- Alliance Resource Partners (ARLP, Financial) surpasses Q1 earnings expectations despite revenue decline.

- Analyst projections suggest substantial upside potential for ARLP shares.

- Current brokerage recommendations rate ARLP as "Outperform."

In a notable financial performance, Alliance Resource Partners (ARLP) reported a Q1 GAAP EPS of $0.57, outperforming market expectations by $0.05. While the company experienced a 17.1% decline in revenue, bringing in $540.5 million, it notably secured 17.7 million tons of contract commitments through 2028, reinforcing its market position. The board declared a quarterly cash distribution of $0.70 per unit, highlighting consistent returns for investors.

Wall Street Analysts' Forecast

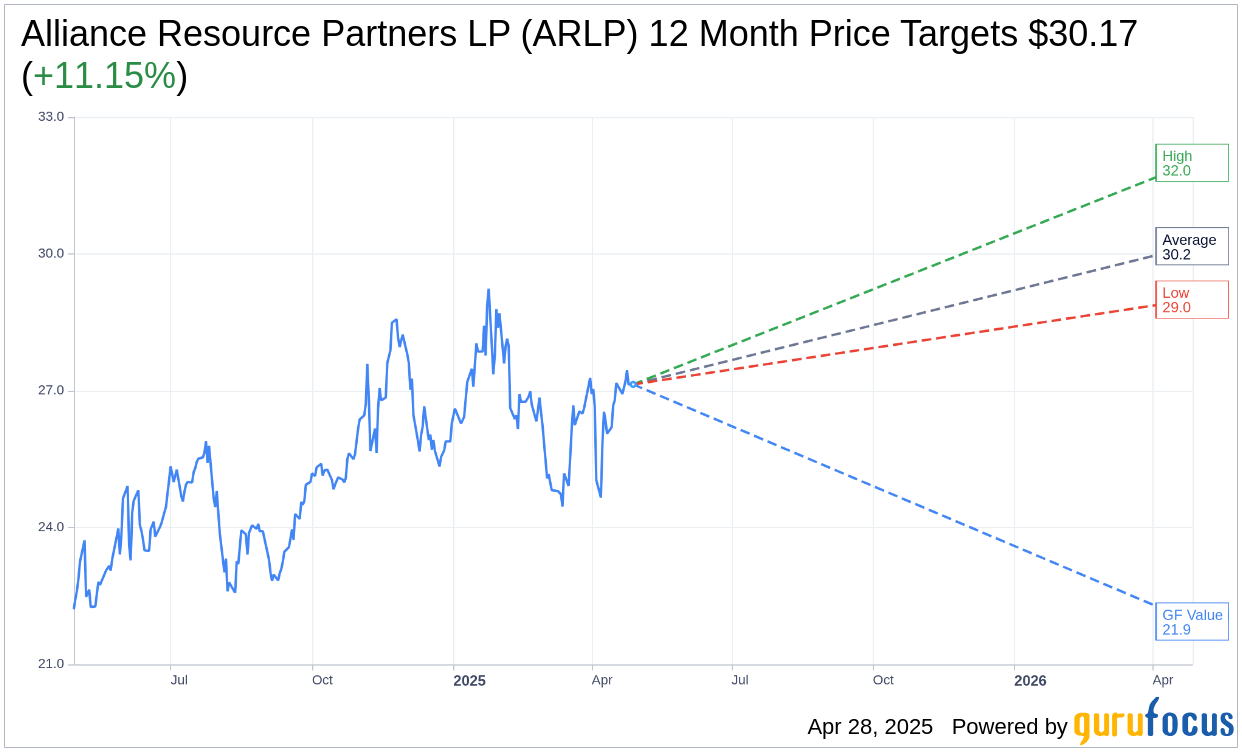

Alliance Resource Partners (ARLP, Financial) is estimated to reach an average price target of $30.17 within a year, according to projections from three analysts. The forecasts range from a high of $32.00 to a low of $29.00, indicating an overall optimistic outlook. This suggests a potential upside of approximately 11.15% from the current share price of $27.14. For more insights into these estimates, explore the Alliance Resource Partners LP (ARLP) Forecast page.

Brokerage firms rate Alliance Resource Partners (ARLP, Financial) with a consensus recommendation of 2.0, categorizing it as "Outperform." This evaluation falls on a scale where 1 represents a Strong Buy and 5 indicates a Sell, reflecting analysts' optimistic expectations for the stock's future performance.

In contrast, the GF Value for Alliance Resource Partners (ARLP, Financial) is projected at $21.94 over the next year, implying a potential downside of 19.16% from the current price of $27.14. This valuation, calculated by GuruFocus, is based on historical trading multiples, past business growth, and future performance estimates. For a comprehensive analysis, visit the Alliance Resource Partners LP (ARLP) Summary page.