Summary:

- Analysts forecast a strong 133.3% increase in EPS for Grab Holdings' first-quarter earnings.

- Revenue is expected to rise by 17.4%, continuing GRAB's history of surpassing expectations.

- Wall Street projects a potential upside of nearly 20% for GRAB's stock price.

As Grab Holdings (NASDAQ: GRAB) eagerly anticipates its first-quarter earnings release on April 29th, following the market close, investors and analysts alike are keenly observing the company's financial outlook. The anticipated earnings per share (EPS) of $0.01 signifies a notable 133.3% increase compared to the previous year, reflecting robust growth. Furthermore, the expected revenue of $766.73 million marks a 17.4% ascent, highlighting GRAB's consistent trend of exceeding revenue expectations.

Analyst Projections and Price Targets

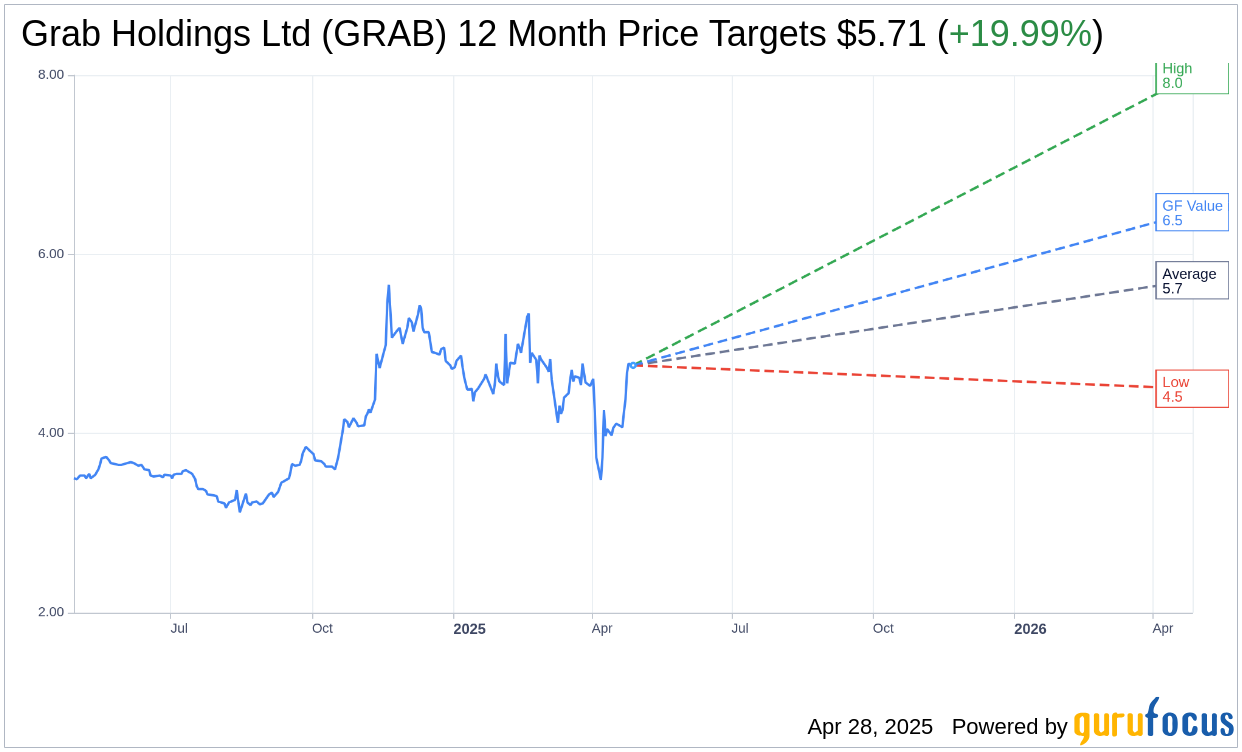

According to a collective analysis from 24 esteemed analysts, the one-year price target for Grab Holdings Ltd (GRAB, Financial) stands at an average of $5.71. This reflects an expected high projection of $8.00 and a low of $4.50. With the current stock price at $4.76, this forecast hints at a promising upside potential of 19.99%. For a more comprehensive overview of these estimates, visit the Grab Holdings Ltd (GRAB) Forecast page.

Brokerage Recommendations

Among 25 brokerage firms, the consensus recommendation for Grab Holdings Ltd (GRAB, Financial) is presently an average of 1.9, which equates to an "Outperform" rating. The rating scale utilized spans from 1 to 5, with 1 suggesting a Strong Buy and 5 indicating a Sell.

GF Value and Potential Growth

Leveraging the proprietary metrics from GuruFocus, Grab Holdings Ltd (GRAB, Financial) is projected to have a GF Value of $6.47 over the next year. This suggests a significant upside potential of 35.92% from the existing share price of $4.76. The GF Value represents GuruFocus' estimation of the stock's fair trading value, determined through historical trading multiples, previous business growth, and predicted future performance. To explore detailed data, visit the Grab Holdings Ltd (GRAB) Summary page.