Key Highlights:

- ThredUp's stock surges following favorable FY24 results and a positive FY25 outlook.

- Analysts see potential with an average price target indicating a modest upside.

- Despite positive sentiment, GuruFocus' GF Value suggests potential overvaluation concerns.

ThredUp Inc. (TDUP, Financial) stock received a boost after analyst Dana Telsey underscored the company's strong conclusion to the fiscal year 2024. Telsey issued an optimistic outlook for fiscal year 2025, forecasting single-digit revenue growth driven by new customer acquisitions, strategic AI investments, and rising demand. In alignment with these promising indicators, Telsey adjusted the price target to $6, a move reflecting confidence in ThredUp's efficient operational model and solid market standing.

Wall Street Analysts Forecast

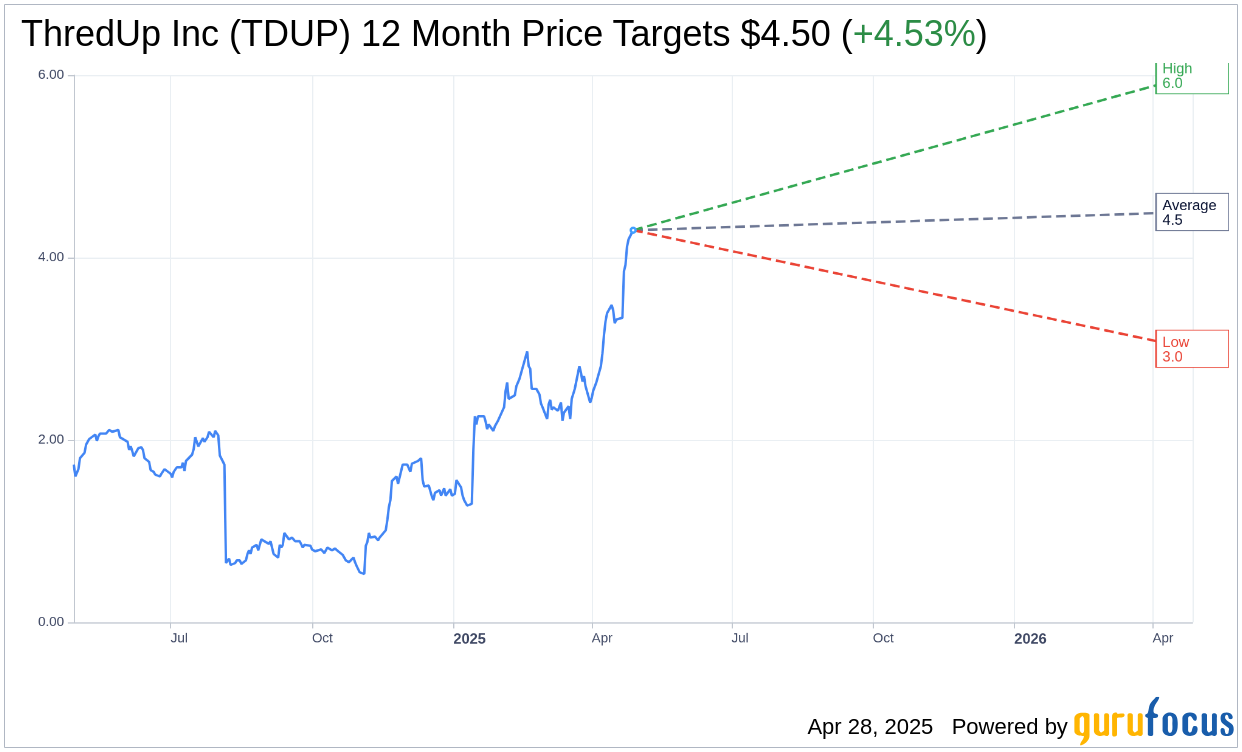

Current insights from two Wall Street analysts place the average price target for ThredUp Inc. (TDUP, Financial) at $4.50, with the bullish scenario reaching $6.00 and the bearish at $3.00. This average target implies a potential upside of 4.53% given the current trading price of $4.31. For more detailed analysis, investors are encouraged to visit the ThredUp Inc (TDUP) Forecast page.

As for brokerage firm recommendations, four firms collectively categorize ThredUp Inc. (TDUP, Financial) with an average rating of 2.0, indicative of an "Outperform" status on a scale where 1 suggests a Strong Buy and 5 signals a Sell.

GF Value Analysis

Despite the optimistic outlook, GuruFocus estimates highlight caution. The projected GF Value for ThredUp Inc. (TDUP, Financial) in one year stands at $1.90, suggesting a potential downside of 55.87% from the current market price of $4.31. This estimate reflects GuruFocus' assessment of the stock's fair trading value, calculated from historical trading multiples, past business growth, and future performance estimates. Investors seeking a comprehensive understanding can explore more on the ThredUp Inc (TDUP) Summary page.