Key Highlights:

- Petros Pharmaceuticals, Inc. (PTPI, Financial) partners with a prominent Big Data firm to enhance AI-driven solutions.

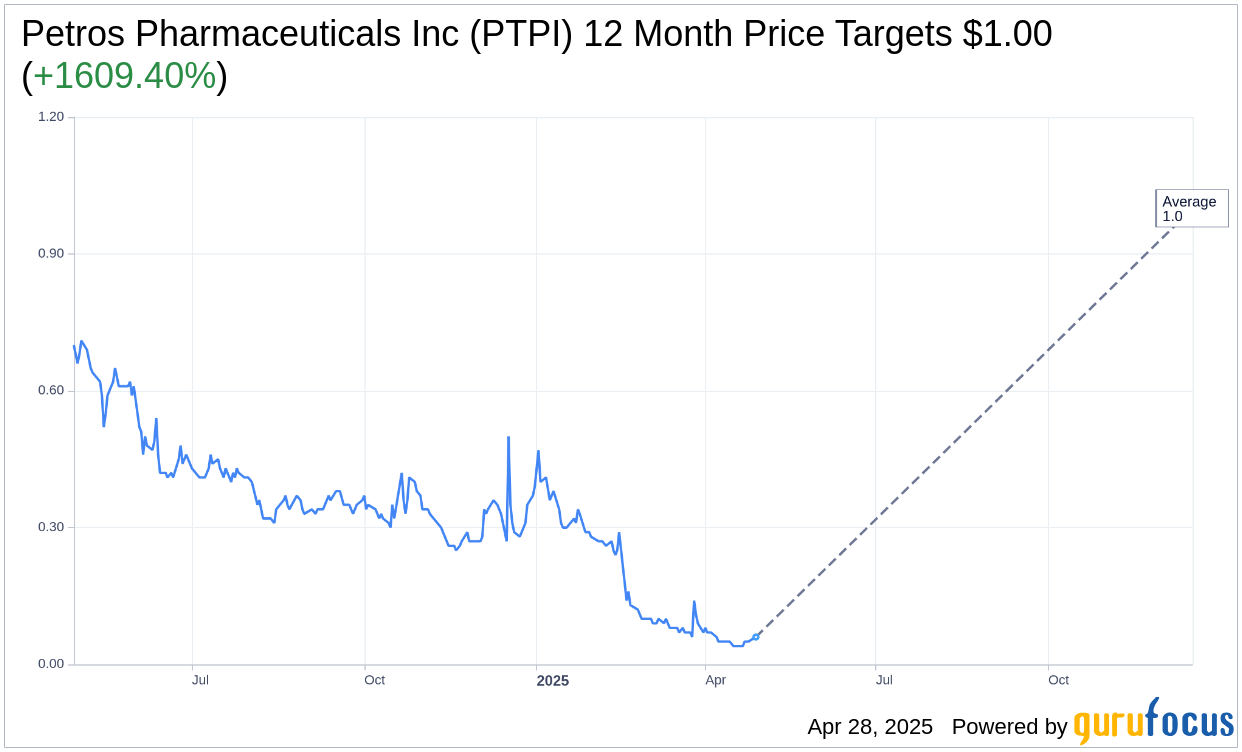

- Wall Street analysts set a one-year price target of $1.00 per share for PTPI, suggesting significant upside potential.

- GuruFocus estimates an impressive upside of 669.23% with a GF Value of $0.45.

Strategic Partnership to Drive Innovation

In a strategic move, Petros Pharmaceuticals, Inc. (NASDAQ: PTPI) has joined forces with a leading Big Data company to elevate its AI-driven platform. This collaboration is poised to revolutionize the transition of prescription medications to over-the-counter status. By enhancing identity verification through global ID libraries, Petros aims to substantially expand its Software-as-a-Medical Device capabilities in the self-care market, positioning itself as a trailblazer in the industry.

Wall Street Analysts' Price Targets

Analysts are optimistic about Petros Pharmaceuticals' potential, assigning a one-year average price target of $1.00. This target represents a remarkable upside of 1,609.40% from the current trading price of $0.06. With both high and low estimates aligning at $1.00, investors can explore more thorough projections on the Petros Pharmaceuticals Inc (PTPI, Financial) Forecast page.

Analyst Recommendations and Ratings

Petros Pharmaceuticals Inc. (PTPI, Financial) currently holds an "Outperform" status with an average brokerage recommendation of 2.0. This rating, sourced from one brokerage firm, uses a scale from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell. Such a favorable recommendation underlines the company's promising outlook and growth potential.

The GF Value Proposition

According to GuruFocus estimates, the GF Value for Petros Pharmaceuticals Inc (PTPI, Financial) in one year stands at $0.45. This suggests an enticing upside of 669.23% from the present price of $0.0585. The GF Value is a crucial metric that assesses a stock's fair value based on historical trading multiples, past business growth, and projected future performance. For more comprehensive insights, investors can visit the Petros Pharmaceuticals Inc (PTPI) Summary page.