Quick Summary:

- NXP Semiconductors (NXPI, Financial) beats earnings with a Q1 non-GAAP EPS of $2.64.

- Revenue hits $2.84 billion, surpassing expectations despite a year-over-year decline.

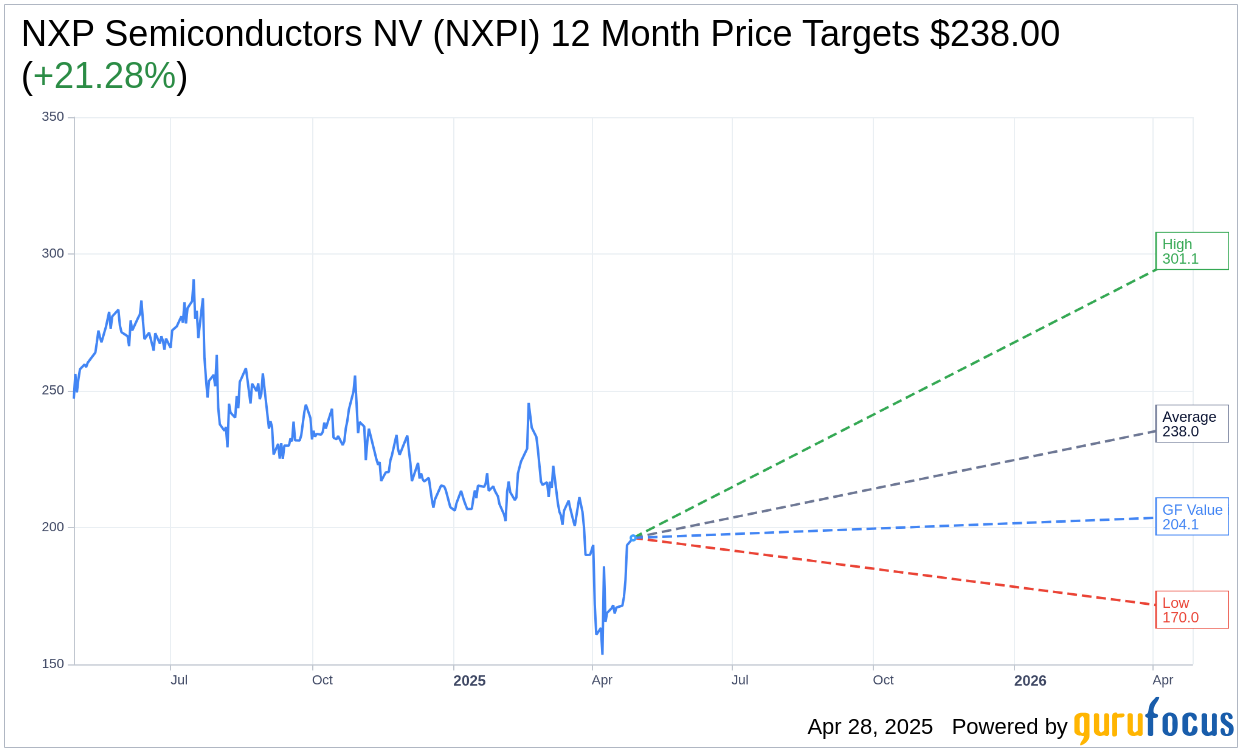

- Analysts forecast an average price target of $238.00, implying a 21.28% upside.

Strong Earnings Performance for NXP Semiconductors

NXP Semiconductors (NXPI) has demonstrated resilience by posting a non-GAAP earnings per share (EPS) of $2.64 for the first quarter, exceeding analyst expectations by $0.04. This achievement highlights the company's strong financial management and capacity to surpass market projections.

Despite a 9.3% year-over-year decline, NXP's revenue reached an impressive $2.84 billion, beating forecasts by $10 million. This performance underscores the company's ability to navigate challenging market conditions effectively.

Revenue Outlook

Looking ahead, NXP Semiconductors anticipates maintaining its revenue momentum, forecasting second-quarter revenue to range between $2.8 billion and $3 billion. This guidance indicates the company's confidence in its operational strategies and market demand for its products.

Wall Street Analysts Forecast

According to insights from 27 analysts, the average one-year price target for NXP Semiconductors NV (NXPI, Financial) is pegged at $238.00, with estimates spanning from a high of $301.12 to a low of $170.00. This average target suggests a potential upside of 21.28% from the current trading price of $196.24. For more detailed analytics, investors can visit the NXP Semiconductors NV (NXPI) Forecast page.

Brokerage Recommendations

The consensus among 31 brokerage firms rates NXP Semiconductors NV (NXPI, Financial) as a 2.0 on the brokerage recommendation scale, indicating an "Outperform" status. The recommendation scale ranges from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell.

GF Value Insights

According to GuruFocus estimates, NXP Semiconductors NV's (NXPI, Financial) projected GF Value for the coming year is $204.08, suggesting a potential upside of 4% from its current price of $196.24. The GF Value reflects GuruFocus' fair value assessment, calculated based on the stock's historical trading multiples, past business growth, and future business performance estimates. To dive deeper into this valuation, investors can explore more on the NXP Semiconductors NV (NXPI) Summary page.