- Rithm Property Trust announces $0.02 per share earnings available for distribution.

- Book value per share stands at $5.40, showcasing financial stability.

- A public offering of $50 million in preferred stock is on the horizon.

Rithm Property Trust (RPT, Financial) has recently revealed its quarterly earnings available for distribution (EAD) at a modest $0.02 per share, while proudly maintaining a book value per common share of $5.40. To further solidify its financial standing, the company has declared a $50 million public offering of its Series C preferred stock. This move signals RPT’s strategic initiatives to enhance its capital structure and investor appeal.

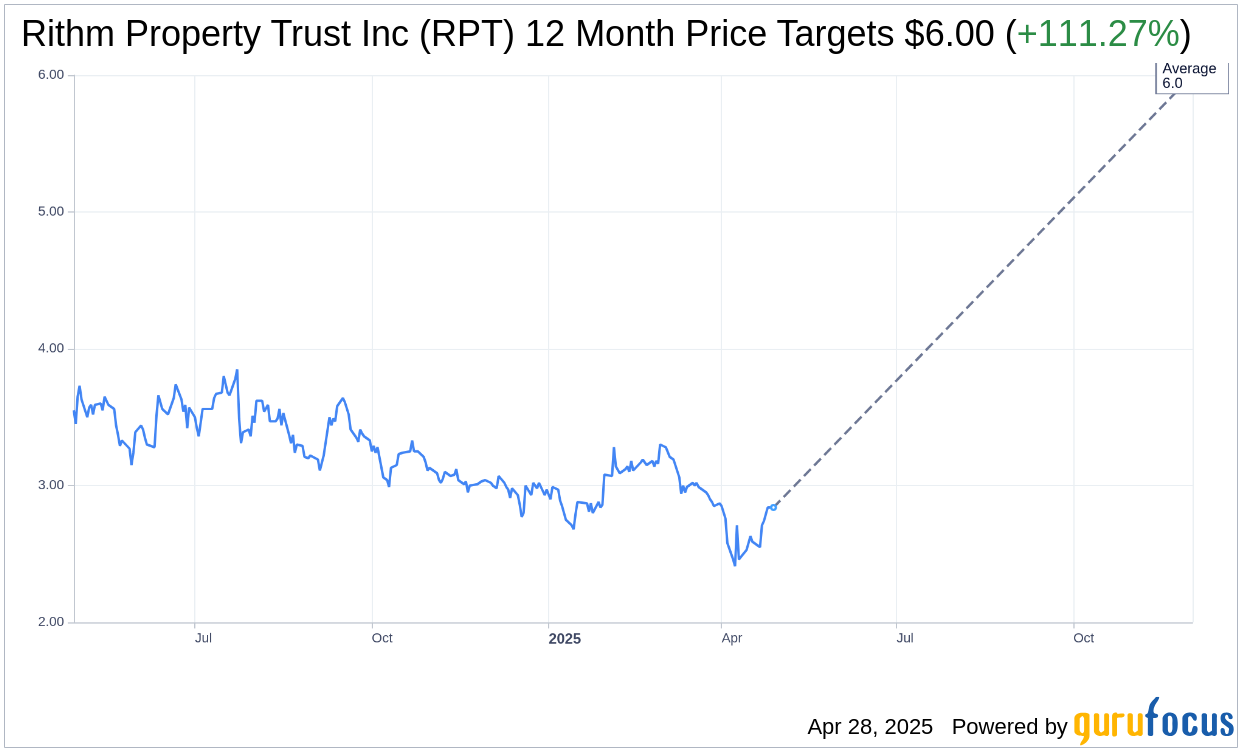

Wall Street Analysts Forecast

Delving into the insights provided by analysts, the one-year price target for Rithm Property Trust Inc (RPT, Financial) is set at an average of $6.00, with both high and low estimates aligning at the same mark. This projection suggests a remarkable upside potential of 111.27% from the current stock price of $2.84. Investors looking to explore further can find more in-depth forecast details on the Rithm Property Trust Inc (RPT) Forecast page.

Moreover, the consensus recommendation from two leading brokerage firms places Rithm Property Trust Inc (RPT, Financial) at an average rating of 2.5, suggesting an "Outperform" status. On the brokerage recommendation scale, a rating of 1 indicates a Strong Buy, while 5 would signal a Sell. This rating highlights the potential RPT holds and the confidence analysts have in its future performance.