CIBC has revised its price target for Brookfield Business Partners (BBU, Financial), lowering it from $34 to $30, while maintaining an "Outperformer" rating on the stock. This decision comes as the firm considers the current macroeconomic uncertainties and the resulting decrease in transaction activity, which are affecting the outlook for diversified financials.

Brookfield Business Partners is set to announce its first-quarter earnings on May 2. The firm is expected to address key issues such as recent trade war developments and supply chain vulnerabilities, which have been areas of concern for investors and analysts alike. As BBU navigates these challenges, the focus will be on how various companies within its portfolio are being impacted by these broader economic factors.

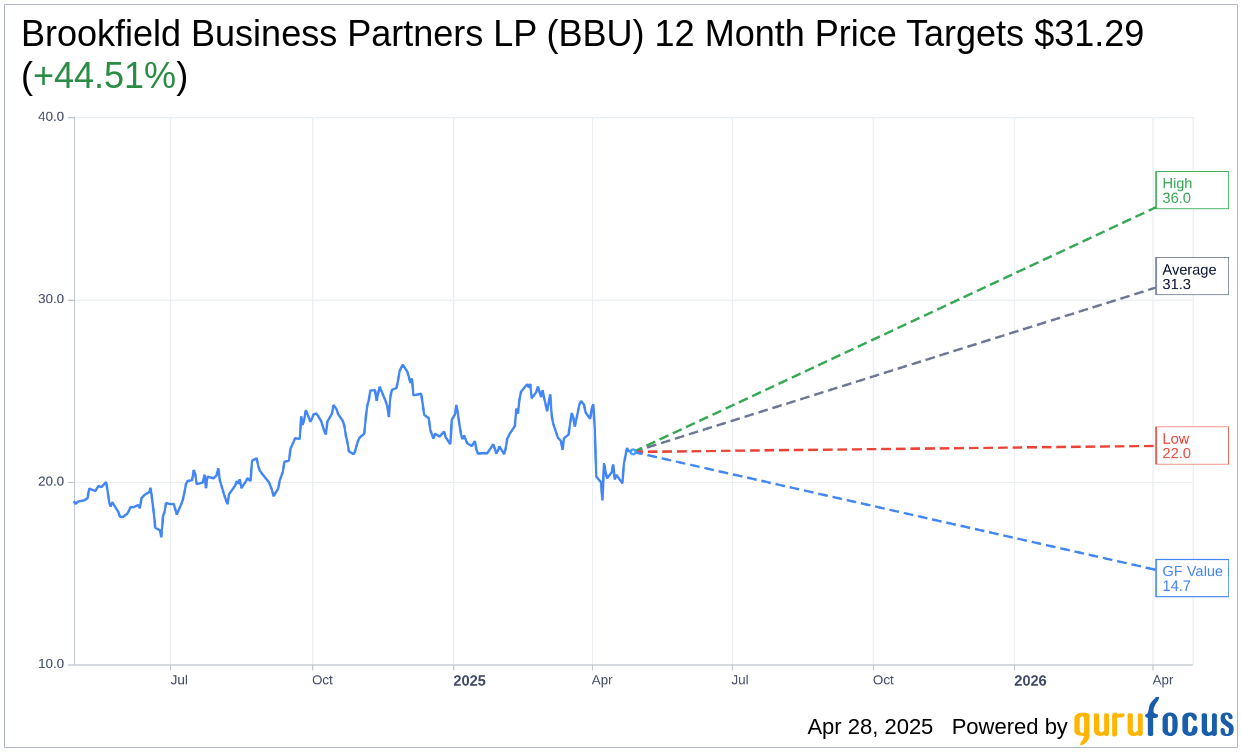

Wall Street Analysts Forecast

Based on the one-year price targets offered by 7 analysts, the average target price for Brookfield Business Partners LP (BBU, Financial) is $31.29 with a high estimate of $36.00 and a low estimate of $22.00. The average target implies an upside of 44.51% from the current price of $21.65. More detailed estimate data can be found on the Brookfield Business Partners LP (BBU) Forecast page.

Based on the consensus recommendation from 7 brokerage firms, Brookfield Business Partners LP's (BBU, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Brookfield Business Partners LP (BBU, Financial) in one year is $14.73, suggesting a downside of 31.96% from the current price of $21.65. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Brookfield Business Partners LP (BBU) Summary page.

BBU Key Business Developments

Release Date: January 31, 2025

- Adjusted EBITDA: Increased to $2.6 billion from $2.5 billion in 2023.

- Net Loss: $109 million in 2024, primarily due to impairments in health care services and natural gas producer.

- Adjusted EFO: $1.5 billion, including $306 million of net gains during the year.

- Industrial Segment EBITDA: $1.2 billion, up from $855 million in 2023.

- Business Services Segment EBITDA: $832 million, down from $900 million in 2023.

- Infrastructure Services Segment EBITDA: $606 million, down from $853 million in 2023.

- Pro Forma Liquidity: $2.7 billion at the corporate level.

- Share Buyback Program: Announced a new $250 million share buyback program.

- Capital Recycling Initiatives: Generated more than $2 billion, including $1 billion from monetizations and distributions.

- Clarios Distribution: $1.2 billion share of a $4.5 billion distribution.

- Chemelex Acquisition: BBU's share of the equity investment was approximately $210 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Brookfield Business Partners LP (BBU, Financial) achieved a record full-year adjusted EBITDA of $2.6 billion, reflecting strong operational performance and increased margins.

- The company generated over $2 billion from capital recycling initiatives, including $1 billion from monetizations and distributions.

- BBU completed a successful financing at Clarios, raising $4.5 billion, with BBU's share amounting to $1.2 billion, representing a 1.5 times multiple of their investment.

- A new $250 million share buyback program was announced, aimed at increasing the per-unit value of BBU.

- BBU acquired Chemelex, a leading manufacturer of electric heat tracing systems, for $210 million, which is expected to generate durable cash flows and leverage Brookfield's platform for growth.

Negative Points

- BBU reported a net loss of $109 million in 2024, primarily due to impairments in healthcare services and natural gas production.

- The company's infrastructure services segment saw a decline in full-year adjusted EBITDA from $853 million in 2023 to $606 million in 2024.

- The business services segment experienced a decrease in full-year adjusted EBITDA from $900 million in 2023 to $832 million in 2024.

- Healthscope, a healthcare business, continues to face challenges with a mismatch between revenue growth and cost escalation.

- CDK, a dealer software and technology services operation, is experiencing higher costs due to planned modernization and technology upgrades, impacting profitability.