Rambus (RMBS, Financial) has reported revenue of $166.7 million for the first quarter, exceeding the market's anticipated $162.83 million. The company attributes this robust performance to significant cash flow from operations and a record-breaking revenue from its memory interface chips. CEO Luc Seraphin highlighted that this achievement underscores the company's market leadership in DDR5 chip products and their advancement in new offerings. With a solid strategic framework and effective business model, Rambus is set for sustainable growth, promising continued value for its shareholders.

Wall Street Analysts Forecast

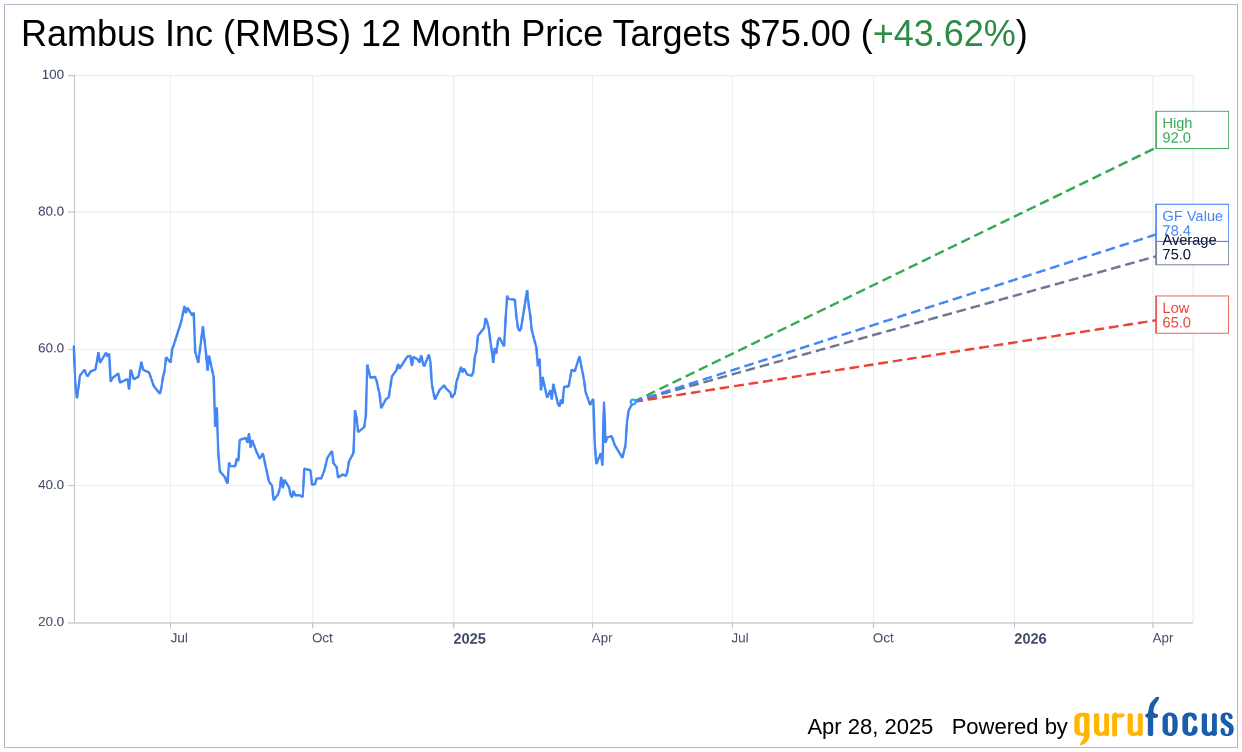

Based on the one-year price targets offered by 8 analysts, the average target price for Rambus Inc (RMBS, Financial) is $75.00 with a high estimate of $92.00 and a low estimate of $65.00. The average target implies an upside of 43.62% from the current price of $52.22. More detailed estimate data can be found on the Rambus Inc (RMBS) Forecast page.

Based on the consensus recommendation from 9 brokerage firms, Rambus Inc's (RMBS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Rambus Inc (RMBS, Financial) in one year is $78.42, suggesting a upside of 50.17% from the current price of $52.22. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Rambus Inc (RMBS) Summary page.

RMBS Key Business Developments

Release Date: February 03, 2025

- Annual Product Revenue: $247 million, a record for the company.

- Cash from Operations: $231 million in 2024, up from $196 million in 2023.

- Q4 Revenue: $161.1 million, above the high end of expectations.

- Q4 Product Revenue: $73.4 million, up 11% sequentially and 37% year over year.

- Royalty Revenue: $58.2 million in Q4.

- Licensing Billings: $63.6 million in Q4.

- Operating Costs: $89.2 million in Q4, including cost of goods sold.

- Non-GAAP Net Income: $59.6 million for Q4.

- Cash, Cash Equivalents, and Marketable Securities: $481.8 million at the end of Q4.

- Free Cash Flow: $48.8 million in Q4.

- Q1 2025 Revenue Guidance: Between $156 million and $162 million.

- Q1 2025 Non-GAAP Earnings Per Share Guidance: Between $0.51 and $0.59.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Rambus Inc (RMBS, Financial) achieved record quarterly results from memory interface chips, contributing to an annual record for product revenue of $247 million.

- The company completed a strategic extension of its patent licensing agreement with Micron through 2029, strengthening its long-term licensing foundation.

- Rambus Inc (RMBS) generated a new annual high for cash from operations, totaling $231 million in 2024.

- The company introduced a record number of new chip products in 2024, expanding its product portfolio and market opportunities.

- Rambus Inc (RMBS) reported strong demand for its DDR5 RCD products, driven by data center growth and continued market share gains.

Negative Points

- The company faces challenges with the chaotic ramp of DDR5 in the market due to the complexity of making chips work together.

- Rambus Inc (RMBS) anticipates a small quarterly difference between licensing billings and royalty revenue due to timing issues.

- The contribution from companion chips remains modest, with significant revenue impact expected only in the second half of 2025.

- The company is experiencing increased operating expenses due to continued investment in R&D for new product developments.

- Rambus Inc (RMBS) is still monitoring the impact of new market entrants like NVIDIA's Grace architecture on its business.