Compass Therapeutics (CMPX, Financial) has unveiled new findings on its CD137 agonist antibody, CTX-471, at the American Association for Cancer Research (AACR) Annual Meeting held in Chicago from April 25-30, 2025. The company showcased a poster titled “Enhanced Efficacy of CTX-471, A CD137 Agonist Antibody, In Models of Immune Checkpoint Failure Via Simultaneous Blockade of Neo-Angiogenesis.”

In combination with the agent Tovecimig, CTX-471 demonstrated significant efficacy in various murine models that are known to resist immune checkpoint inhibitors. Notably, this includes the CT26B2m and MC38B2m knockout mouse tumor models, which have been developed to simulate the loss of human leukocyte antigen (HLA) in patients.

The research also included unique models of resistance to immunotherapy, created without inducing heightened natural killer (NK) cell susceptibility. One such model involved the CT26 cells engineered with a B2m gene deletion, which were further adapted in tumor-experienced mice. This generated a resistant line of CT26B2m-/- cells. Another model focused on MC38 cells with an H-2k1 MHC-I locus knockout, leading to a specific homozygous loss.

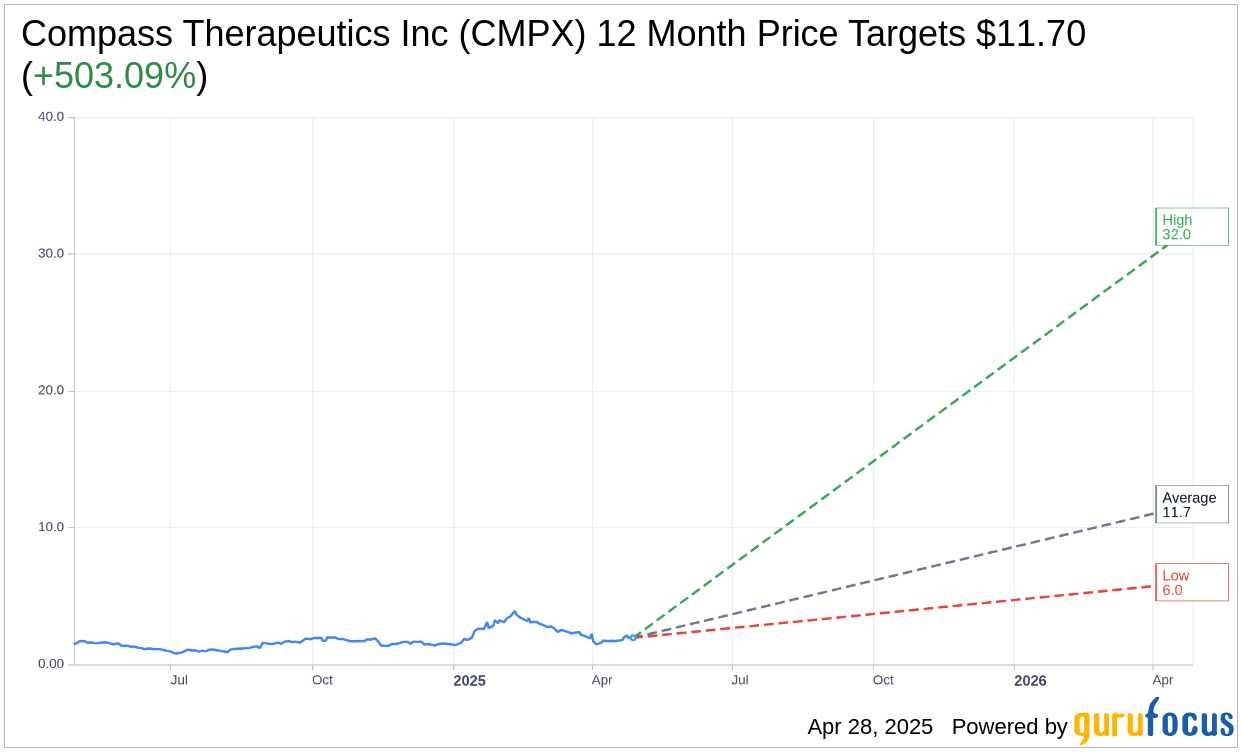

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for Compass Therapeutics Inc (CMPX, Financial) is $11.70 with a high estimate of $32.00 and a low estimate of $6.00. The average target implies an upside of 503.09% from the current price of $1.94. More detailed estimate data can be found on the Compass Therapeutics Inc (CMPX) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Compass Therapeutics Inc's (CMPX, Financial) average brokerage recommendation is currently 1.4, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.