Key Insights for Investors:

- CVR Energy beats Q1 earnings and revenue estimates, with a notable upward surprise.

- Analyst projections indicate modest price target and "Hold" consensus.

- GuruFocus GF Value suggests potential upside opportunity for CVR Energy's stock.

CVR Energy (CVI, Financial) reported impressive earnings results for the first quarter, with a Non-GAAP EPS of -$0.58. This exceeded analysts' expectations by $0.30, signaling a positive surprise for investors. The company's revenue stood strong at $1.64 billion, surpassing projections by $250 million, despite witnessing an 11.8% decrease year-over-year. Looking ahead, analysts predict Q2 revenue to reach $1.92 billion, accompanied by an EPS of $0.14.

Wall Street Analysts Forecast

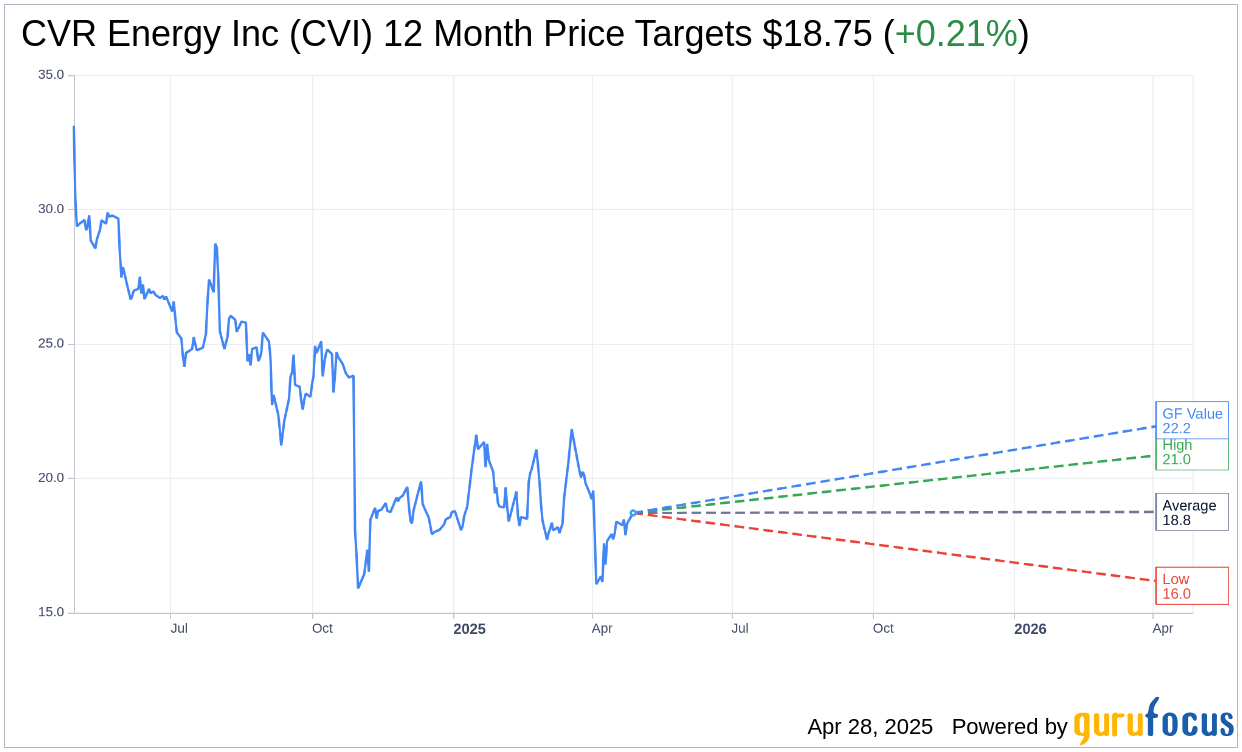

Market experts have provided a one-year price target for CVR Energy Inc (CVI, Financial), with the average target price set at $18.75. The high estimate reaches $21.00, while the low estimate is $16.00, suggesting a slight potential upside of 0.21% from the current price of $18.71. For a deeper dive into these projections, visit the CVR Energy Inc (CVI) Forecast page.

The consensus recommendation from seven brokerage firms positions CVR Energy Inc (CVI, Financial) at an average rating of 3.4, translating to a "Hold" status. This rating scale categorizes from 1, indicating a Strong Buy, to 5, which denotes a Sell.

According to GuruFocus estimates, the projected GF Value for CVR Energy Inc (CVI, Financial) over the next year is pegged at $22.16. This indicates a potential 18.44% upside from the present price of $18.71. The GF Value is calculated by assessing the historical trading multiples of the stock, past growth trajectories, and anticipated future business performance. For further detailed insights, visit the CVR Energy Inc (CVI) Summary page.