Highlights:

- AMD is poised to meet its Q1 targets, but faces challenges from AI chip export restrictions to China.

- HSBC has revised AMD's price target to $70 amid competition and sales hurdles in China.

- Analysts remain optimistic with an average one-year price target of $137.35, suggesting a 44.71% upside.

Advanced Micro Devices (AMD, Financial) is expected to meet its Q1 financial goals, but the company's outlook for Q2 is clouded by a substantial $800 million charge due to AI chip export restrictions to China. This has prompted HSBC to revise its price target for AMD down to $70, pointing out hurdles such as decreased graphics processing unit (GPU) sales in China and aggressive pricing strategies from competitors like Intel. Currently, HSBC maintains a "Reduce" rating on AMD stock.

Wall Street Analysts' Forecast

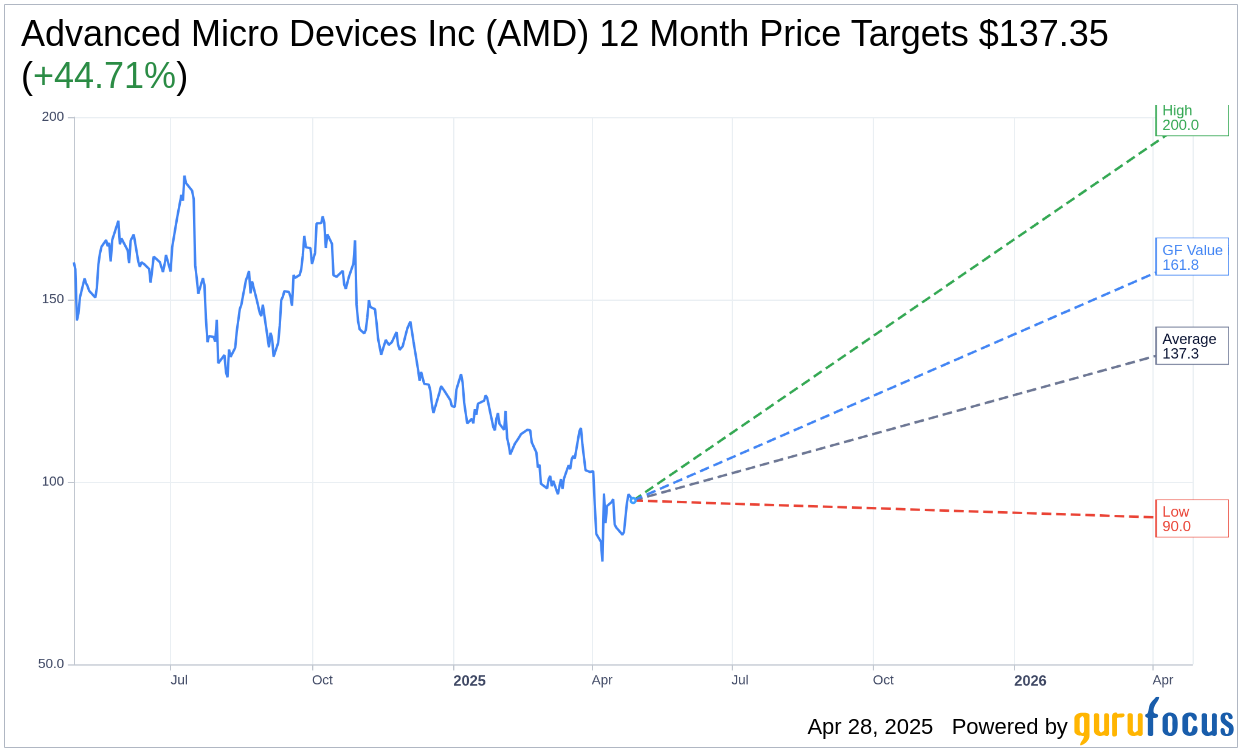

As per projections from 40 industry analysts, the average one-year price target for Advanced Micro Devices Inc (AMD, Financial) stands at $137.35. Estimates vary significantly, with a high of $200.00 and a low of $90.00. This average forecast reflects a potential upside of 44.71% from AMD's current trading price of $94.91. For an in-depth analysis, visit the Advanced Micro Devices Inc (AMD) Forecast page.

With a consensus recommendation from 50 brokerage firms, AMD boasts an average brokerage recommendation score of 2.3, positioning it in the "Outperform" category. On the rating scale, 1 represents a Strong Buy, while 5 indicates a Sell.

GuruFocus's estimates suggest that AMD's GF Value in one year might reach $161.80. This implies a substantial upside of 70.48% from its current price of $94.91. GF Value is GuruFocus's intrinsic value estimate based on historical trading multiples, past business growth, and projected future performance. Explore more detailed insights on the Advanced Micro Devices Inc (AMD, Financial) Summary page.