Relmada Therapeutics (RLMD, Financial) is set to hold a virtual meeting to discuss the topline efficacy and safety data from its Phase 2 study of NDV-01. This investigational treatment targets high-grade non-muscle invasive bladder cancer (HG-NMIBC). The webcast is scheduled for April 28 at 4:30 PM.

During the meeting, Relmada's management aims to provide insights into the preliminary results of the study, focusing on the drug's effectiveness and safety profile. Stakeholders and interested parties are encouraged to join the webcast to gain a deeper understanding of NDV-01's potential impact in treating HG-NMIBC.

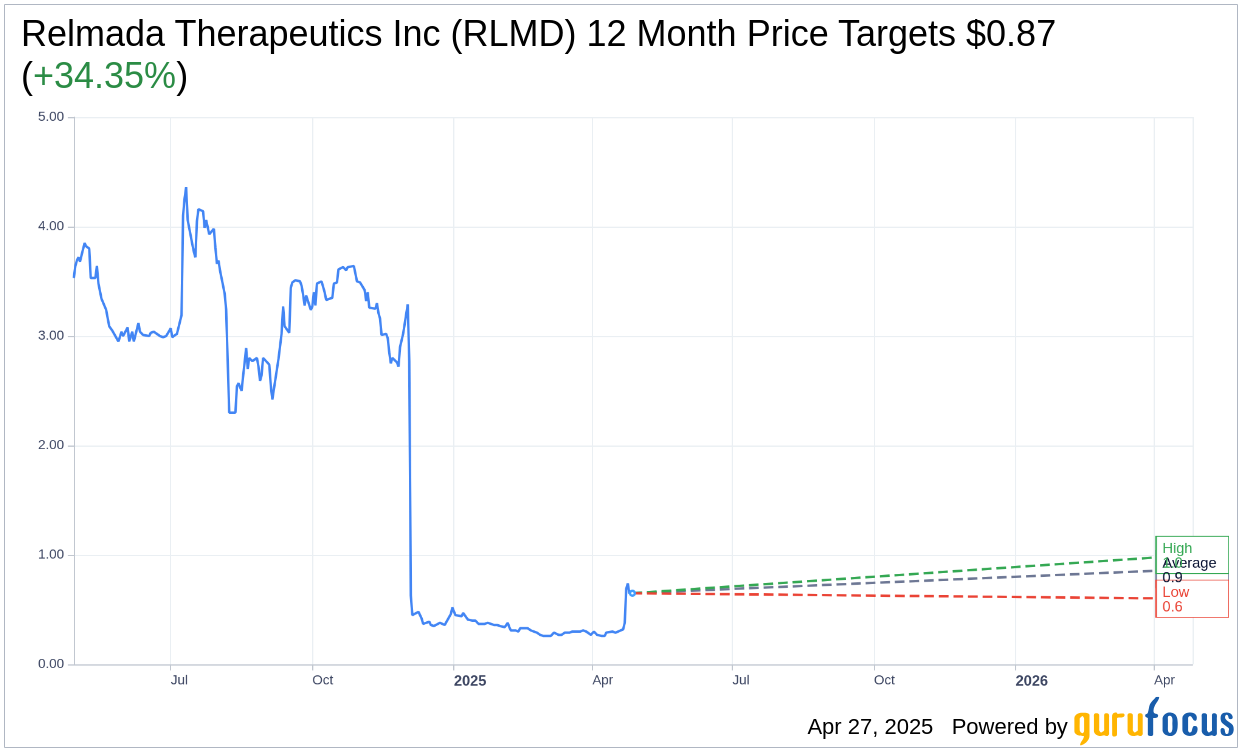

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for Relmada Therapeutics Inc (RLMD, Financial) is $0.87 with a high estimate of $1.00 and a low estimate of $0.60. The average target implies an upside of 34.35% from the current price of $0.65. More detailed estimate data can be found on the Relmada Therapeutics Inc (RLMD) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Relmada Therapeutics Inc's (RLMD, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

RLMD Key Business Developments

Release Date: March 27, 2025

- Cash Equivalents and Short-term Investments: $44.9 million as of December 31, 2024, compared to $96.3 million as of December 31, 2023.

- Cash Used in Operations: $8.8 million for Q4 2024, compared to $10.2 million for Q4 2023.

- Research and Development Expense: $11 million for Q4 2024, compared to $14.7 million for Q4 2023.

- General and Administrative Expense: $8.1 million for Q4 2024, compared to $12.1 million for Q4 2023.

- Net Loss: $18.6 million or $0.62 per share for Q4 2024, compared to $25.1 million or $0.84 per share for Q4 2023.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Relmada Therapeutics Inc (RLMD, Financial) has successfully acquired rights to two promising candidates, NDVA1 for non-muscle invasive bladder cancer and Sopranoon for compulsion-related disorders, enhancing their product pipeline.

- The company is focusing on strategic product acquisitions to maximize shareholder value, demonstrating a proactive approach to growth.

- Relmada's financial management shows a decrease in both research and development expenses and general administrative expenses compared to the previous year, indicating improved cost efficiency.

- The company maintains a strong development capability with a history of conducting multiple Phase 3 and Phase 1 trials, which is attractive to potential partners.

- Relmada has a cash position of approximately $44.9 million as of December 31, 2024, providing a financial cushion for ongoing and future projects.

Negative Points

- Relmada Therapeutics Inc (RLMD) experienced a significant decrease in cash equivalents and short-term investments from $96.3 million in 2023 to $44.9 million in 2024, indicating a substantial cash burn.

- The company reported a net loss of $18.6 million for the fourth quarter of 2024, which, although reduced from the previous year, still reflects ongoing financial challenges.

- There is uncertainty regarding the future development of RP11 due to a competitive landscape and regulatory challenges, which may impact the company's strategic focus.

- The discontinuation of Phase 3 studies for 1,017 in major depressive disorder has shifted the company's focus, potentially delaying progress in this therapeutic area.

- Relmada's reliance on strategic acquisitions for growth may pose risks if future acquisitions do not meet expectations or if integration challenges arise.