Summary:

- Entergy (ETR, Financial) will announce its Q1 earnings before the market opens on April 29.

- Analysts predict an EPS of $0.69 and revenue of $3.05 billion.

- ETR has consistently outperformed EPS expectations, though revenue forecasts remain challenging.

Entergy's Upcoming Earnings Release

Entergy Corp (ETR) is poised to disclose its first-quarter earnings results on April 29, ahead of the market's opening. Analysts have projected an earnings per share (EPS) of $0.69 coupled with anticipated revenue of $3.05 billion. Historically, Entergy has exceeded EPS expectations 75% of the time over the past two years, even though it has struggled to surpass revenue projections. Over recent months, there have been five upward revisions and one downward revision to EPS forecasts, with a minor increase in revenue expectations.

Wall Street Analysts' Projections

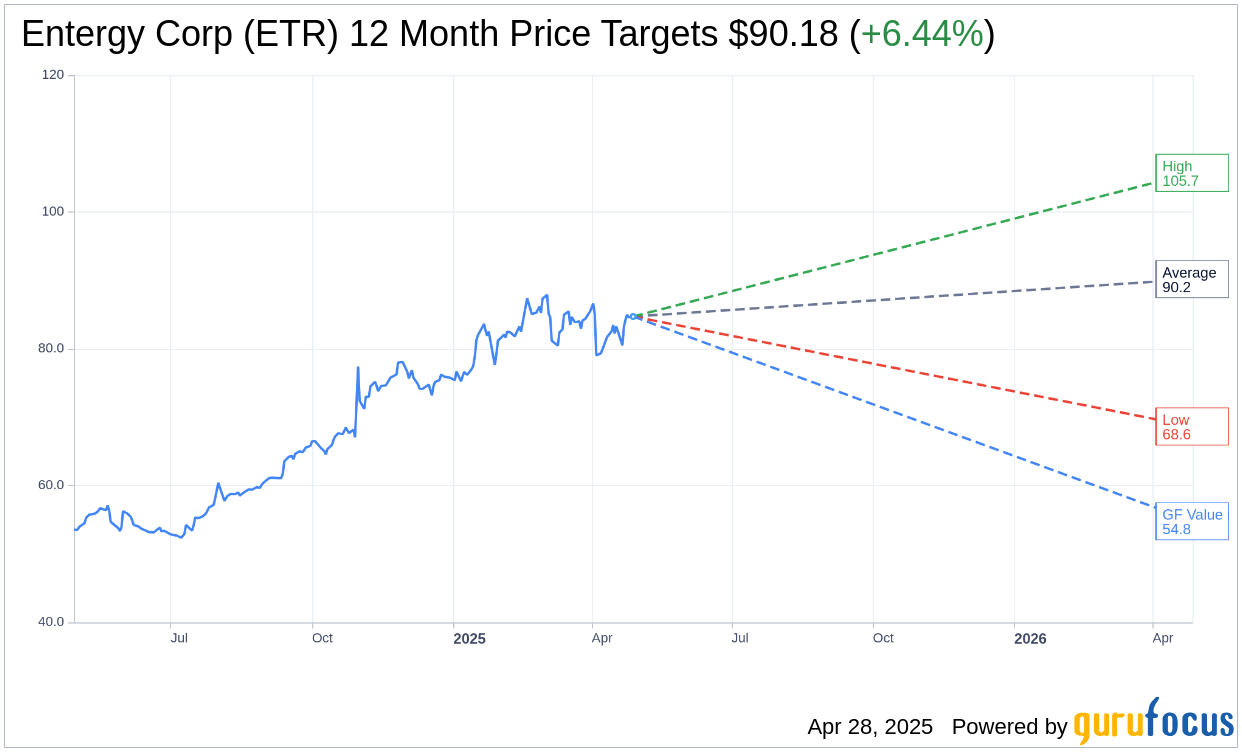

Wall Street's analysis, as per 16 analysts’ one-year price targets, reflects an average target price for Entergy Corp (ETR, Financial) of $90.18. Analysts' estimates range from a high of $105.72 to a low of $68.64. This average target suggests a potential upside of 6.44% from the current share price of $84.73. For a deeper dive into these projections, visit the Entergy Corp (ETR) Forecast page.

Based on input from 20 brokerage firms, Entergy Corp (ETR, Financial) has achieved an average brokerage recommendation of 2.2, aligning with an "Outperform" status on the scale where 1 denotes a Strong Buy and 5 signifies a Sell.

GuruFocus' Valuation Insights

From a valuation perspective, the GF Value estimate for Entergy Corp (ETR, Financial) in one year's time stands at $54.78, indicating a potential downside of 35.34% from the current trading price of $84.725. The GF Value is GuruFocus' assessment of the stock's fair trading value, formulated using historical trading multiples, previous business growth patterns, and forward-looking performance estimates. For more comprehensive data, refer to the Entergy Corp (ETR) Summary page.