Perfect Corp. (PERF, Financial) announced its first-quarter revenue of $16 million, slightly below the market consensus of $16.16 million. Despite this minor shortfall, the company's leadership highlighted its ongoing revenue growth and sturdy financial health.

Under the direction of Alice Chang, Founder, Chairwoman, and CEO, Perfect Corp. has continued to deliver positive net income and maintain a strong cash flow. The firm attributes its consistent performance to effective management and the ability to capitalize on new market opportunities.

By focusing on expanding its total addressable market, Perfect Corp. not only continues to draw in new clients but is also setting itself up for sustained, long-term growth, according to company statements.

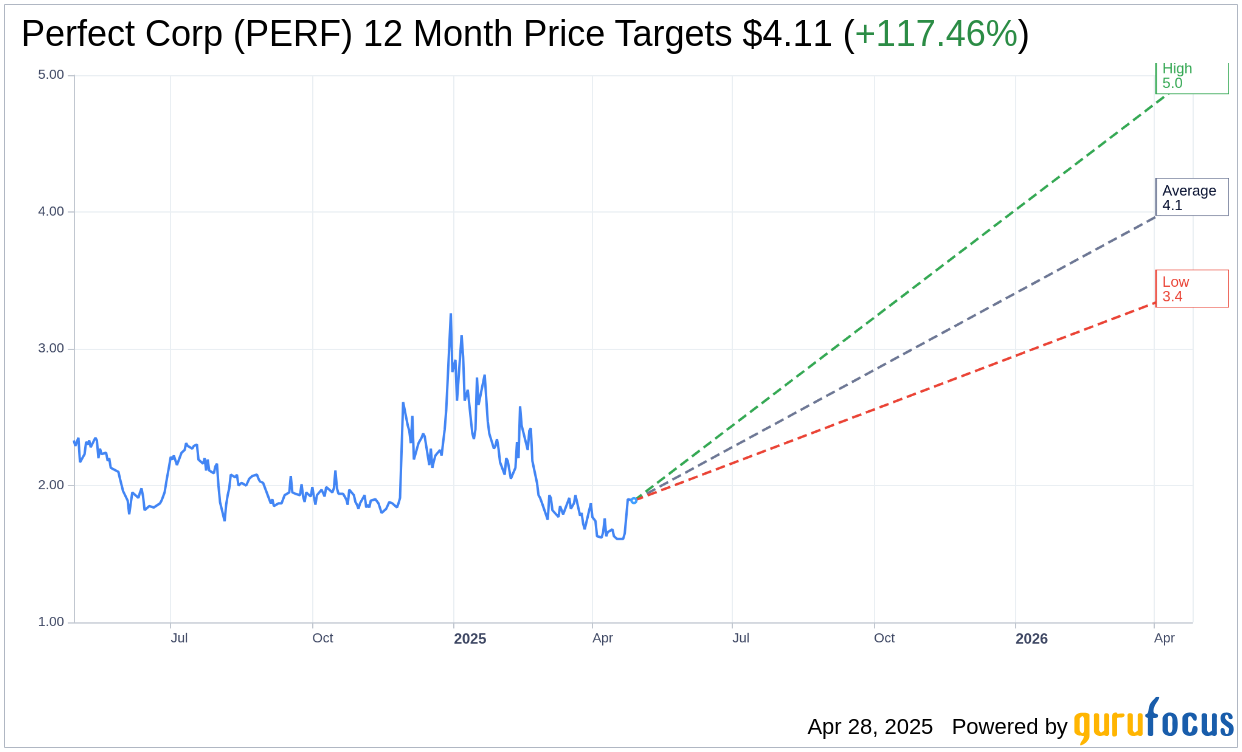

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Perfect Corp (PERF, Financial) is $4.11 with a high estimate of $5.00 and a low estimate of $3.44. The average target implies an upside of 117.46% from the current price of $1.89. More detailed estimate data can be found on the Perfect Corp (PERF) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, Perfect Corp's (PERF, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

PERF Key Business Developments

Release Date: February 27, 2025

- Total Revenue: Increased 12.5% year over year to $60.2 million for the full year 2024.

- Net Income: $5 million for the full year 2024, with an adjusted net income of $8.3 million, up 18.6% from 2023.

- Operating Cash Flow: Generated a net inflow of $13 million for the full year 2024.

- Cash and Cash Equivalents: $165.9 million as of December 31, 2024.

- Gross Profit: $46.9 million for the full year 2024, with a gross margin of 78%.

- Operating Expenses: Total operating expenses for the full year 2024 increased 2.7% to $50.1 million.

- Mobile App Subscribers: Active paying subscribers increased 14.3% to over 1 million by the end of 2024.

- Enterprise Clients: Reached 732 brand clients with over 822,000 skills onboarded.

- 2025 Revenue Growth Guidance: Projected to range from 13% to 14.5% year over year.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Perfect Corp (PERF, Financial) achieved a double-digit revenue growth of 12.5% year over year, reaching $60.2 million in 2024.

- The company reported a strong net income of $5 million, with an adjusted net income increase of 18.6% to $8.3 million compared to 2023.

- The B2C mobile app business saw significant growth, with active paying subscribers increasing by 14.3% to over 1 million by the end of 2024.

- Perfect Corp (PERF) maintains a robust balance sheet with over $165.9 million in cash and cash equivalents.

- The acquisition of Wanna from Farfetch is expected to expand Perfect Corp's market reach in the luxury fashion segment, enhancing its competitive position.

Negative Points

- The B2B market remains challenging, with clients cautious about spending due to potential tariffs and economic uncertainties.

- Licensing revenue decreased significantly by 72.2% in the fourth quarter of 2024, as the company transitions to a subscription-based model.

- Gross margins declined from 81.3% in 2023 to 74.1% in the fourth quarter of 2024, primarily due to increased third-party payment processing fees.

- Operating expenses increased by 2.7% for the full year 2024, driven by higher sales and marketing costs.

- The B2B revenue contribution is expected to decrease, potentially dropping to 30-40% of total revenue in 2025, as B2C growth outpaces B2B.