Cantor Fitzgerald has begun coverage of Viking Therapeutics (VKTX, Financial) with an Overweight rating, setting a price target of $104. The firm's analysis is primarily centered on Viking’s leading drug, VK2735, a GLP-1 agonist that is advancing to Phase 3 trials for the treatment of general obesity. While investors anticipate the Phase 2 results for the oral version of VK2735 in the latter half of 2025, the company's confidence is primarily rooted in the subcutaneous formulation of the drug, which is slated to begin its Phase 3 trial in the second quarter.

Cantor Fitzgerald asserts that VK2735 offers an improvement over tirzepatide, citing better pharmacokinetics and slightly enhanced potency as key factors. The firm is optimistic that if VK2735 proves to surpass tirzepatide in performance, it could achieve significant market success, potentially reaching multi-blockbuster status.

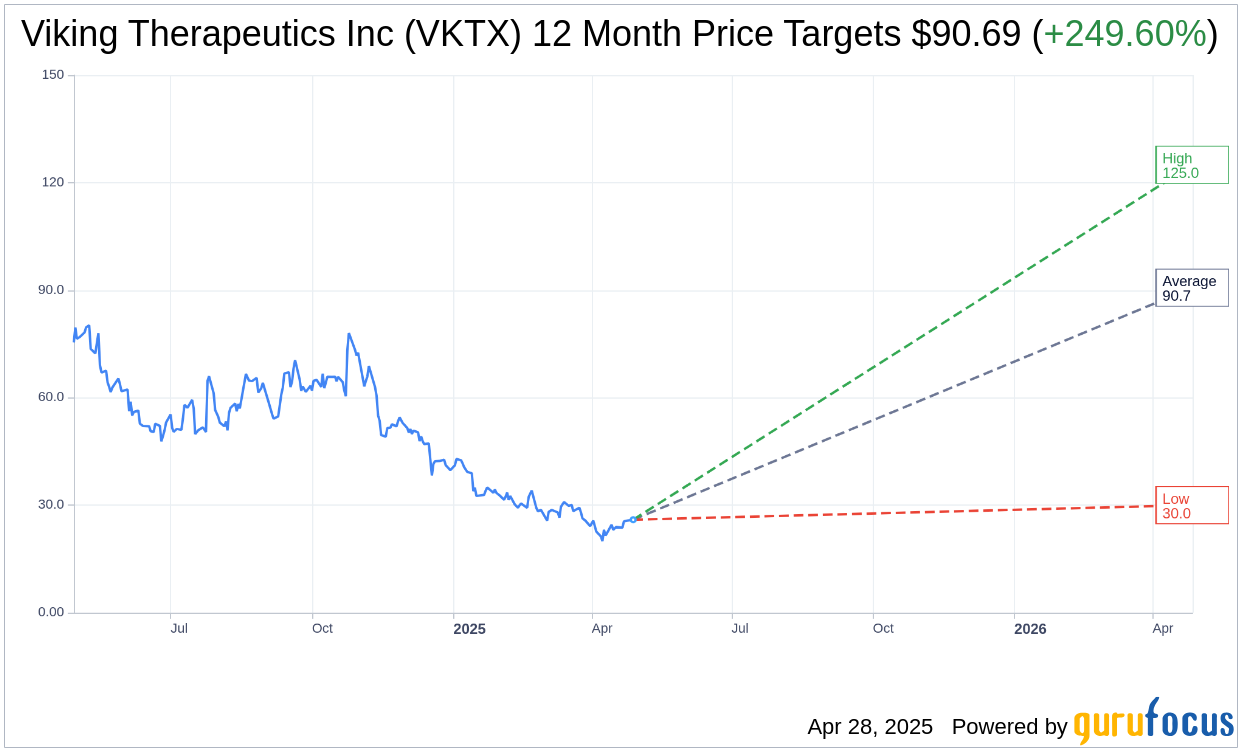

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Viking Therapeutics Inc (VKTX, Financial) is $90.69 with a high estimate of $125.00 and a low estimate of $30.00. The average target implies an upside of 249.60% from the current price of $25.94. More detailed estimate data can be found on the Viking Therapeutics Inc (VKTX) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, Viking Therapeutics Inc's (VKTX, Financial) average brokerage recommendation is currently 1.7, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

VKTX Key Business Developments

Release Date: April 23, 2025

- Research and Development Expenses: $41.4 million for Q1 2025, up from $24.1 million in Q1 2024.

- General and Administrative Expenses: $14.1 million for Q1 2025, up from $10 million in Q1 2024.

- Net Loss: $45.6 million or $0.41 per share for Q1 2025, compared to $27.4 million or $0.26 per share in Q1 2024.

- Cash, Cash Equivalents, and Short-term Investments: $852 million as of March 31, 2025, down from $903 million as of December 31, 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Viking Therapeutics Inc (VKTX, Financial) announced positive data from four separate clinical programs, including VK2735 for obesity and VK2809 for NASH and fibrosis.

- The company made significant progress toward initiating Phase 3 trials for the subcutaneous VK2735 program, expected to commence later this quarter.

- Viking Therapeutics Inc (VKTX) completed enrollment for the Phase 2 trial of the VK2735 oral tablet for obesity, indicating strong interest in the program.

- A long-term manufacturing agreement was secured to support the future commercialization of VK2735, suggesting readiness for large-scale production.

- The company maintains a strong financial position with over $850 million in cash, providing a solid runway for ongoing and future clinical trials.

Negative Points

- Research and development expenses increased significantly to $41.4 million, impacting the company's financials.

- The net loss for the first quarter of 2025 was $45.6 million, a substantial increase from the previous year.

- General and administrative expenses rose to $14.1 million, driven by legal, patent services, and stock-based compensation costs.

- There is uncertainty regarding the potential impact of tariffs on future operations, which could affect commercial activities.

- The company faces logistical challenges in preparing for the Phase 3 trials, including supply chain and site readiness.