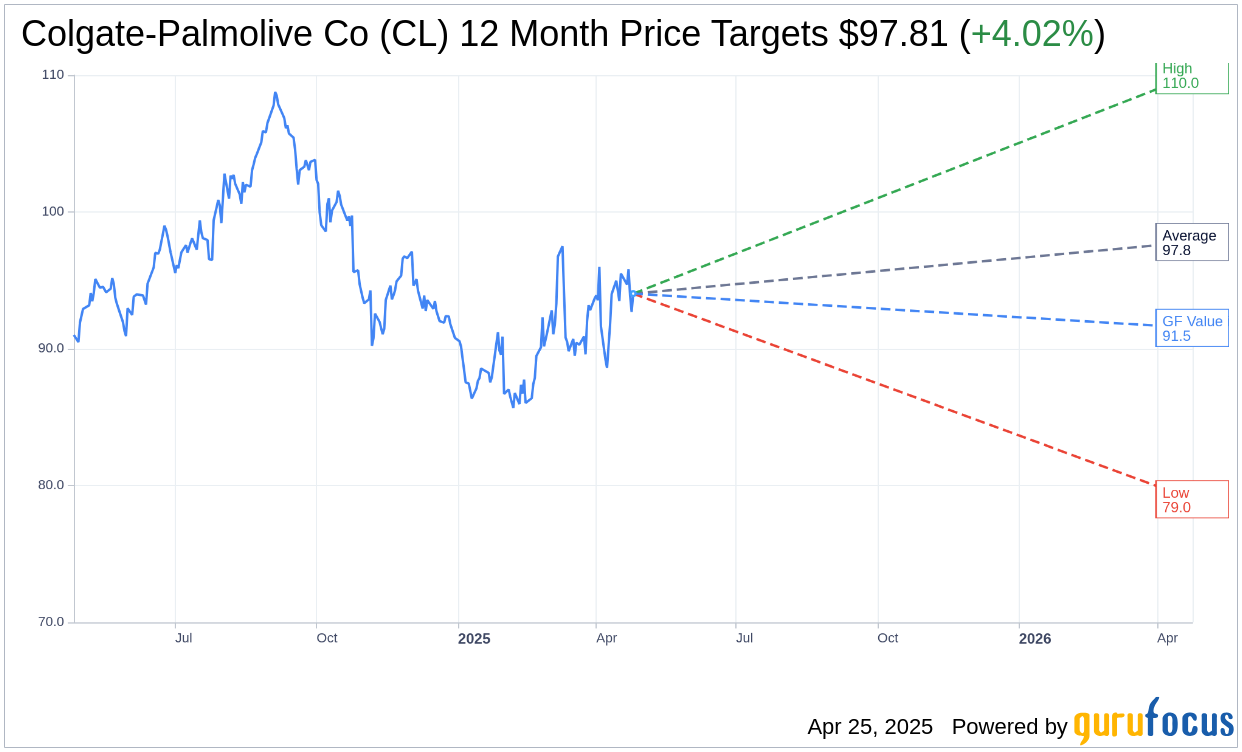

The current analyst consensus presents an average target price of $97.81 for Colgate-Palmolive Co (CL, Financial), offering a potential upside of 4.02% from its current trading price of $94.03. Analysts' projections range between $79.00 and $110.00. For more in-depth analysis, investors can refer to the Colgate-Palmolive Co (CL) Forecast page.

Brokerage Recommendations

Out of 24 brokerage firms, the consensus recommendation for Colgate-Palmolive Co (CL, Financial) is rated at 2.5, signifying an "Outperform" status. This rating is part of a scale ranging from 1, which indicates a Strong Buy, to 5, indicating a Sell. This suggests a moderate confidence level among analysts regarding the stock's future performance.

Evaluating GF Value Estimates

According to GuruFocus estimates, the one-year projected GF Value for Colgate-Palmolive Co (CL, Financial) is $91.53, which shows a potential downside of 2.66% from the current price. The GF Value metric represents GuruFocus' calculated fair market value, derived from historical trading multiples, past growth rates, and future business performance projections. Further data and analysis are available on the Colgate-Palmolive Co (CL) Summary page.