In its latest quarterly report, BMRC announced a tangible book value per share of $22.48 for the first quarter. The bank's Common Equity Tier 1 (CET1) capital ratio stood at 0.04%. Despite lowering deposit rates, BMRC experienced robust deposit growth, which the company attributes to its effective relationship banking strategy.

BMRC's commercial lending operations showed significant momentum, with originations reaching approximately five times the figures recorded in the first quarter of 2024. This uptick began accelerating in March and has maintained its pace into April, bolstering expectations for enhanced margin growth in the coming months.

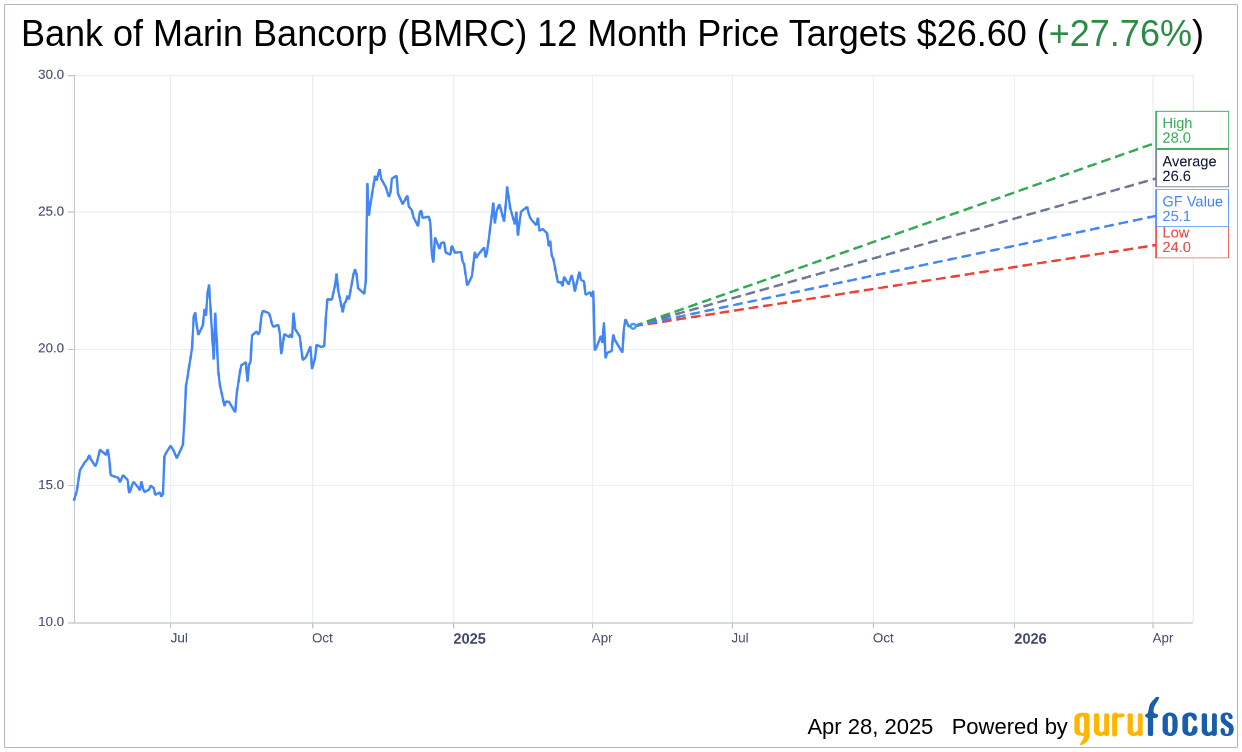

Wall Street Analysts Forecast

Based on the one-year price targets offered by 5 analysts, the average target price for Bank of Marin Bancorp (BMRC, Financial) is $26.60 with a high estimate of $28.00 and a low estimate of $24.00. The average target implies an upside of 27.76% from the current price of $20.82. More detailed estimate data can be found on the Bank of Marin Bancorp (BMRC) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Bank of Marin Bancorp's (BMRC, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bank of Marin Bancorp (BMRC, Financial) in one year is $25.14, suggesting a upside of 20.75% from the current price of $20.82. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bank of Marin Bancorp (BMRC) Summary page.