Pretzelmaker, famed for its Pretzel Bites and part of the FAT Brands portfolio, has launched a new store in Ardmore, Oklahoma. The latest addition aims to enhance the brand’s presence in non-traditional venues, such as convenience stores, by leveraging its adaptable store design.

This Ardmore location, while offering a complete menu, is set to serve as a strategic model that will help Pretzelmaker, under the FAT (ticker: FAT), to explore growth opportunities within the convenience store sector. The company sees significant potential in expanding its on-the-go offerings through these channels.

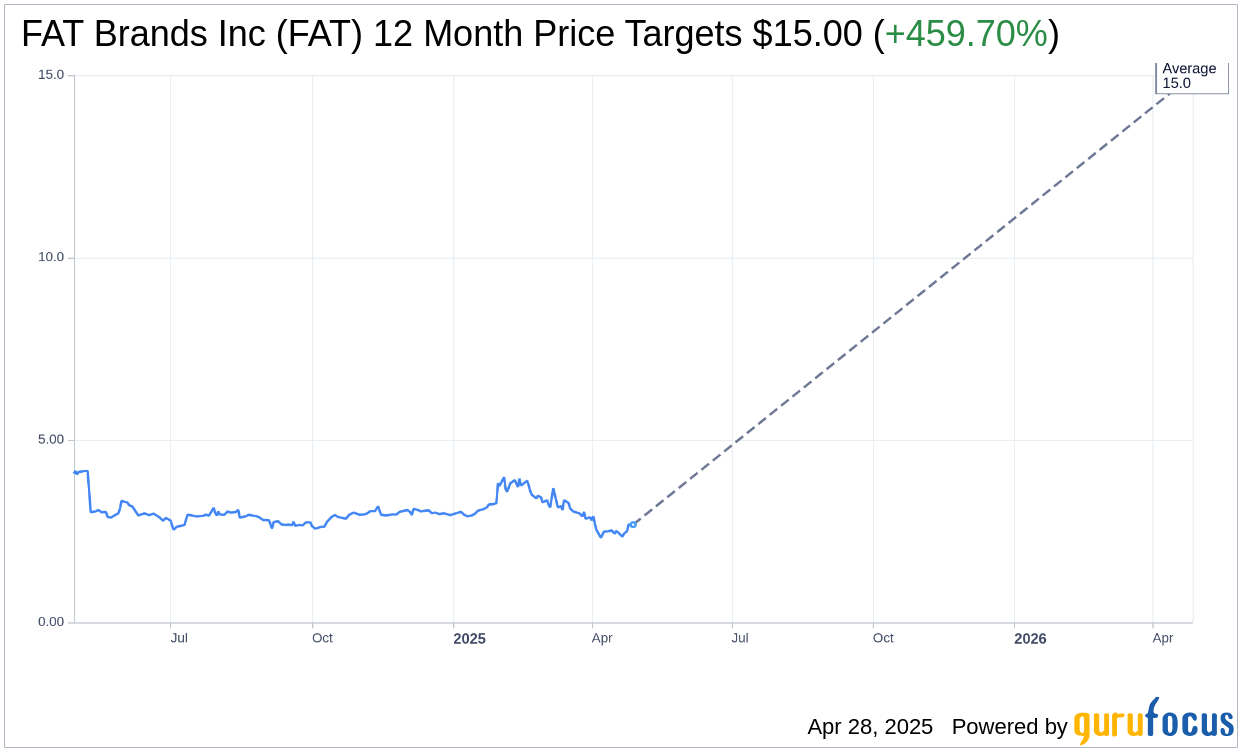

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for FAT Brands Inc (FAT, Financial) is $15.00 with a high estimate of $15.00 and a low estimate of $15.00. The average target implies an upside of 459.70% from the current price of $2.68. More detailed estimate data can be found on the FAT Brands Inc (FAT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, FAT Brands Inc's (FAT, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for FAT Brands Inc (FAT, Financial) in one year is $5.46, suggesting a upside of 103.73% from the current price of $2.68. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the FAT Brands Inc (FAT) Summary page.

FAT Key Business Developments

Release Date: February 27, 2025

- Total Revenue: Decreased 8.4% to $145.3 million compared to $158.6 million in the prior year quarter.

- System-wide Sales: $580.2 million for the quarter, representing a 7.4% decrease from the last year's quarter.

- Full Year Revenue: Increased 23.4% to $592.7 million.

- Full Year System-wide Sales: Increased 3.1% to $2.4 billion.

- Net Loss: $67.4 million or $4.06 per diluted share compared to a net loss of $26.2 million or $1.68 per share in the prior year quarter.

- Adjusted Net Loss: $29.9 million or $1.87 per diluted share compared to $17.3 million or $1.15 per diluted share in the prior year quarter.

- Adjusted EBITDA: $14.4 million compared to $27 million in the year ago quarter.

- General and Administrative Expense: Increased to $34.5 million from $30.3 million in the year ago quarter.

- Costs of Restaurant and Factory Revenues: Decreased to $97.2 million compared to $105.1 million.

- Advertising Expense: Decreased to $11.8 million from $13.8 million in the year ago period.

- Total Other Expense Net: $36.4 million compared to $31.9 million in last year's quarter.

- New Restaurants Opened in 2024: 92 new restaurants.

- Planned New Locations for 2025: Over 100 new locations.

- Development Pipeline: Signed agreements for approximately 1,000 additional locations.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- FAT Brands Inc (FAT, Financial) successfully spun out Twin Hospitality Group, enhancing transparency and allowing shareholders to directly participate in the growth of Twin Peaks.

- The company plans to open over 100 new locations in 2025, building on the 92 new restaurants opened in 2024, indicating strong organic growth.

- FAT Brands Inc (FAT) has a robust development pipeline with signed agreements for approximately 1,000 additional locations, expected to generate significant incremental annual adjusted EBITDA.

- Co-branding initiatives, such as Great American Cookies and Marble Slab Creamery, have been successful, with co-branded locations generating 10% to 20% higher incremental sales.

- The company's manufacturing facility in Georgia presents significant growth potential, currently operating at only 40% capacity, with plans to increase utilization to 60% to 70%.

Negative Points

- Total revenue decreased by 8.4% in the fourth quarter of 2024 compared to the prior year, primarily due to one less operating week.

- The company reported a net loss of $67.4 million for the fourth quarter, significantly higher than the $26.2 million loss in the prior year quarter.

- FAT Brands Inc (FAT) recognized $30.6 million of non-cash, goodwill, and other intangible asset impairment due to a decline in restaurant performance.

- General and administrative expenses increased due to store closure costs, impacting overall profitability.

- The company faces challenges with franchisee financing and construction delays, causing slippage in the opening of new stores.