- Amplify Energy cancels merger deal, focusing on new strategies to boost shareholder value.

- Analysts project significant upside potential for AMPY with a price target of $10.25.

- Company achieves an "Outperform" rating, suggesting strong market performance.

Amplify Energy (AMPY, Financial) has experienced a remarkable 19% upswing in its stock valuation following the announcement of terminating its merger agreement with Juniper Capital Advisors. This decision, primarily driven by market volatility, marks a strategic pivot for the company, which initially aimed to acquire substantial oil reserves. As a result, Amplify Energy is now redirecting efforts to explore alternative opportunities aimed at enhancing shareholder value.

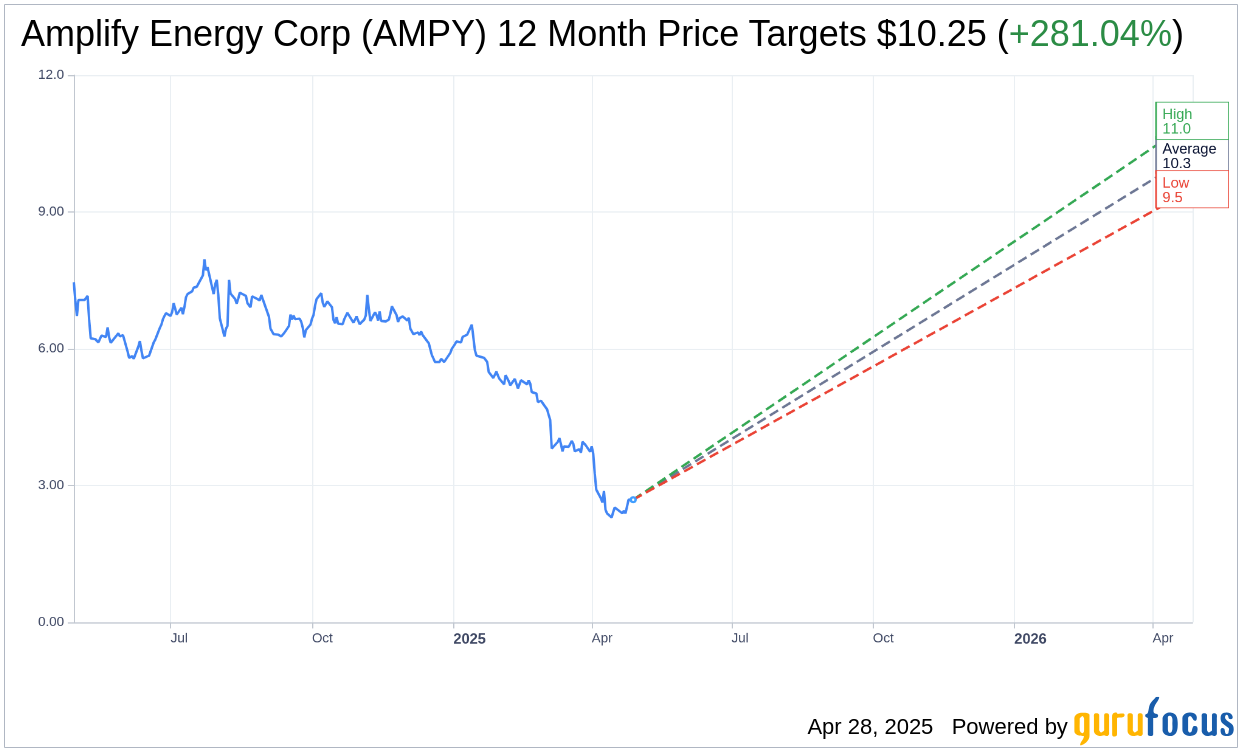

Wall Street Analysts Forecast

According to projections by two leading analysts, the average price target for Amplify Energy Corp (AMPY, Financial) stands at $10.25, with forecasts reaching as high as $11.00 and as low as $9.50. This average target indicates an impressive potential upside of 281.04% from its current trading price of $2.69. Investors can explore more detailed projection data on the Amplify Energy Corp (AMPY) Forecast page.

The consensus recommendation from two brokerage firms currently positions Amplify Energy Corp (AMPY, Financial) with an average brokerage recommendation of 2.0, equating to an "Outperform" rating. This evaluation follows a scale ranging from 1 (Strong Buy) to 5 (Sell), reflecting positive expectations for the company's market performance.

Furthermore, GuruFocus' own GF Value estimation suggests that the fair value for Amplify Energy Corp (AMPY, Financial) in one year could be $6.91. This represents a possible upside of 156.88% from its present price of $2.69. The GF Value is a well-rounded calculation that considers historical trading multiples, previous business growth, and anticipated future performance. For an in-depth analysis, investors should visit the Amplify Energy Corp (AMPY) Summary page.