NXP Semiconductors NV (NXPI, Financial) anticipates its second-quarter revenue to range between $2.8 billion and $3 billion, aligning with market expectations of $2.85 billion. The company forecasts a gross margin between 55.8% and 56.8% for the same period. In the first quarter, NXP reported revenues of $2.84 billion, which matched the midpoint of its guidance estimates.

The company's performance reflects a cautious optimism as it continues to adapt to the challenging market landscape. This environment is marked by uncertainties, particularly due to the impact of tariffs with varying direct and indirect consequences. Despite these external pressures, NXP remains focused on managing controllable factors, aiming to sustain robust profitability and earnings.

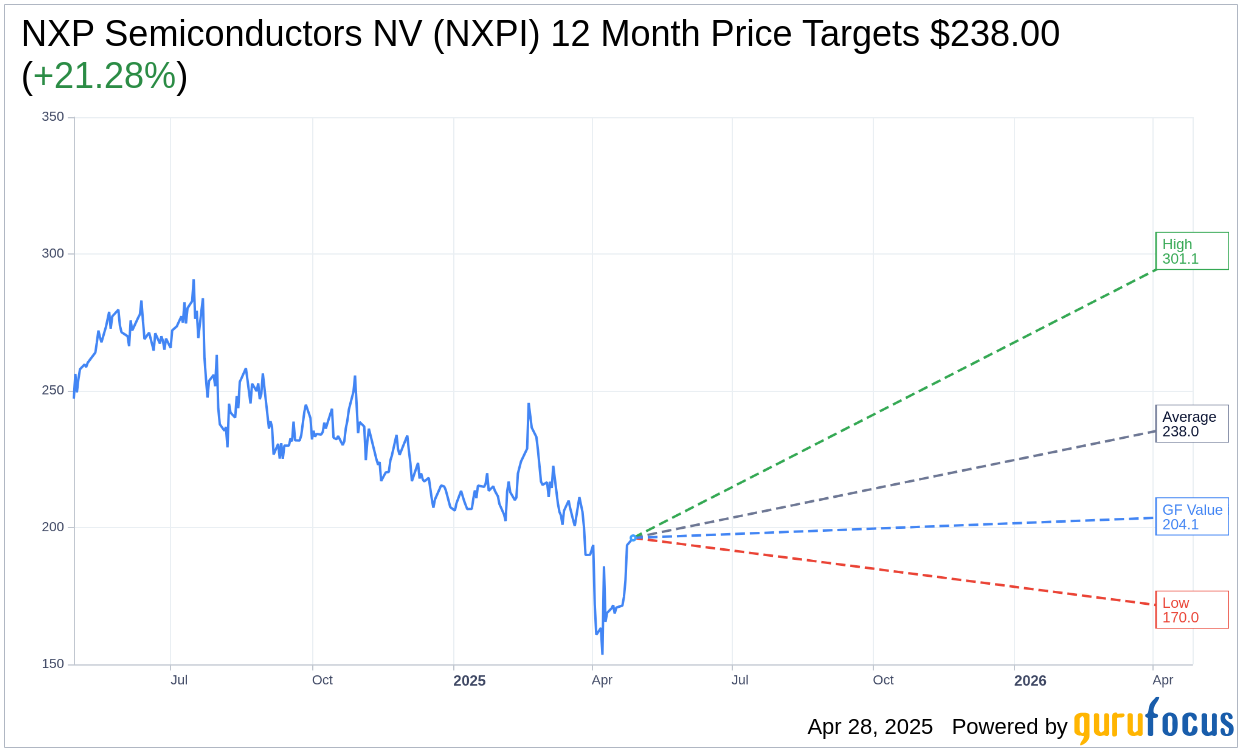

Wall Street Analysts Forecast

Based on the one-year price targets offered by 27 analysts, the average target price for NXP Semiconductors NV (NXPI, Financial) is $238.00 with a high estimate of $301.12 and a low estimate of $170.00. The average target implies an upside of 21.28% from the current price of $196.24. More detailed estimate data can be found on the NXP Semiconductors NV (NXPI) Forecast page.

Based on the consensus recommendation from 31 brokerage firms, NXP Semiconductors NV's (NXPI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NXP Semiconductors NV (NXPI, Financial) in one year is $204.08, suggesting a upside of 4% from the current price of $196.24. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NXP Semiconductors NV (NXPI) Summary page.

NXPI Key Business Developments

Release Date: February 04, 2025

- Q4 Revenue: $3.11 billion, down 9% year on year.

- Full-Year 2024 Revenue: $12.61 billion, down 5% year on year.

- Q4 Non-GAAP Operating Margin: 34.2%, down 140 basis points year on year.

- Full-Year 2024 Non-GAAP Operating Margin: 34.6%, down 50 basis points year on year.

- Automotive Q4 Revenue: $1.79 billion, down 6% year on year.

- Automotive Full-Year Revenue: $7.15 billion, down 4% year on year.

- Industry and IoT Q4 Revenue: $516 million, down 22% year on year.

- Industry and IoT Full-Year Revenue: $2.27 billion, down 3% year on year.

- Mobile Q4 Revenue: $396 million, down 2% year on year.

- Mobile Full-Year Revenue: $1.49 billion, up 13% year on year.

- Communication Infrastructure and Other Q4 Revenue: $409 million, down 10% year on year.

- Communication Infrastructure and Other Full-Year Revenue: $1.69 billion, down 20% year on year.

- Q4 Non-GAAP Gross Margin: 57.5%, down 120 basis points year on year.

- Full-Year 2024 Non-GAAP Gross Margin: 58.1%, down 40 basis points year on year.

- Q4 Non-GAAP Earnings Per Share: $3.18, $0.05 above guidance midpoint.

- Full-Year 2024 Non-GAAP Free Cash Flow: $2.09 billion, 17% of revenue.

- Q4 Non-GAAP Free Cash Flow: $292 million, 9% of revenue.

- Q1 2025 Revenue Guidance: $2.825 billion, down 10% year on year.

- Q1 2025 Non-GAAP Gross Margin Guidance: 56.3%.

- Q1 2025 Non-GAAP Operating Margin Guidance: 31.5%.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- NXP Semiconductors NV (NXPI, Financial) delivered Q4 revenue of $3.11 billion, which was $11 million better than the midpoint of their guidance.

- The company maintained distribution channel inventory flat at eight weeks, below their long-term target of 11 weeks, demonstrating effective inventory management.

- NXP's automotive segment showed company-specific growth in accelerated growth drivers such as S32 for software-defined vehicles, automotive connectivity, radar, and electrification.

- The company announced strategic acquisitions of Aviva and TTTech Auto, which are expected to enhance their long-term competitive position in the automotive market.

- NXP returned $2.41 billion to shareholders in 2024, which was 115% of the total non-GAAP free cash flow generated during the year, indicating strong shareholder returns.

Negative Points

- Q4 revenue decreased by 9% year on year, reflecting challenges in the macroeconomic environment.

- The non-GAAP operating margin in Q4 was 34.2%, down 140 basis points from the previous year, indicating margin pressure.

- The Industrial and IoT segment experienced a significant decline, with Q4 revenue down 22% year on year.

- Communication infrastructure and other segments missed expectations, with Q4 revenue down 10% year on year.

- NXP is experiencing poor forward visibility and high turns business, reflecting uncertainty in customer demand and order patterns.