Summit Therapeutics (SMMT, Financial) has acknowledged a significant development as Akeso (AKESF) reported that the Chinese health authorities have approved ivonescimab for a second medical indication. This approval stems from the successful results of the Phase III clinical trial named HARMONi-2, officially known as AK112-303, which evaluated the drug as a monotherapy against pembrolizumab in patients suffering from locally advanced or metastatic non-small cell lung cancer with positive PD-L1 expression.

HARMONi-2, conducted exclusively in China, is a multi-center Phase III study managed entirely by Akeso. During the process of reviewing Akeso's application for expanding the drug's label in China, the National Medical Products Administration (NMPA) requested an interim analysis of overall survival data. Akeso reported a clinically meaningful hazard ratio of 0.777, derived from an analysis conducted at 39% data maturity with an impressively low nominal alpha level of 0.0001.

This trend in overall survival, despite the trial's primary focus on progression-free survival, highlights the potential of ivonescimab as a transformative next-generation PD-1 directed immunotherapy. The promising results suggest significant benefits for patients with lung cancer and possibly other tumor types as well, according to Summit's leadership.

Despite this positive development, shares of Summit Therapeutics (SMMT, Financial) remain in a trading halt, having previously declined by 37%, equivalent to a drop of $13.49, closing at $23.21.

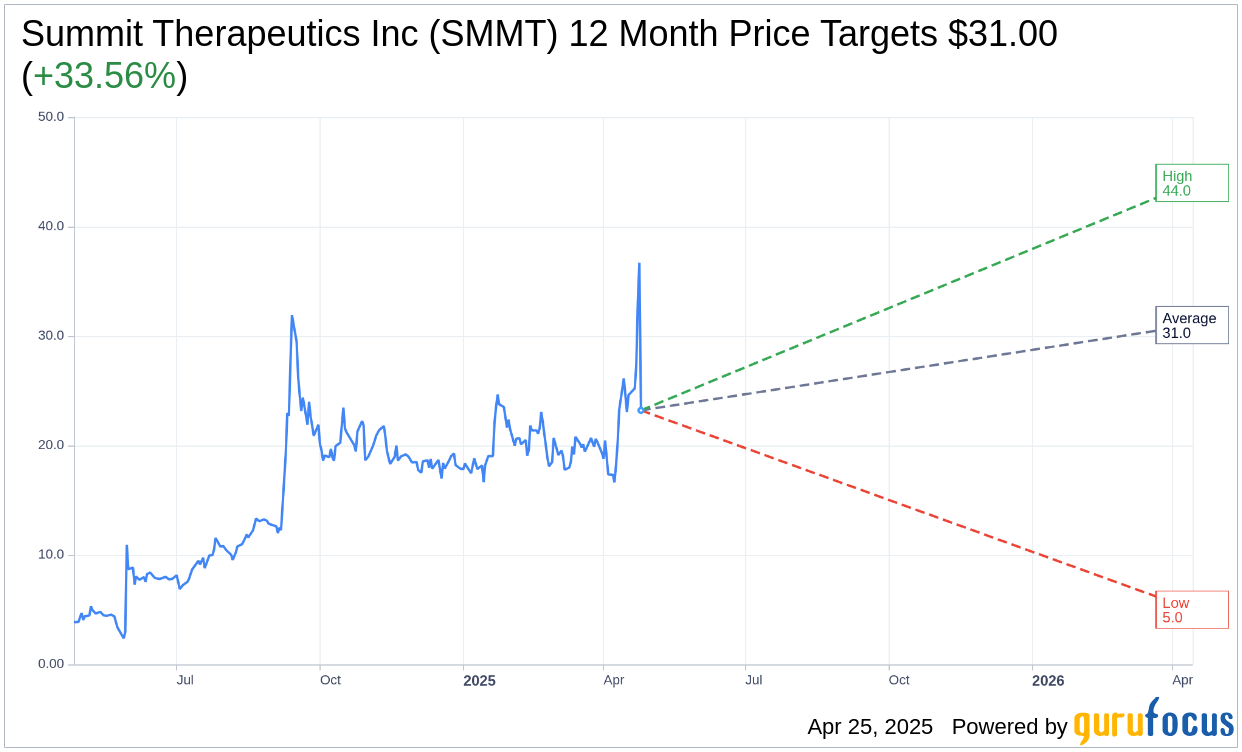

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for Summit Therapeutics Inc (SMMT, Financial) is $31.00 with a high estimate of $44.00 and a low estimate of $5.00. The average target implies an upside of 33.56% from the current price of $23.21. More detailed estimate data can be found on the Summit Therapeutics Inc (SMMT) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Summit Therapeutics Inc's (SMMT, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Summit Therapeutics Inc (SMMT, Financial) in one year is $0.39, suggesting a downside of 98.32% from the current price of $23.21. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Summit Therapeutics Inc (SMMT) Summary page.

SMMT Key Business Developments

Release Date: February 24, 2025

- Cash Position: Approximately $412 million at the end of 2024.

- Debt Status: Debt-free as of the end of 2024.

- GAAP R&D Expenses: $150.8 million for the full year 2024, up from $59.4 million in the previous year.

- Non-GAAP R&D Expenses: $134.8 million for the full year 2024, compared to $55 million in the previous year.

- Acquired In-Process R&D Expenses: $15 million for 2024, down from $520.9 million in the previous year.

- GAAP G&A Expenses: $60.5 million for the full year 2024, compared to $30.3 million in the previous year.

- Non-GAAP G&A Expenses: $25.5 million for the full year 2024, compared to $20.6 million in the prior year.

- Non-GAAP Operating Expenses: $175.3 million for the full year 2024, down from $596.5 million in the previous year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Summit Therapeutics Inc (SMMT, Financial) announced a clinical trial collaboration with Pfizer to evaluate Ivonescimab in combination with multiple Pfizer antibody drug conjugates in unique solid tumor settings.

- The company completed enrollment and received Fast Track designation for its global Phase III trial, HARMONi, targeting EGFR mutated advanced non-small cell lung cancer.

- Summit Therapeutics Inc (SMMT) expanded the HARMONi-3 trial to include a larger patient population, addressing both squamous and non-squamous histologies.

- The company has a strong cash position of approximately $412 million and is debt-free, providing a solid financial foundation for ongoing and future trials.

- Ivonescimab has been featured in numerous publications and presentations, indicating strong interest and recognition in the medical community.

Negative Points

- The company's R&D expenses increased significantly to $150.8 million in 2024 from $59.4 million in the previous year, reflecting the expansion of clinical trials.

- There is uncertainty regarding the timing of the HARMONi-2 overall survival data, which is crucial for regulatory approval processes.

- Summit Therapeutics Inc (SMMT) faces challenges in providing a clear timeline for the top-line readout of the HARMONi-3 trial due to ongoing site activations.

- The company has not disclosed specific details about the Pfizer collaboration, such as which ADCs will be used or the tumor types targeted, leaving some strategic aspects unclear.

- The competitive landscape in non-small cell lung cancer is intense, with multiple ongoing Phase III studies by other companies, which could impact market share and approval timelines.