- Microsoft (MSFT, Financial) is expected to post substantial cloud revenue growth amid strong AI demand.

- Current price targets show a considerable upside potential, with a consensus "Outperform" rating.

- GuruFocus estimates suggest a 27.52% increase in GF Value from the current stock price.

Microsoft Corp. (MSFT) stands poised to deliver significant cloud revenue growth this week, according to Wedbush analysts. Despite prevailing concerns surrounding tariffs, the company is set to benefit from the escalating demand for artificial intelligence (AI) and increased cloud spending. This positive sentiment extends to other major technology firms due to report their earnings, promising a robust sector outlook.

Wall Street Analysts Forecast

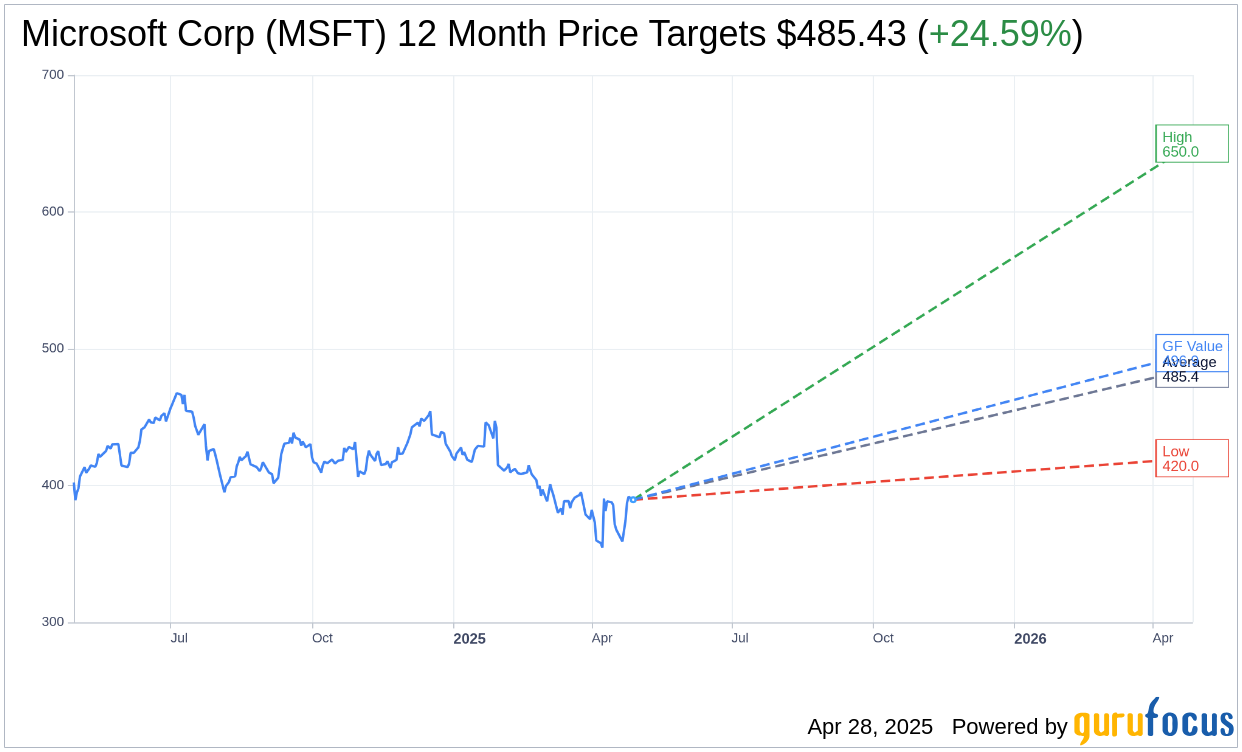

Currently, 48 analysts have offered one-year price targets for Microsoft Corp. (MSFT, Financial), with an average target price set at $485.43. This represents a potential upside of 24.59% from the current share price of $389.62. Analysts' price predictions range from a low of $420.00 to a high of $650.00, underscoring varied perspectives on the stock's future potential. For a closer look at the detailed estimates, visit the Microsoft Corp (MSFT) Forecast page.

Reflecting the positive outlook, Microsoft Corp. (MSFT, Financial) has received an average brokerage recommendation of 1.8 from 60 brokerage firms, categorizing it under the "Outperform" status. This rating is based on a scale from 1 to 5, where 1 is a Strong Buy and 5 indicates a Sell recommendation.

Growth Potential and Valuation

According to GuruFocus estimates, the GF Value of Microsoft Corp (MSFT, Financial) for the upcoming year is projected to be $496.86. This estimation suggests a promising upside of 27.52% from the current market price of $389.62. The GF Value metric offers an insightful valuation, derived from historical trading multiples, historical business growth, and future business performance forecasts. For more comprehensive information, visit the Microsoft Corp (MSFT) Summary page.