Raymond James has adjusted its price target for The Bancorp (TBBK, Financial), reducing it from $67 to $57, while maintaining an Outperform rating on the stock. This decision follows The Bancorp's first-quarter performance, which did not meet market expectations despite exhibiting strong underlying trends.

Analysts indicate a potential catalyst for the company's improvement could be the anticipated completion of the Aubrey sale. The management of The Bancorp has confirmed that this transaction remains on schedule to conclude by the May 23 deadline.

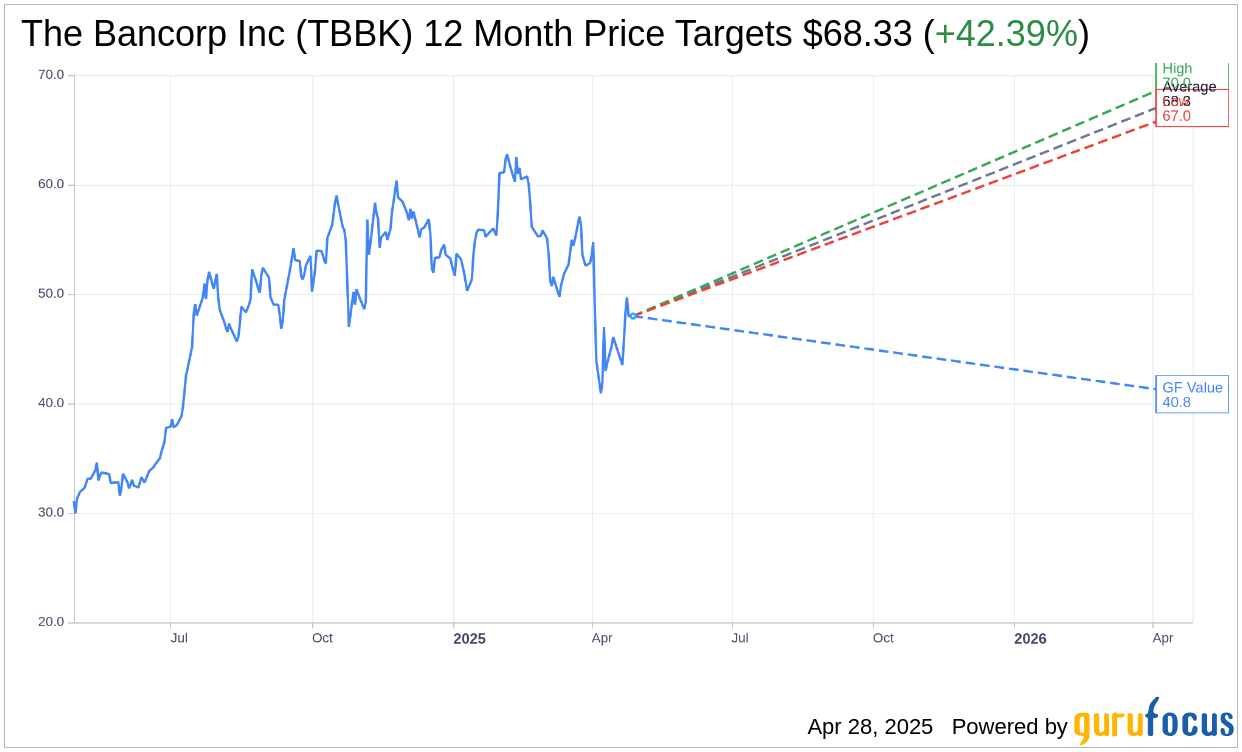

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for The Bancorp Inc (TBBK, Financial) is $68.33 with a high estimate of $70.00 and a low estimate of $67.00. The average target implies an upside of 42.39% from the current price of $47.99. More detailed estimate data can be found on the The Bancorp Inc (TBBK) Forecast page.

Based on the consensus recommendation from 3 brokerage firms, The Bancorp Inc's (TBBK, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Bancorp Inc (TBBK, Financial) in one year is $40.84, suggesting a downside of 14.9% from the current price of $47.99. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Bancorp Inc (TBBK) Summary page.

TBBK Key Business Developments

Release Date: April 25, 2025

- Earnings Per Share (EPS): $1.19 per diluted share, a 12% increase over Q1 2024.

- Net Income: Impacted by provisions for credit losses and credit enhancement income, both at $45.9 million, resulting in no net impact.

- Net Interest Income: Decreased by 3% compared to Q1 2024.

- Net Interest Margin: 4.07%, down from 4.55% in Q4 2024.

- Fintech Solutions Group GDP: Increased 18% year over year.

- Total Fees: Grew 26% year over year.

- Credit Sponsorship Balances: Grew to $574 million, a 26% increase quarter over quarter.

- Loan Balances: Grew 17% year over year; excluding consumer fintech loans, grew 6%.

- Average Fintech Solutions Deposits: Increased 26% to $7.81 billion from $6.18 billion in Q1 2024.

- Non-Interest Income: $37.8 million, a 29% increase over Q1 2024.

- Prepaid, Debit Card, ACH, and Other Payment Fees: Increased 13% to $30.8 million.

- Consumer Credit Fintech Fees: $3.6 million.

- Non-Interest Expense: $53.3 million, a 14% increase over Q1 2024.

- Salaries and Benefits: Increased by 11%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Bancorp Inc (TBBK, Financial) reported a 12% increase in earnings per diluted share for Q1 2025 compared to Q1 2024.

- The fintech Solutions Group showed significant momentum with GDP increasing 18% year over year and total fees growing 26%.

- Credit sponsorship balances grew 26% quarter over quarter, with expectations to exceed $1 billion by year-end 2025.

- The company successfully reduced substandard assets in its rebel portfolio, with a 1% decrease in substandard loans and a 20% decrease in special mentioned loans compared to the prior quarter.

- The Bancorp Inc (TBBK) confirmed its guidance of $5.25 per diluted share for 2025, excluding the impact of $150 million in stock buybacks authorized for the year.

Negative Points

- Net interest income was down 3% compared to Q1 2024, impacted by a lower rate environment.

- The net interest margin decreased to 4.07% from 4.55% in Q4 2024.

- Non-interest expense increased by 14% compared to Q1 2024, including an 11% rise in salaries and benefits.

- The fintech loan yields fell more than deposit rates, impacting the net interest margin.

- The company experienced volatility in deposit costs due to insurance settlements, which temporarily increased funding costs.