Key Takeaways:

- Arista Networks (ANET, Financial) has faced a challenging year with a 33% drop in stock price.

- Despite tariff concerns, the company is optimistic with a 19.5% revenue growth rate.

- Analysts maintain an "Outperform" rating with an average price target suggesting significant upside potential.

Arista Networks (ANET) has encountered a turbulent year, seeing its stock plummet by approximately 33%, largely due to trade tariffs impacting its gross margins. Nevertheless, the company remains bullish, reporting an impressive 19.5% growth rate in revenue and expressing confidence in achieving its artificial intelligence revenue targets. Analysts are showing resilience in their outlook, maintaining an "Outperform" rating and adjusting their price targets accordingly.

Wall Street Analysts Forecast

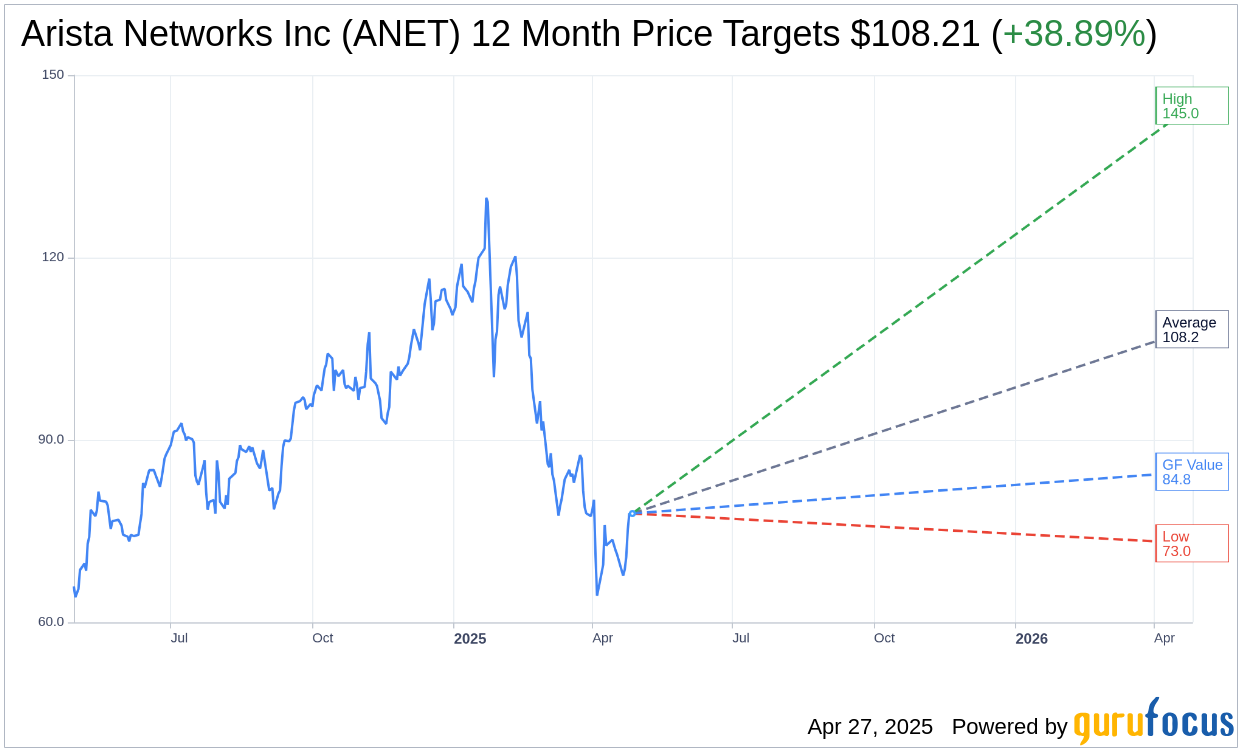

Presently, 19 analysts predict that the average one-year price target for Arista Networks Inc (ANET, Financial) is $108.21. Projections range from a high estimate of $145.00 to a low of $73.00. This average price target suggests a potential upside of 38.89% from the current stock price of $77.91. For a deeper dive into these projections, refer to the Arista Networks Inc (ANET) Forecast page.

The consensus from 25 brokerage firms gives Arista Networks Inc (ANET, Financial) an average recommendation of 1.9 on a scale where 1 indicates a "Strong Buy" and 5 means "Sell," reinforcing its "Outperform" status.

Understanding GF Value

From a valuation perspective, GuruFocus estimates that the GF Value for Arista Networks Inc (ANET, Financial) in the next year is pegged at $84.79. This estimation indicates a potential upside of 8.83% from its current price of $77.91. The GF Value is a crucial metric that suggests what the fair trading value of the stock should be, calculated using historical trading multiples, past business performance, and future business performance estimates. For more comprehensive data, visit the Arista Networks Inc (ANET) Summary page.