Key Highlights:

- Roper Technologies (ROP, Financial) reports a 12% increase in Q1 revenue fueled by acquisitions and organic growth.

- The acquisition of CentralReach is set to significantly boost Roper's revenue and EBITDA.

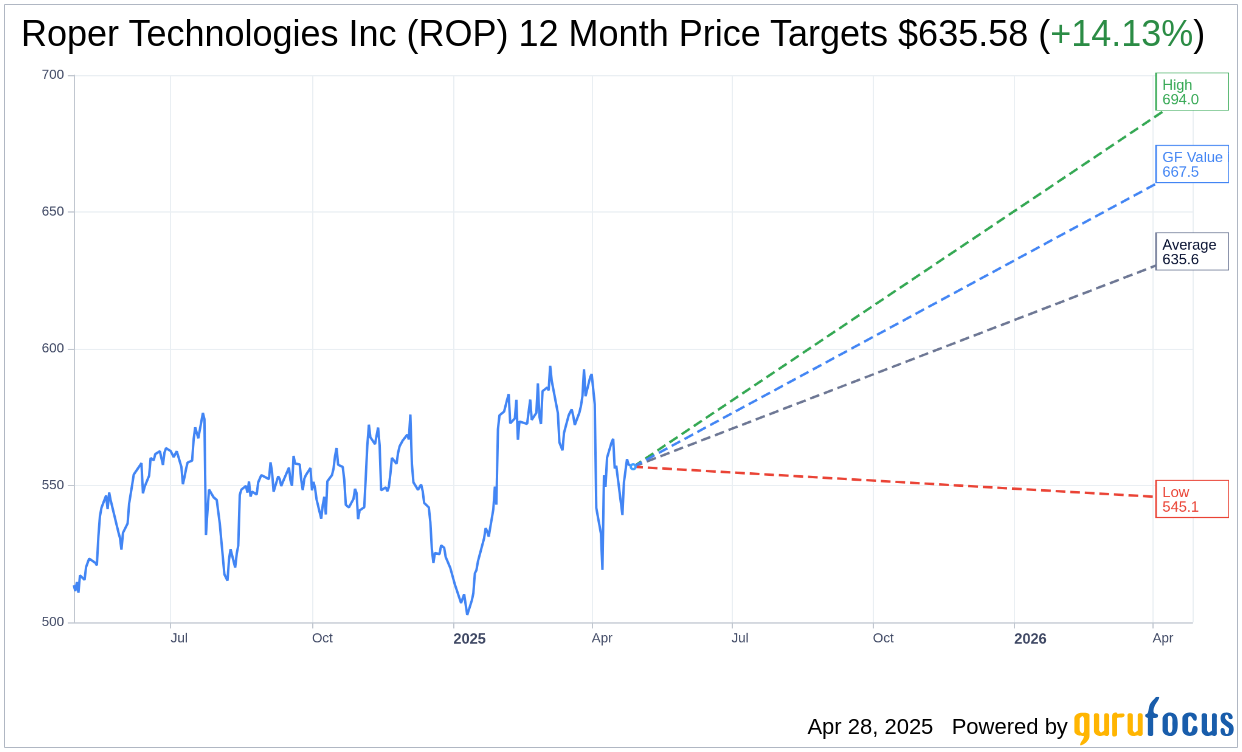

- Analysts project an average 14.13% stock price increase, with an "Outperform" rating from brokerages.

Roper Technologies (ROP) Q1 Revenue Surge

Roper Technologies (ROP) recently announced a robust 12% rise in their first-quarter revenue, attributing this growth to a blend of organic expansion and strategic acquisitions. A significant driver behind this uptick is Roper's recent $1.65 billion acquisition of CentralReach. This acquisition is expected to meaningfully enhance both revenue and EBITDA, bolstering Roper's position in the industry. Furthermore, the management team has revised their full-year 2025 revenue growth guidance to 12%, underlining their confidence in the company's sustained business momentum.

Wall Street Analysts' Outlook

According to insights from 13 analysts, the average price target for Roper Technologies Inc (ROP, Financial) over the next year is $635.58. Forecasts range from a high of $694.00 to a low of $545.12, suggesting a potential upside of 14.13% from the current share price of $556.87. For further details, visit the Roper Technologies Inc (ROP) Forecast page.

The consensus recommendation from 18 brokerage firms positions Roper Technologies Inc (ROP, Financial) with an average brokerage recommendation of 2.1, signaling an "Outperform" status. The rating system operates on a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 suggests a Sell.

GuruFocus Valuation Insights

Based on calculations by GuruFocus, the estimated GF Value for Roper Technologies Inc (ROP, Financial) in one year's time is projected to be $667.54. This represents an anticipated upside of 19.87% from the current share price of $556.87. The GF Value reflects GuruFocus' assessment of the stock's fair trading value, derived from historical trading multiples, historical growth, and projected future performance. More extensive data is available on the Roper Technologies Inc (ROP) Summary page.