- IBM's strategic $150 billion investment in the U.S. focuses on advancing its manufacturing capabilities, including mainframe and quantum computing.

- Analysts foresee a potential 7.63% upside for IBM with an average price target of $250.14, signifying market optimism.

- Despite a consensus 'Outperform' rating, GuruFocus estimates a potential downside of 33.28% based on GF Value calculations.

IBM (IBM, Financial) is gearing up for a major transformation with a bold announcement to infuse $150 billion into the United States over the next five years. This investment is strategically aligned with the company’s ambitions to enhance its American manufacturing prowess, with a spotlight on mainframe and quantum computing advancements.

Analyst Price Predictions

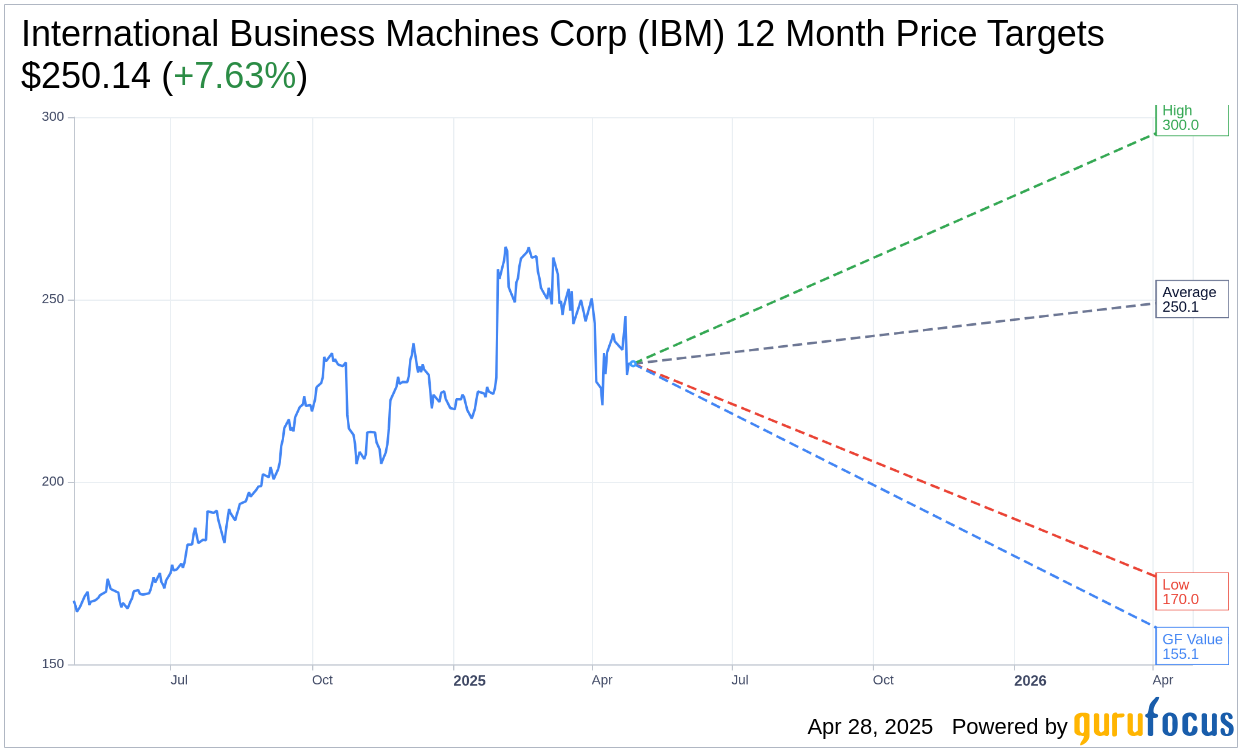

The sentiment among 18 Wall Street analysts suggests a bullish outlook for International Business Machines Corp (IBM, Financial), projecting an average price target of $250.14. This target encompasses a spectrum from a high of $300.00 to a low of $170.00, indicating a potential upside of 7.63% from the current trading price of $232.41. Investors can delve into further detailed estimate data on the International Business Machines Corp (IBM) Forecast page.

Brokerage Recommendations

An analysis of 23 brokerage firms highlights a consensus recommendation for IBM of 2.4, which translates to an "Outperform" status. The brokerage rating system, ranging from 1 to 5, classifies 1 as a Strong Buy and 5 as a Sell, positioning IBM favorably within this index.

GF Value Assessment

In contrast to the optimistic price targets, GuruFocus provides a more cautious perspective with an estimated GF Value of $155.07 for IBM over the next year. This estimation suggests a conceivable downside of 33.28% from the current share price of $232.41. The GF Value methodology encompasses historical trading multiples, past business growth, and future performance predictions. For a comprehensive overview, investors are encouraged to visit the International Business Machines Corp (IBM, Financial) Summary page.