Summary:

- Zebra Technologies (ZBRA, Financial) is set to announce its first-quarter earnings on April 29, with analysts predicting a significant earnings increase.

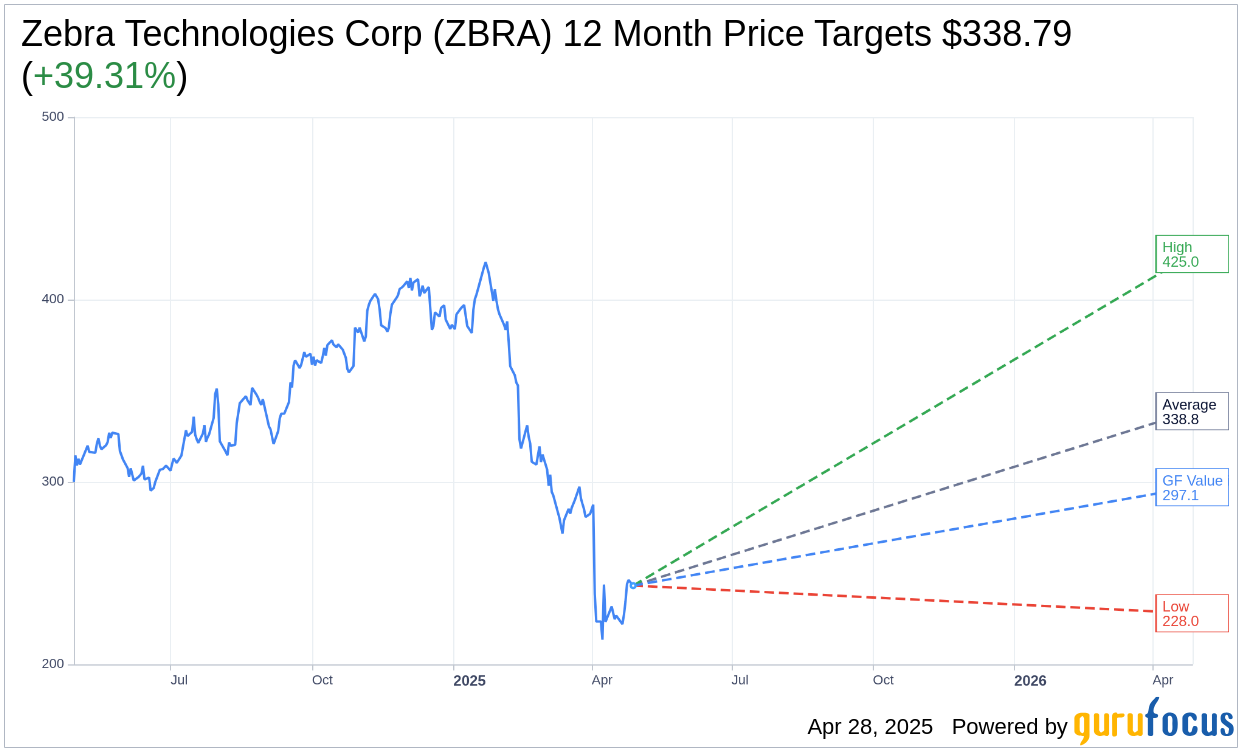

- Wall Street analysts project a notable upside for ZBRA, with a positive average price target.

- GuruFocus estimates suggest that ZBRA's stock could offer an attractive potential increase in value.

Upcoming Earnings Announcement for Zebra Technologies

Zebra Technologies (ZBRA) is poised to unveil its first-quarter earnings on April 29. Analysts are projecting an earnings per share (EPS) of $3.62, marking an impressive 27.5% growth from the prior year. Expected revenue stands at a solid $1.29 billion, reflecting a 9.8% increase year-over-year. Historically, Zebra Technologies has consistently outperformed both earnings and revenue forecasts, making it a compelling stock to watch.

Wall Street Analysts' Insights and Predictions

According to projections from 15 analysts, the average one-year price target for Zebra Technologies Corp (ZBRA, Financial) is $338.79. This estimation includes a high of $425.00 and a low of $228.00. The average target suggests a potential upside of 39.31% from the current stock price of $243.19. For additional insights, visit the Zebra Technologies Corp (ZBRA) Forecast page.

Brokerage Recommendations and GF Value Estimate

The consensus recommendation from 18 brokerage firms positions Zebra Technologies Corp (ZBRA, Financial) at an average brokerage recommendation of 2.3, indicating it is in the "Outperform" category. This rating system ranges from 1, which represents a Strong Buy, to 5, which indicates a Sell position.

According to GuruFocus estimates, the projected GF Value for Zebra Technologies Corp (ZBRA, Financial) over the next year is $297.12. This suggests a potential upside of 22.18% from the current price of $243.19. The GF Value is GuruFocus' measure of a stock's fair trading value, derived from historical trading multiples, business growth patterns, and anticipated performance metrics. More detailed analysis can be found on the Zebra Technologies Corp (ZBRA) Summary page.