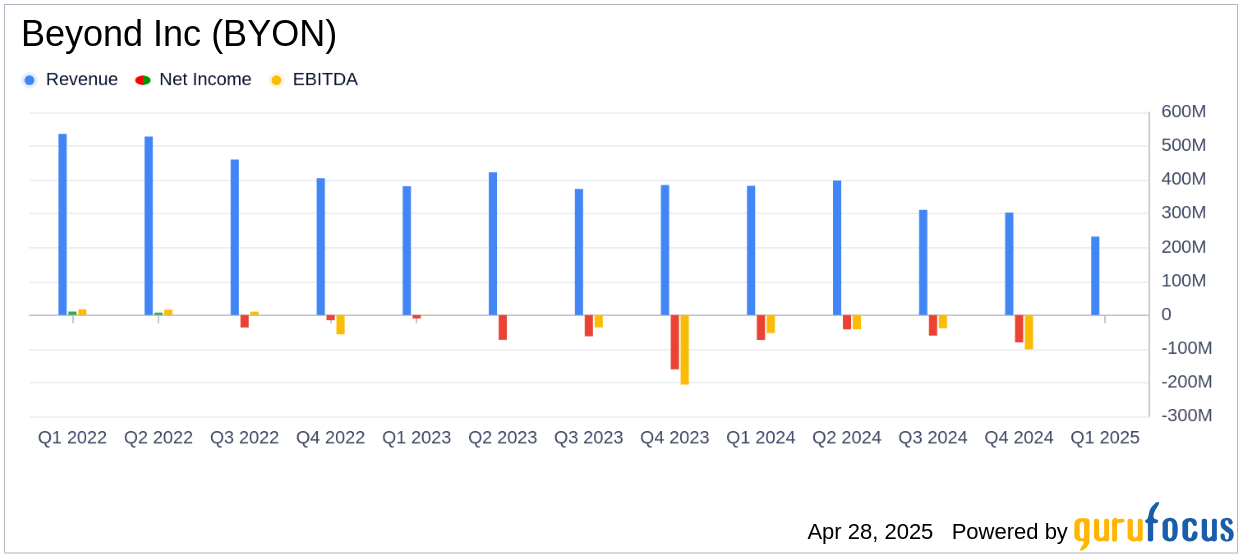

On April 28, 2025, Beyond Inc (BYON, Financial) released its 8-K filing for the first quarter ended March 31, 2025. The company, an online retailer known for its diverse product offerings including home and garden items, reported a net revenue of $232 million, falling short of the estimated $288.15 million. Despite this, Beyond Inc demonstrated a 46% improvement in net loss and a 72% improvement in adjusted EBITDA year-over-year, driven by strategic initiatives such as gross margin expansion and cost reductions.

Company Overview

Beyond Inc is a prominent online retailer offering a wide range of products from furniture to electronics. The company operates through a direct business model, selling from its own inventory, and a partner business model, which involves selling merchandise from various suppliers. The majority of its revenue is generated from the partner business, primarily within the U.S. market.

Performance and Challenges

Beyond Inc's performance in the first quarter reflects its ongoing restructuring efforts. The company reported a net loss of $40 million, which includes $17 million of non-core and non-cash expenses. The diluted net loss per share was $0.74, compared to the estimated loss of $0.54 per share. Despite the revenue shortfall, the company's strategic focus on eliminating non-contributory SKUs and vendors has laid a foundation for future profitability and growth.

Financial Achievements

The company's gross profit margin improved by 560 basis points year-over-year, reaching 25.1% of net revenue. Sales and marketing expenses were reduced by 430 basis points, reflecting enhanced marketing efficiency. These achievements are crucial for a retail company like Beyond Inc, as they indicate improved operational efficiency and cost management, essential for navigating the cyclical nature of the retail industry.

Key Financial Metrics

Beyond Inc's balance sheet shows total assets of $363.7 million, with cash, cash equivalents, and restricted cash totaling $141.5 million. The company's liabilities decreased to $220.4 million from $239.2 million at the end of 2024. These metrics highlight the company's efforts to strengthen its financial position amidst restructuring.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Revenue | $232 million | $382 million |

| Gross Profit | $58 million | $74 million |

| Net Loss | $40 million | $74 million |

| Adjusted EBITDA | ($13) million | ($48) million |

Analysis and Commentary

Adrianne Lee, President and CFO of Beyond, stated, “While the previously disclosed decision to eliminate non-contributory SKUs and vendors led to lower revenue, we are steadfast in building a more stable foundation for profitability and growth.”

Marcus Lemonis, Executive Chairman and Principal Executive Officer, added, “Our first quarter results illustrate our team’s progress against the mandate to return to profitability including margin optimization, SKU rationalization, and fixed cost restructuring.”

Beyond Inc's strategic restructuring efforts are evident in its financial results, with significant improvements in key operational metrics. The company's focus on cost reduction and margin expansion positions it well for future growth, despite current revenue challenges. As the company transitions out of restructuring, its ability to leverage its diversified vendor base and enhance customer value will be critical in achieving sustained profitability and growth.

Explore the complete 8-K earnings release (here) from Beyond Inc for further details.